ECB Annual Report on supervisory activities

ssmar2016.en.pdf?utm_source=POLITICO.EU&utm_campaign=b1bb431652-EMAIL_CAMPAIGN_2017_03_23&utm_medium=email&utm_term=0_10959edeb5-b1bb431652-189797857&utm_source=POLITICO

ssmar2016.en.pdf?utm_source=POLITICO.EU&utm_campaign=b1bb431652-EMAIL_CAMPAIGN_2017_03_23&utm_medium=email&utm_term=0_10959edeb5-b1bb431652-189797857&utm_source=POLITICO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

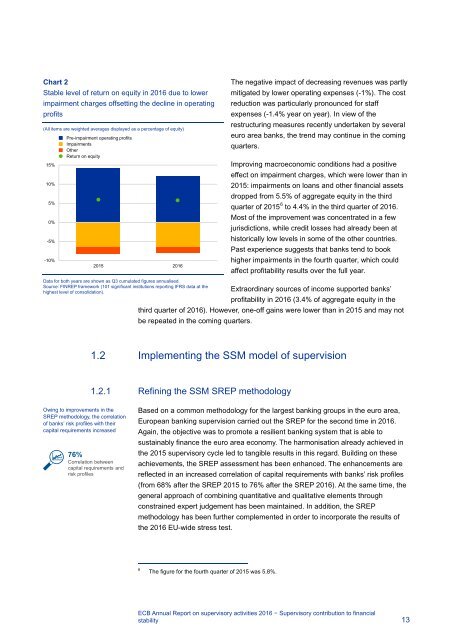

Chart 2<br />

Stable level of return <strong>on</strong> equity in 2016 due to lower<br />

impairment charges offsetting the decline in operating<br />

profits<br />

(All items are weighted averages displayed as a percentage of equity)<br />

15%<br />

10%<br />

5%<br />

0%<br />

-5%<br />

-10%<br />

Pre-impairment operating profits<br />

Impairments<br />

Other<br />

Return <strong>on</strong> equity<br />

2015 2016<br />

The negative impact of decreasing revenues was partly<br />

mitigated by lower operating expenses (-1%). The cost<br />

reducti<strong>on</strong> was particularly pr<strong>on</strong>ounced for staff<br />

expenses (-1.4% year <strong>on</strong> year). In view of the<br />

restructuring measures recently undertaken by several<br />

euro area banks, the trend may c<strong>on</strong>tinue in the coming<br />

quarters.<br />

Improving macroec<strong>on</strong>omic c<strong>on</strong>diti<strong>on</strong>s had a positive<br />

effect <strong>on</strong> impairment charges, which were lower than in<br />

2015: impairments <strong>on</strong> loans and other financial assets<br />

dropped from 5.5% of aggregate equity in the third<br />

quarter of 2015 6 to 4.4% in the third quarter of 2016.<br />

Most of the improvement was c<strong>on</strong>centrated in a few<br />

jurisdicti<strong>on</strong>s, while credit losses had already been at<br />

historically low levels in some of the other countries.<br />

Past experience suggests that banks tend to book<br />

higher impairments in the fourth quarter, which could<br />

affect profitability results over the full year.<br />

Data for both years are shown as Q3 cumulated figures annualised.<br />

Source: FINREP framework (101 significant instituti<strong>on</strong>s reporting IFRS data at the<br />

highest level of c<strong>on</strong>solidati<strong>on</strong>).<br />

Extraordinary sources of income supported banks’<br />

profitability in 2016 (3.4% of aggregate equity in the<br />

third quarter of 2016). However, <strong>on</strong>e-off gains were lower than in 2015 and may not<br />

be repeated in the coming quarters.<br />

1.2 Implementing the SSM model of supervisi<strong>on</strong><br />

1.2.1 Refining the SSM SREP methodology<br />

Owing to improvements in the<br />

SREP methodology, the correlati<strong>on</strong><br />

of banks’ risk profiles with their<br />

capital requirements increased<br />

76%<br />

Correlati<strong>on</strong> between<br />

capital requirements and<br />

risk profiles<br />

Based <strong>on</strong> a comm<strong>on</strong> methodology for the largest banking groups in the euro area,<br />

European banking supervisi<strong>on</strong> carried out the SREP for the sec<strong>on</strong>d time in 2016.<br />

Again, the objective was to promote a resilient banking system that is able to<br />

sustainably finance the euro area ec<strong>on</strong>omy. The harm<strong>on</strong>isati<strong>on</strong> already achieved in<br />

the 2015 <strong>supervisory</strong> cycle led to tangible results in this regard. Building <strong>on</strong> these<br />

achievements, the SREP assessment has been enhanced. The enhancements are<br />

reflected in an increased correlati<strong>on</strong> of capital requirements with banks’ risk profiles<br />

(from 68% after the SREP 2015 to 76% after the SREP 2016). At the same time, the<br />

general approach of combining quantitative and qualitative elements through<br />

c<strong>on</strong>strained expert judgement has been maintained. In additi<strong>on</strong>, the SREP<br />

methodology has been further complemented in order to incorporate the results of<br />

the 2016 EU-wide stress test.<br />

6<br />

The figure for the fourth quarter of 2015 was 5.8%.<br />

<str<strong>on</strong>g>ECB</str<strong>on</strong>g> <str<strong>on</strong>g>Annual</str<strong>on</strong>g> <str<strong>on</strong>g>Report</str<strong>on</strong>g> <strong>on</strong> <strong>supervisory</strong> <strong>activities</strong> 2016 − Supervisory c<strong>on</strong>tributi<strong>on</strong> to financial<br />

stability 13