Revenue for Telecoms

2cdncba

2cdncba

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Revenue</strong> <strong>for</strong> <strong>Telecoms</strong> – Issues In-Depth | 129<br />

7.1 Costs of obtaining a contract |<br />

340-40-25-3<br />

[IFRS 15.93]<br />

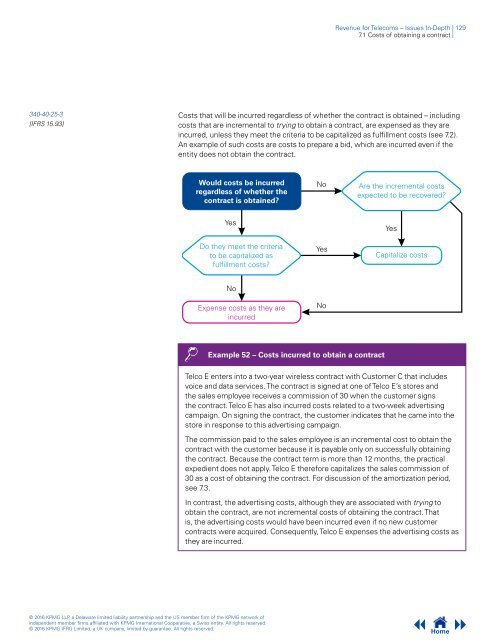

Costs that will be incurred regardless of whether the contract is obtained – including<br />

costs that are incremental to trying to obtain a contract, are expensed as they are<br />

incurred, unless they meet the criteria to be capitalized as fulfillment costs (see 7.2).<br />

An example of such costs are costs to prepare a bid, which are incurred even if the<br />

entity does not obtain the contract.<br />

Would costs be incurred<br />

regardless of whether the<br />

contract is obtained?<br />

No<br />

Are the incremental costs<br />

expected to be recovered?<br />

Yes<br />

Do they meet the criteria<br />

to be capitalized as<br />

fulfillment costs?<br />

Yes<br />

Yes<br />

Capitalize costs<br />

No<br />

Expense costs as they are<br />

incurred<br />

No<br />

Example 52 – Costs incurred to obtain a contract<br />

Telco E enters into a two-year wireless contract with Customer C that includes<br />

voice and data services. The contract is signed at one of Telco E’s stores and<br />

the sales employee receives a commission of 30 when the customer signs<br />

the contract. Telco E has also incurred costs related to a two-week advertising<br />

campaign. On signing the contract, the customer indicates that he came into the<br />

store in response to this advertising campaign.<br />

The commission paid to the sales employee is an incremental cost to obtain the<br />

contract with the customer because it is payable only on successfully obtaining<br />

the contract. Because the contract term is more than 12 months, the practical<br />

expedient does not apply. Telco E there<strong>for</strong>e capitalizes the sales commission of<br />

30 as a cost of obtaining the contract. For discussion of the amortization period,<br />

see 7.3.<br />

In contrast, the advertising costs, although they are associated with trying to<br />

obtain the contract, are not incremental costs of obtaining the contract. That<br />

is, the advertising costs would have been incurred even if no new customer<br />

contracts were acquired. Consequently, Telco E expenses the advertising costs as<br />

they are incurred.<br />

© 2016 KPMG LLP, a Delaware limited liability partnership and the US member firm of the KPMG network of<br />

independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.<br />

© 2016 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.<br />

Home