2015-16

Corrections-Annual-Report-2015-16

Corrections-Annual-Report-2015-16

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DEPARTMENT OF CORRECTIONAL SERVICES<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

For the year ended 30 June 20<strong>16</strong><br />

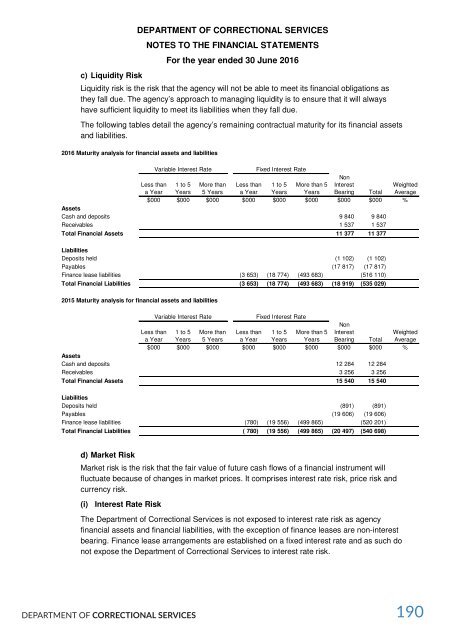

c) Liquidity Risk<br />

Liquidity risk is the risk that the agency will not be able to meet its financial obligations as<br />

they fall due. The agency’s approach to managing liquidity is to ensure that it will always<br />

have sufficient liquidity to meet its liabilities when they fall due.<br />

The following tables detail the agency’s remaining contractual maturity for its financial assets<br />

and liabilities.<br />

20<strong>16</strong> Maturity analysis for financial assets and liabilities<br />

Variable Interest Rate<br />

Fixed Interest Rate<br />

Less than<br />

a Year<br />

1 to 5<br />

Years<br />

More than<br />

5 Years<br />

Less than<br />

a Year<br />

1 to 5<br />

Years<br />

More than 5<br />

Years<br />

Non<br />

Interest<br />

Bearing Total<br />

Weighted<br />

Average<br />

$000 $000 $000 $000 $000 $000 $000 $000 %<br />

Assets<br />

Cash and deposits 9 840 9 840<br />

Receivables 1 537 1 537<br />

Total Financial Assets 11 377 11 377<br />

Liabilities<br />

Deposits held (1 102) (1 102)<br />

Payables (17 817) (17 817)<br />

Finance lease liabilities (3 653) (18 774) (493 683) (5<strong>16</strong> 110)<br />

Total Financial Liabilities (3 653) (18 774) (493 683) (18 919) (535 029)<br />

<strong>2015</strong> Maturity analysis for financial assets and liabilities<br />

Variable Interest Rate<br />

Fixed Interest Rate<br />

Less than<br />

a Year<br />

1 to 5<br />

Years<br />

More than<br />

5 Years<br />

Less than<br />

a Year<br />

1 to 5<br />

Years<br />

More than 5<br />

Years<br />

Non<br />

Interest<br />

Bearing Total<br />

Weighted<br />

Average<br />

$000 $000 $000 $000 $000 $000 $000 $000 %<br />

Assets<br />

Cash and deposits 12 284 12 284<br />

Receivables 3 256 3 256<br />

Total Financial Assets 15 540 15 540<br />

Liabilities<br />

Deposits held (891) (891)<br />

Payables (19 606) (19 606)<br />

Finance lease liabilities (780) (19 556) (499 865) (520 201)<br />

Total Financial Liabilities ( 780) (19 556) (499 865) (20 497) (540 698)<br />

d) Market Risk<br />

Market risk is the risk that the fair value of future cash flows of a financial instrument will<br />

fluctuate because of changes in market prices. It comprises interest rate risk, price risk and<br />

currency risk.<br />

(i) Interest Rate Risk<br />

The Department of Correctional Services is not exposed to interest rate risk as agency<br />

financial assets and financial liabilities, with the exception of finance leases are non-interest<br />

bearing. Finance lease arrangements are established on a fixed interest rate and as such do<br />

not expose the Department of Correctional Services to interest rate risk.<br />

DEPARTMENT OF CORRECTIONAL SERVICES 190