Revenue for Telecoms

2cdncba

2cdncba

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

114 | <strong>Revenue</strong> <strong>for</strong> <strong>Telecoms</strong> – Issues In-Depth<br />

| 6 Step 5: Recognize revenue when or as the entity satisfies a per<strong>for</strong>mance obligation<br />

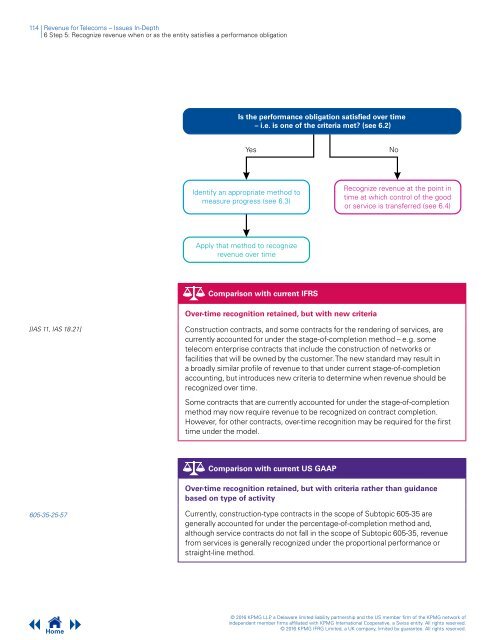

Is the per<strong>for</strong>mance obligation satisfied over time<br />

– i.e. is one of the criteria met? (see 6.2)<br />

Yes<br />

No<br />

Identify an appropriate method to<br />

measure progress (see 6.3)<br />

Recognize revenue at the point in<br />

time at which control of the good<br />

or service is transferred (see 6.4)<br />

Apply that method to recognize<br />

revenue over time<br />

Comparison with current IFRS<br />

Over-time recognition retained, but with new criteria<br />

[IAS 11, IAS 18.21]<br />

Construction contracts, and some contracts <strong>for</strong> the rendering of services, are<br />

currently accounted <strong>for</strong> under the stage-of-completion method – e.g. some<br />

telecom enterprise contracts that include the construction of networks or<br />

facilities that will be owned by the customer. The new standard may result in<br />

a broadly similar profile of revenue to that under current stage-of-completion<br />

accounting, but introduces new criteria to determine when revenue should be<br />

recognized over time.<br />

Some contracts that are currently accounted <strong>for</strong> under the stage-of-completion<br />

method may now require revenue to be recognized on contract completion.<br />

However, <strong>for</strong> other contracts, over-time recognition may be required <strong>for</strong> the first<br />

time under the model.<br />

Comparison with current US GAAP<br />

Over-time recognition retained, but with criteria rather than guidance<br />

based on type of activity<br />

605-35-25-57 Currently, construction-type contracts in the scope of Subtopic 605-35 are<br />

generally accounted <strong>for</strong> under the percentage-of-completion method and,<br />

although service contracts do not fall in the scope of Subtopic 605‐35, revenue<br />

from services is generally recognized under the proportional per<strong>for</strong>mance or<br />

straight-line method.<br />

Home<br />

© 2016 KPMG LLP, a Delaware limited liability partnership and the US member firm of the KPMG network of<br />

independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.<br />

© 2016 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.