Revenue for Telecoms

2cdncba

2cdncba

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Revenue</strong> <strong>for</strong> <strong>Telecoms</strong> – Issues In-Depth | 107<br />

5.2 Allocate the transaction price |<br />

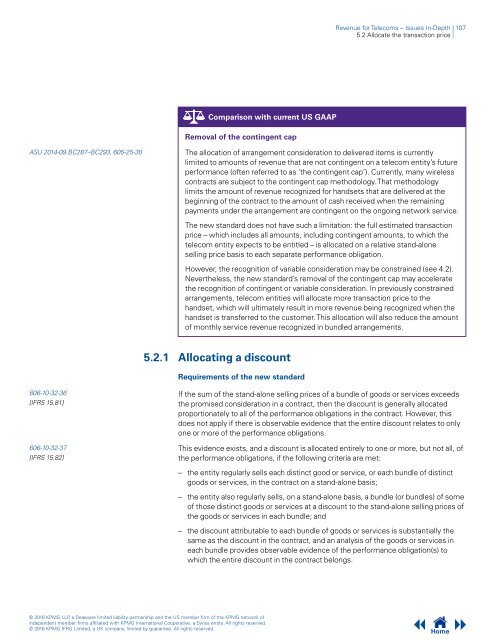

Comparison with current US GAAP<br />

Removal of the contingent cap<br />

ASU 2014-09.BC287–BC293, 605-25-30<br />

The allocation of arrangement consideration to delivered items is currently<br />

limited to amounts of revenue that are not contingent on a telecom entity’s future<br />

per<strong>for</strong>mance (often referred to as ‘the contingent cap’). Currently, many wireless<br />

contracts are subject to the contingent cap methodology. That methodology<br />

limits the amount of revenue recognized <strong>for</strong> handsets that are delivered at the<br />

beginning of the contract to the amount of cash received when the remaining<br />

payments under the arrangement are contingent on the ongoing network service.<br />

The new standard does not have such a limitation: the full estimated transaction<br />

price – which includes all amounts, including contingent amounts, to which the<br />

telecom entity expects to be entitled – is allocated on a relative stand-alone<br />

selling price basis to each separate per<strong>for</strong>mance obligation.<br />

However, the recognition of variable consideration may be constrained (see 4.2).<br />

Nevertheless, the new standard’s removal of the contingent cap may accelerate<br />

the recognition of contingent or variable consideration. In previously constrained<br />

arrangements, telecom entities will allocate more transaction price to the<br />

handset, which will ultimately result in more revenue being recognized when the<br />

handset is transferred to the customer. This allocation will also reduce the amount<br />

of monthly service revenue recognized in bundled arrangements.<br />

5.2.1 Allocating a discount<br />

Requirements of the new standard<br />

606-10-32-36<br />

[IFRS 15.81]<br />

606-10-32-37<br />

[IFRS 15.82]<br />

If the sum of the stand-alone selling prices of a bundle of goods or services exceeds<br />

the promised consideration in a contract, then the discount is generally allocated<br />

proportionately to all of the per<strong>for</strong>mance obligations in the contract. However, this<br />

does not apply if there is observable evidence that the entire discount relates to only<br />

one or more of the per<strong>for</strong>mance obligations.<br />

This evidence exists, and a discount is allocated entirely to one or more, but not all, of<br />

the per<strong>for</strong>mance obligations, if the following criteria are met:<br />

– the entity regularly sells each distinct good or service, or each bundle of distinct<br />

goods or services, in the contract on a stand-alone basis;<br />

– the entity also regularly sells, on a stand-alone basis, a bundle (or bundles) of some<br />

of those distinct goods or services at a discount to the stand-alone selling prices of<br />

the goods or services in each bundle; and<br />

– the discount attributable to each bundle of goods or services is substantially the<br />

same as the discount in the contract, and an analysis of the goods or services in<br />

each bundle provides observable evidence of the per<strong>for</strong>mance obligation(s) to<br />

which the entire discount in the contract belongs.<br />

© 2016 KPMG LLP, a Delaware limited liability partnership and the US member firm of the KPMG network of<br />

independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.<br />

© 2016 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.<br />

Home