Revenue for Telecoms

2cdncba

2cdncba

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Revenue</strong> <strong>for</strong> <strong>Telecoms</strong> – Issues In-Depth | 47<br />

3.3 Telecom equipment |<br />

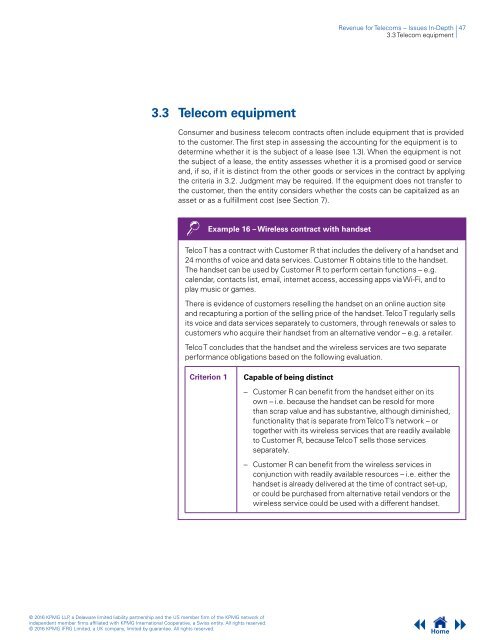

3.3 Telecom equipment<br />

Consumer and business telecom contracts often include equipment that is provided<br />

to the customer. The first step in assessing the accounting <strong>for</strong> the equipment is to<br />

determine whether it is the subject of a lease (see 1.3). When the equipment is not<br />

the subject of a lease, the entity assesses whether it is a promised good or service<br />

and, if so, if it is distinct from the other goods or services in the contract by applying<br />

the criteria in 3.2. Judgment may be required. If the equipment does not transfer to<br />

the customer, then the entity considers whether the costs can be capitalized as an<br />

asset or as a fulfillment cost (see Section 7).<br />

Example 16 – Wireless contract with handset<br />

Telco T has a contract with Customer R that includes the delivery of a handset and<br />

24 months of voice and data services. Customer R obtains title to the handset.<br />

The handset can be used by Customer R to per<strong>for</strong>m certain functions – e.g.<br />

calendar, contacts list, email, internet access, accessing apps via Wi-Fi, and to<br />

play music or games.<br />

There is evidence of customers reselling the handset on an online auction site<br />

and recapturing a portion of the selling price of the handset. Telco T regularly sells<br />

its voice and data services separately to customers, through renewals or sales to<br />

customers who acquire their handset from an alternative vendor – e.g. a retailer.<br />

Telco T concludes that the handset and the wireless services are two separate<br />

per<strong>for</strong>mance obligations based on the following evaluation.<br />

Criterion 1<br />

Capable of being distinct<br />

– Customer R can benefit from the handset either on its<br />

own – i.e. because the handset can be resold <strong>for</strong> more<br />

than scrap value and has substantive, although diminished,<br />

functionality that is separate from Telco T’s network – or<br />

together with its wireless services that are readily available<br />

to Customer R, because Telco T sells those services<br />

separately.<br />

– Customer R can benefit from the wireless services in<br />

conjunction with readily available resources – i.e. either the<br />

handset is already delivered at the time of contract set-up,<br />

or could be purchased from alternative retail vendors or the<br />

wireless service could be used with a different handset.<br />

© 2016 KPMG LLP, a Delaware limited liability partnership and the US member firm of the KPMG network of<br />

independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.<br />

© 2016 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.<br />

Home