Revenue for Telecoms

2cdncba

2cdncba

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Revenue</strong> <strong>for</strong> <strong>Telecoms</strong> – Issues In-Depth | 49<br />

3.3 Telecom equipment |<br />

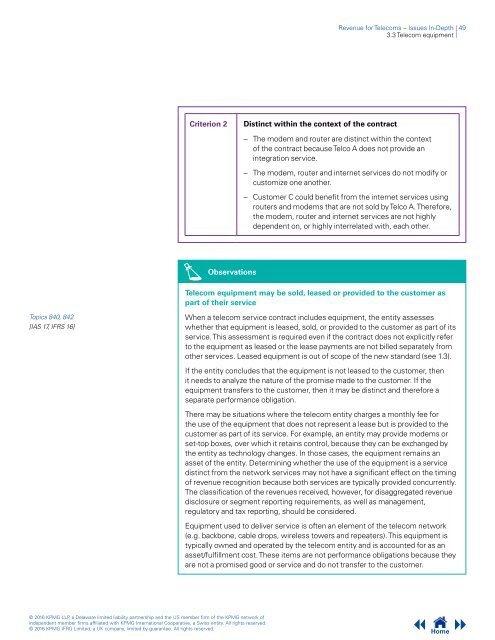

Criterion 2<br />

Distinct within the context of the contract<br />

– The modem and router are distinct within the context<br />

of the contract because Telco A does not provide an<br />

integration service.<br />

– The modem, router and internet services do not modify or<br />

customize one another.<br />

– Customer C could benefit from the internet services using<br />

routers and modems that are not sold by Telco A. There<strong>for</strong>e,<br />

the modem, router and internet services are not highly<br />

dependent on, or highly interrelated with, each other.<br />

Observations<br />

Telecom equipment may be sold, leased or provided to the customer as<br />

part of their service<br />

Topics 840, 842<br />

[IAS 17, IFRS 16]<br />

When a telecom service contract includes equipment, the entity assesses<br />

whether that equipment is leased, sold, or provided to the customer as part of its<br />

service. This assessment is required even if the contract does not explicitly refer<br />

to the equipment as leased or the lease payments are not billed separately from<br />

other services. Leased equipment is out of scope of the new standard (see 1.3).<br />

If the entity concludes that the equipment is not leased to the customer, then<br />

it needs to analyze the nature of the promise made to the customer. If the<br />

equipment transfers to the customer, then it may be distinct and there<strong>for</strong>e a<br />

separate per<strong>for</strong>mance obligation.<br />

There may be situations where the telecom entity charges a monthly fee <strong>for</strong><br />

the use of the equipment that does not represent a lease but is provided to the<br />

customer as part of its service. For example, an entity may provide modems or<br />

set-top boxes, over which it retains control, because they can be exchanged by<br />

the entity as technology changes. In those cases, the equipment remains an<br />

asset of the entity. Determining whether the use of the equipment is a service<br />

distinct from the network services may not have a significant effect on the timing<br />

of revenue recognition because both services are typically provided concurrently.<br />

The classification of the revenues received, however, <strong>for</strong> disaggregated revenue<br />

disclosure or segment reporting requirements, as well as management,<br />

regulatory and tax reporting, should be considered.<br />

Equipment used to deliver service is often an element of the telecom network<br />

(e.g. backbone, cable drops, wireless towers and repeaters). This equipment is<br />

typically owned and operated by the telecom entity and is accounted <strong>for</strong> as an<br />

asset/fulfillment cost. These items are not per<strong>for</strong>mance obligations because they<br />

are not a promised good or service and do not transfer to the customer.<br />

© 2016 KPMG LLP, a Delaware limited liability partnership and the US member firm of the KPMG network of<br />

independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.<br />

© 2016 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.<br />

Home