Revenue for Telecoms

2cdncba

2cdncba

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Revenue</strong> <strong>for</strong> <strong>Telecoms</strong> – Issues In-Depth | 93<br />

4.5 Noncash consideration |<br />

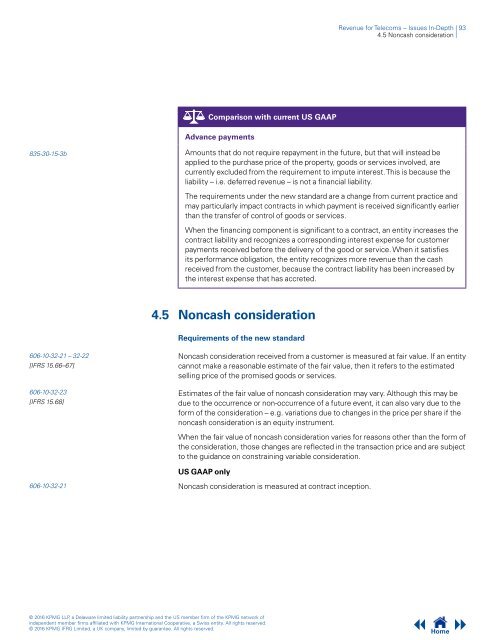

Comparison with current US GAAP<br />

Advance payments<br />

835-30-15-3b<br />

Amounts that do not require repayment in the future, but that will instead be<br />

applied to the purchase price of the property, goods or services involved, are<br />

currently excluded from the requirement to impute interest. This is because the<br />

liability – i.e. deferred revenue – is not a financial liability.<br />

The requirements under the new standard are a change from current practice and<br />

may particularly impact contracts in which payment is received significantly earlier<br />

than the transfer of control of goods or services.<br />

When the financing component is significant to a contract, an entity increases the<br />

contract liability and recognizes a corresponding interest expense <strong>for</strong> customer<br />

payments received be<strong>for</strong>e the delivery of the good or service. When it satisfies<br />

its per<strong>for</strong>mance obligation, the entity recognizes more revenue than the cash<br />

received from the customer, because the contract liability has been increased by<br />

the interest expense that has accreted.<br />

4.5 Noncash consideration<br />

Requirements of the new standard<br />

606-10-32-21 – 32-22<br />

[IFRS 15.66–67]<br />

606-10-32-23<br />

[IFRS 15.68]<br />

Noncash consideration received from a customer is measured at fair value. If an entity<br />

cannot make a reasonable estimate of the fair value, then it refers to the estimated<br />

selling price of the promised goods or services.<br />

Estimates of the fair value of noncash consideration may vary. Although this may be<br />

due to the occurrence or non-occurrence of a future event, it can also vary due to the<br />

<strong>for</strong>m of the consideration – e.g. variations due to changes in the price per share if the<br />

noncash consideration is an equity instrument.<br />

When the fair value of noncash consideration varies <strong>for</strong> reasons other than the <strong>for</strong>m of<br />

the consideration, those changes are reflected in the transaction price and are subject<br />

to the guidance on constraining variable consideration.<br />

US GAAP only<br />

606-10-32-21<br />

Noncash consideration is measured at contract inception.<br />

© 2016 KPMG LLP, a Delaware limited liability partnership and the US member firm of the KPMG network of<br />

independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.<br />

© 2016 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.<br />

Home