Revenue for Telecoms

2cdncba

2cdncba

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Revenue</strong> <strong>for</strong> <strong>Telecoms</strong> – Issues In-Depth | 15<br />

1.3 Partially in scope |<br />

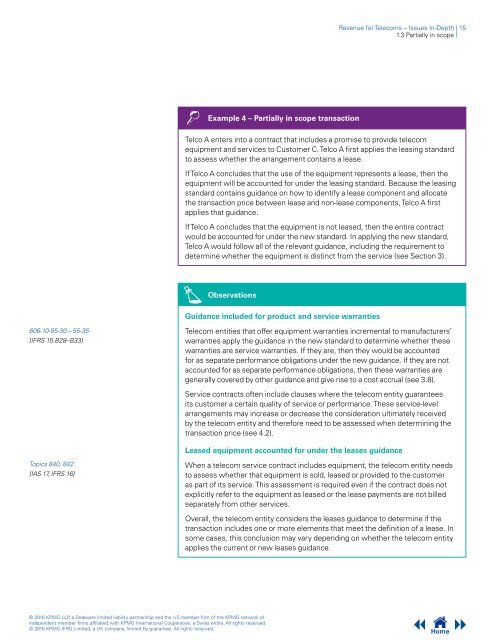

Example 4 – Partially in scope transaction<br />

Telco A enters into a contract that includes a promise to provide telecom<br />

equipment and services to Customer C. Telco A first applies the leasing standard<br />

to assess whether the arrangement contains a lease.<br />

If Telco A concludes that the use of the equipment represents a lease, then the<br />

equipment will be accounted <strong>for</strong> under the leasing standard. Because the leasing<br />

standard contains guidance on how to identify a lease component and allocate<br />

the transaction price between lease and non-lease components, Telco A first<br />

applies that guidance.<br />

If Telco A concludes that the equipment is not leased, then the entire contract<br />

would be accounted <strong>for</strong> under the new standard. In applying the new standard,<br />

Telco A would follow all of the relevant guidance, including the requirement to<br />

determine whether the equipment is distinct from the service (see Section 3).<br />

Observations<br />

Guidance included <strong>for</strong> product and service warranties<br />

606-10-55-30 – 55-35<br />

[IFRS 15.B28–B33]<br />

Telecom entities that offer equipment warranties incremental to manufacturers’<br />

warranties apply the guidance in the new standard to determine whether these<br />

warranties are service warranties. If they are, then they would be accounted<br />

<strong>for</strong> as separate per<strong>for</strong>mance obligations under the new guidance. If they are not<br />

accounted <strong>for</strong> as separate per<strong>for</strong>mance obligations, then these warranties are<br />

generally covered by other guidance and give rise to a cost accrual (see 3.8).<br />

Service contracts often include clauses where the telecom entity guarantees<br />

its customer a certain quality of service or per<strong>for</strong>mance. These service-level<br />

arrangements may increase or decrease the consideration ultimately received<br />

by the telecom entity and there<strong>for</strong>e need to be assessed when determining the<br />

transaction price (see 4.2).<br />

Leased equipment accounted <strong>for</strong> under the leases guidance<br />

Topics 840, 842<br />

[IAS 17, IFRS 16]<br />

When a telecom service contract includes equipment, the telecom entity needs<br />

to assess whether that equipment is sold, leased or provided to the customer<br />

as part of its service. This assessment is required even if the contract does not<br />

explicitly refer to the equipment as leased or the lease payments are not billed<br />

separately from other services.<br />

Overall, the telecom entity considers the leases guidance to determine if the<br />

transaction includes one or more elements that meet the definition of a lease. In<br />

some cases, this conclusion may vary depending on whether the telecom entity<br />

applies the current or new leases guidance.<br />

© 2016 KPMG LLP, a Delaware limited liability partnership and the US member firm of the KPMG network of<br />

independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.<br />

© 2016 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.<br />

Home