Revenue for Telecoms

2cdncba

2cdncba

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Revenue</strong> <strong>for</strong> <strong>Telecoms</strong> – Issues In-Depth | 31<br />

2.2 Consideration received be<strong>for</strong>e concluding that a contract exists |<br />

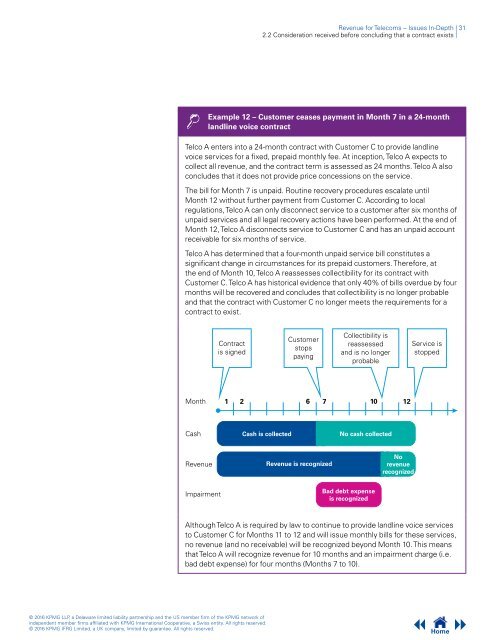

Example 12 – Customer ceases payment in Month 7 in a 24-month<br />

landline voice contract<br />

Telco A enters into a 24-month contract with Customer C to provide landline<br />

voice services <strong>for</strong> a fixed, prepaid monthly fee. At inception, Telco A expects to<br />

collect all revenue, and the contract term is assessed as 24 months. Telco A also<br />

concludes that it does not provide price concessions on the service.<br />

The bill <strong>for</strong> Month 7 is unpaid. Routine recovery procedures escalate until<br />

Month 12 without further payment from Customer C. According to local<br />

regulations, Telco A can only disconnect service to a customer after six months of<br />

unpaid services and all legal recovery actions have been per<strong>for</strong>med. At the end of<br />

Month 12, Telco A disconnects service to Customer C and has an unpaid account<br />

receivable <strong>for</strong> six months of service.<br />

Telco A has determined that a four-month unpaid service bill constitutes a<br />

significant change in circumstances <strong>for</strong> its prepaid customers. There<strong>for</strong>e, at<br />

the end of Month 10, Telco A reassesses collectibility <strong>for</strong> its contract with<br />

Customer C. Telco A has historical evidence that only 40% of bills overdue by four<br />

months will be recovered and concludes that collectibility is no longer probable<br />

and that the contract with Customer C no longer meets the requirements <strong>for</strong> a<br />

contract to exist.<br />

Contract<br />

is signed<br />

Customer<br />

stops<br />

paying<br />

Collectibility is<br />

reassessed<br />

and is no longer<br />

probable<br />

Service is<br />

stopped<br />

Month<br />

1 2 6 7 10 12<br />

Cash<br />

Cash is collected<br />

No cash collected<br />

<strong>Revenue</strong><br />

<strong>Revenue</strong> is recognized<br />

No<br />

revenue<br />

recognized<br />

Impairment<br />

Bad debt expense<br />

is recognized<br />

Although Telco A is required by law to continue to provide landline voice services<br />

to Customer C <strong>for</strong> Months 11 to 12 and will issue monthly bills <strong>for</strong> these services,<br />

no revenue (and no receivable) will be recognized beyond Month 10. This means<br />

that Telco A will recognize revenue <strong>for</strong> 10 months and an impairment charge (i.e.<br />

bad debt expense) <strong>for</strong> four months (Months 7 to 10).<br />

© 2016 KPMG LLP, a Delaware limited liability partnership and the US member firm of the KPMG network of<br />

independent member firms affiliated with KPMG International Cooperative, a Swiss entity. All rights reserved.<br />

© 2016 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.<br />

Home