Revenue for Telecoms

2cdncba

2cdncba

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

32 | <strong>Revenue</strong> <strong>for</strong> <strong>Telecoms</strong> – Issues In-Depth<br />

| 2 Step 1: Identify the contract with a customer<br />

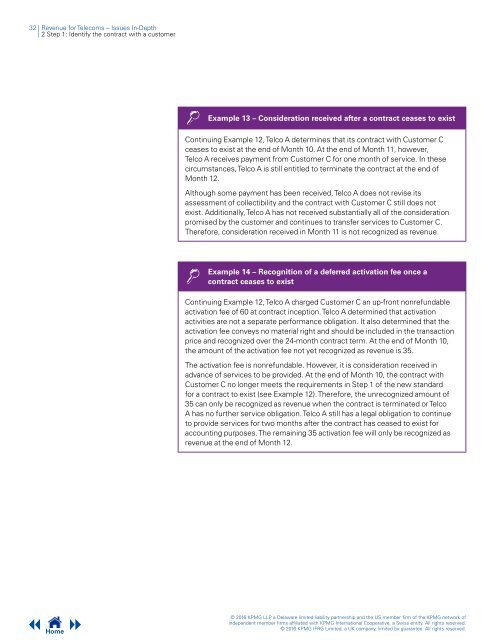

Example 13 – Consideration received after a contract ceases to exist<br />

Continuing Example 12, Telco A determines that its contract with Customer C<br />

ceases to exist at the end of Month 10. At the end of Month 11, however,<br />

Telco A receives payment from Customer C <strong>for</strong> one month of service. In these<br />

circumstances, Telco A is still entitled to terminate the contract at the end of<br />

Month 12.<br />

Although some payment has been received, Telco A does not revise its<br />

assessment of collectibility and the contract with Customer C still does not<br />

exist. Additionally, Telco A has not received substantially all of the consideration<br />

promised by the customer and continues to transfer services to Customer C.<br />

There<strong>for</strong>e, consideration received in Month 11 is not recognized as revenue.<br />

Example 14 – Recognition of a deferred activation fee once a<br />

contract ceases to exist<br />

Continuing Example 12, Telco A charged Customer C an up-front nonrefundable<br />

activation fee of 60 at contract inception. Telco A determined that activation<br />

activities are not a separate per<strong>for</strong>mance obligation. It also determined that the<br />

activation fee conveys no material right and should be included in the transaction<br />

price and recognized over the 24-month contract term. At the end of Month 10,<br />

the amount of the activation fee not yet recognized as revenue is 35.<br />

The activation fee is nonrefundable. However, it is consideration received in<br />

advance of services to be provided. At the end of Month 10, the contract with<br />

Customer C no longer meets the requirements in Step 1 of the new standard<br />

<strong>for</strong> a contract to exist (see Example 12). There<strong>for</strong>e, the unrecognized amount of<br />

35 can only be recognized as revenue when the contract is terminated or Telco<br />

A has no further service obligation. Telco A still has a legal obligation to continue<br />

to provide services <strong>for</strong> two months after the contract has ceased to exist <strong>for</strong><br />

accounting purposes. The remaining 35 activation fee will only be recognized as<br />

revenue at the end of Month 12.<br />

Home<br />

© 2016 KPMG LLP, a Delaware limited liability partnership and the US member firm of the KPMG network of<br />

independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.<br />

© 2016 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.