Revenue for Telecoms

2cdncba

2cdncba

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

78 | <strong>Revenue</strong> <strong>for</strong> <strong>Telecoms</strong> – Issues In-Depth<br />

| 4 Step 3: Determine the transaction price<br />

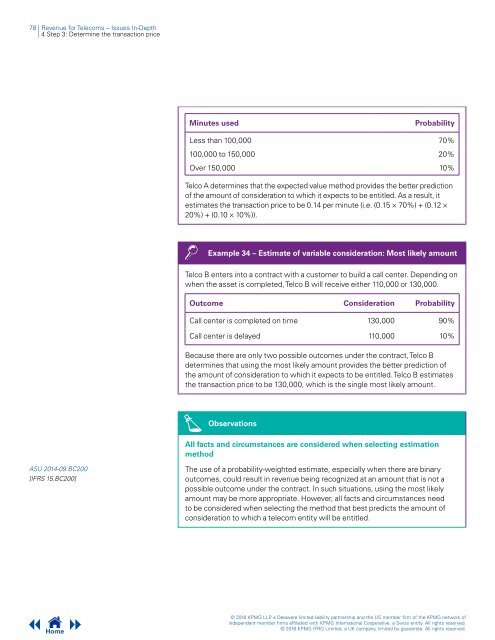

Minutes used<br />

Probability<br />

Less than 100,000 70%<br />

100,000 to 150,000 20%<br />

Over 150,000 10%<br />

Telco A determines that the expected value method provides the better prediction<br />

of the amount of consideration to which it expects to be entitled. As a result, it<br />

estimates the transaction price to be 0.14 per minute (i.e. (0.15 × 70%) + (0.12 ×<br />

20%) + (0.10 × 10%)).<br />

Example 34 – Estimate of variable consideration: Most likely amount<br />

Telco B enters into a contract with a customer to build a call center. Depending on<br />

when the asset is completed, Telco B will receive either 110,000 or 130,000.<br />

Outcome Consideration Probability<br />

Call center is completed on time 130,000 90%<br />

Call center is delayed 110,000 10%<br />

Because there are only two possible outcomes under the contract, Telco B<br />

determines that using the most likely amount provides the better prediction of<br />

the amount of consideration to which it expects to be entitled. Telco B estimates<br />

the transaction price to be 130,000, which is the single most likely amount.<br />

Observations<br />

All facts and circumstances are considered when selecting estimation<br />

method<br />

ASU 2014-09.BC200<br />

[IFRS 15.BC200]<br />

The use of a probability-weighted estimate, especially when there are binary<br />

outcomes, could result in revenue being recognized at an amount that is not a<br />

possible outcome under the contract. In such situations, using the most likely<br />

amount may be more appropriate. However, all facts and circumstances need<br />

to be considered when selecting the method that best predicts the amount of<br />

consideration to which a telecom entity will be entitled.<br />

Home<br />

© 2016 KPMG LLP, a Delaware limited liability partnership and the US member firm of the KPMG network of<br />

independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.<br />

© 2016 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.