2015-16

Corrections-Annual-Report-2015-16

Corrections-Annual-Report-2015-16

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

OUR ORGANISATION<br />

Risk Management Framework<br />

NTDCS has a Risk Management Framework in<br />

place to manage risk within a structured and<br />

effective manner. This framework allows the<br />

Department to reasonably manage, mitigate and<br />

eliminate risks, including fraud.<br />

The framework consists of a risk management<br />

plan to inform staff of the risk management<br />

process, a risk management toolkit which steps<br />

users through the risk assessment process and<br />

both a strategic and operational risk register.<br />

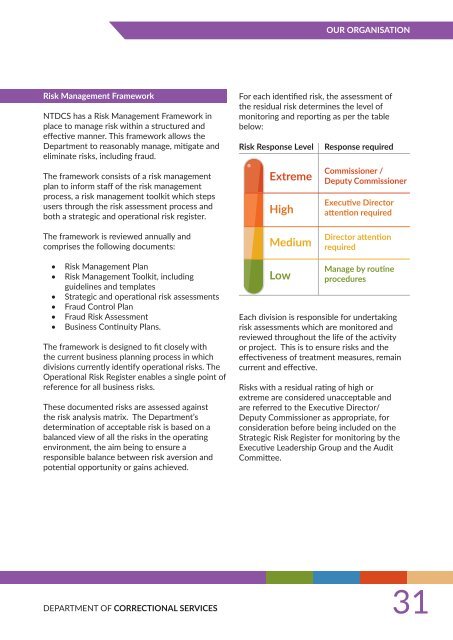

For each identified risk, the assessment of<br />

the residual risk determines the level of<br />

monitoring and reporting as per the table<br />

below:<br />

Risk Response Level<br />

Extreme<br />

High<br />

Response required<br />

Commissioner /<br />

Deputy Commissioner<br />

Executive Director<br />

attention required<br />

The framework is reviewed annually and<br />

comprises the following documents:<br />

Medium<br />

Director attention<br />

required<br />

• Risk Management Plan<br />

• Risk Management Toolkit, including<br />

guidelines and templates<br />

• Strategic and operational risk assessments<br />

• Fraud Control Plan<br />

• Fraud Risk Assessment<br />

• Business Continuity Plans.<br />

The framework is designed to fit closely with<br />

the current business planning process in which<br />

divisions currently identify operational risks. The<br />

Operational Risk Register enables a single point of<br />

reference for all business risks.<br />

These documented risks are assessed against<br />

the risk analysis matrix. The Department’s<br />

determination of acceptable risk is based on a<br />

balanced view of all the risks in the operating<br />

environment, the aim being to ensure a<br />

responsible balance between risk aversion and<br />

potential opportunity or gains achieved.<br />

Low<br />

Manage by routine<br />

procedures<br />

Each division is responsible for undertaking<br />

risk assessments which are monitored and<br />

reviewed throughout the life of the activity<br />

or project. This is to ensure risks and the<br />

effectiveness of treatment measures, remain<br />

current and effective.<br />

Risks with a residual rating of high or<br />

extreme are considered unacceptable and<br />

are referred to the Executive Director/<br />

Deputy Commissioner as appropriate, for<br />

consideration before being included on the<br />

Strategic Risk Register for monitoring by the<br />

Executive Leadership Group and the Audit<br />

Committee.<br />

DEPARTMENT OF CORRECTIONAL SERVICES<br />

31