Revenue for Telecoms

2cdncba

2cdncba

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Revenue</strong> <strong>for</strong> <strong>Telecoms</strong> – Issues In-Depth | 27<br />

2.1 Criteria to determine whether a contract exists |<br />

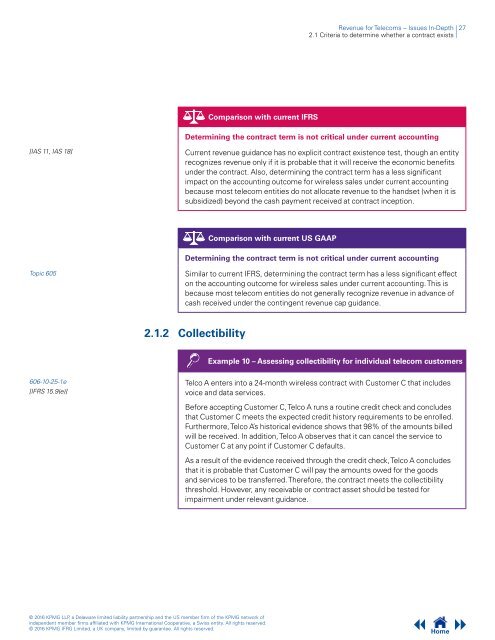

Comparison with current IFRS<br />

Determining the contract term is not critical under current accounting<br />

[IAS 11, IAS 18]<br />

Current revenue guidance has no explicit contract existence test, though an entity<br />

recognizes revenue only if it is probable that it will receive the economic benefits<br />

under the contract. Also, determining the contract term has a less significant<br />

impact on the accounting outcome <strong>for</strong> wireless sales under current accounting<br />

because most telecom entities do not allocate revenue to the handset (when it is<br />

subsidized) beyond the cash payment received at contract inception.<br />

Comparison with current US GAAP<br />

Determining the contract term is not critical under current accounting<br />

Topic 605<br />

Similar to current IFRS, determining the contract term has a less significant effect<br />

on the accounting outcome <strong>for</strong> wireless sales under current accounting. This is<br />

because most telecom entities do not generally recognize revenue in advance of<br />

cash received under the contingent revenue cap guidance.<br />

2.1.2 Collectibility<br />

Example 10 – Assessing collectibility <strong>for</strong> individual telecom customers<br />

606-10-25-1e<br />

[IFRS 15.9(e)]<br />

Telco A enters into a 24-month wireless contract with Customer C that includes<br />

voice and data services.<br />

Be<strong>for</strong>e accepting Customer C, Telco A runs a routine credit check and concludes<br />

that Customer C meets the expected credit history requirements to be enrolled.<br />

Furthermore, Telco A’s historical evidence shows that 98% of the amounts billed<br />

will be received. In addition, Telco A observes that it can cancel the service to<br />

Customer C at any point if Customer C defaults.<br />

As a result of the evidence received through the credit check, Telco A concludes<br />

that it is probable that Customer C will pay the amounts owed <strong>for</strong> the goods<br />

and services to be transferred. There<strong>for</strong>e, the contract meets the collectibility<br />

threshold. However, any receivable or contract asset should be tested <strong>for</strong><br />

impairment under relevant guidance.<br />

© 2016 KPMG LLP, a Delaware limited liability partnership and the US member firm of the KPMG network of<br />

independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.<br />

© 2016 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.<br />

Home