Revenue for Telecoms

2cdncba

2cdncba

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

178 | <strong>Revenue</strong> <strong>for</strong> <strong>Telecoms</strong> – Issues In-Depth<br />

| 11 Repurchase agreements<br />

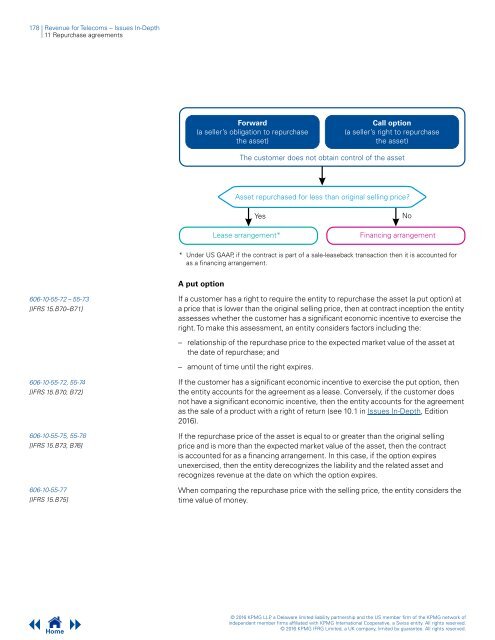

Forward<br />

(a seller’s obligation to repurchase<br />

the asset)<br />

Call option<br />

(a seller’s right to repurchase<br />

the asset)<br />

The customer does not obtain control of the asset<br />

Asset repurchased <strong>for</strong> less than original selling price?<br />

Yes<br />

Lease arrangement*<br />

No<br />

Financing arrangement<br />

* Under US GAAP, if the contract is part of a sale-leaseback transaction then it is accounted <strong>for</strong><br />

as a financing arrangement.<br />

A put option<br />

606-10-55-72 – 55-73<br />

[IFRS 15.B70–B71]<br />

If a customer has a right to require the entity to repurchase the asset (a put option) at<br />

a price that is lower than the original selling price, then at contract inception the entity<br />

assesses whether the customer has a significant economic incentive to exercise the<br />

right. To make this assessment, an entity considers factors including the:<br />

– relationship of the repurchase price to the expected market value of the asset at<br />

the date of repurchase; and<br />

– amount of time until the right expires.<br />

606-10-55-72, 55-74<br />

[IFRS 15.B70, B72]<br />

606-10-55-75, 55-78<br />

[IFRS 15.B73, B76]<br />

606-10-55-77<br />

[IFRS 15.B75]<br />

If the customer has a significant economic incentive to exercise the put option, then<br />

the entity accounts <strong>for</strong> the agreement as a lease. Conversely, if the customer does<br />

not have a significant economic incentive, then the entity accounts <strong>for</strong> the agreement<br />

as the sale of a product with a right of return (see 10.1 in Issues In-Depth, Edition<br />

2016).<br />

If the repurchase price of the asset is equal to or greater than the original selling<br />

price and is more than the expected market value of the asset, then the contract<br />

is accounted <strong>for</strong> as a financing arrangement. In this case, if the option expires<br />

unexercised, then the entity derecognizes the liability and the related asset and<br />

recognizes revenue at the date on which the option expires.<br />

When comparing the repurchase price with the selling price, the entity considers the<br />

time value of money.<br />

Home<br />

© 2016 KPMG LLP, a Delaware limited liability partnership and the US member firm of the KPMG network of<br />

independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.<br />

© 2016 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.