ECB Annual Report on supervisory activities

ssmar2016.en.pdf?utm_source=POLITICO.EU&utm_campaign=b1bb431652-EMAIL_CAMPAIGN_2017_03_23&utm_medium=email&utm_term=0_10959edeb5-b1bb431652-189797857&utm_source=POLITICO

ssmar2016.en.pdf?utm_source=POLITICO.EU&utm_campaign=b1bb431652-EMAIL_CAMPAIGN_2017_03_23&utm_medium=email&utm_term=0_10959edeb5-b1bb431652-189797857&utm_source=POLITICO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

• Abanka d.d. (Slovenia)<br />

• Akciju sabiedrība “Rietumu Banka” (Latvia)<br />

• Banca Mediolanum S.p.A. (Italy)<br />

• Citibank Holdings Ireland Limited (Ireland)<br />

The 2016 comprehensive assessment was similar to the rigorous exercises<br />

undertaken for a total of 130 banks in 2014 and 9 banks in 2015. It c<strong>on</strong>sisted of an<br />

asset quality review (AQR) and a stress test.<br />

The AQR comp<strong>on</strong>ent was performed following the methodology applied in the 2014<br />

and 2015 exercises. It was a prudential rather than an accounting exercise. It<br />

provided a point-in-time assessment of the carrying values of banks’ assets as at<br />

year-end 2015 and determined whether there was a need to strengthen individual<br />

banks’ capital bases. The identificati<strong>on</strong> of additi<strong>on</strong>al n<strong>on</strong>-performing exposures and<br />

increases in specific and collective provisi<strong>on</strong> levels c<strong>on</strong>stituted the main drivers of<br />

AQR adjustments to CET1.<br />

The stress test comp<strong>on</strong>ent used the methodology applied in the 2016 EBA stress<br />

test. The AQR results served as a starting point for the stress test, which projected<br />

the evoluti<strong>on</strong> of banks’ capital positi<strong>on</strong>s over three years (2016-2018) under a<br />

baseline scenario and an adverse scenario.<br />

The threshold ratios applied for identifying capital shortfalls were maintained at the<br />

same levels as in 2014 and 2015: a CET1 ratio of 8% for the AQR and the baseline<br />

scenario of the stress test, and a CET1 ratio of 5.5% for the adverse scenario of the<br />

stress test. The maximum of the shortfalls in the different comp<strong>on</strong>ents of the exercise<br />

determined a bank’s overall capital shortfall. A summary of the results of the three<br />

participating banks which c<strong>on</strong>sented to their disclosure is shown in Table 3.<br />

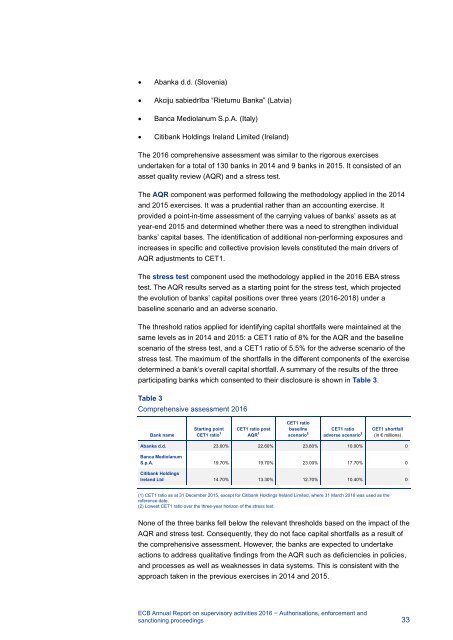

Table 3<br />

Comprehensive assessment 2016<br />

Bank name<br />

Starting point<br />

CET1 ratio 1<br />

CET1 ratio post<br />

AQR 1<br />

CET1 ratio<br />

baseline<br />

scenario 2<br />

CET1 ratio<br />

adverse scenario 2<br />

CET1 shortfall<br />

(in € milli<strong>on</strong>s)<br />

Abanka d.d. 23.00% 22.60% 23.80% 10.00% 0<br />

Banca Mediolanum<br />

S.p.A. 19.70% 19.70% 23.00% 17.70% 0<br />

Citibank Holdings<br />

Ireland Ltd 14.70% 13.30% 12.70% 10.40% 0<br />

(1) CET1 ratio as at 31 December 2015, except for Citibank Holdings Ireland Limited, where 31 March 2016 was used as the<br />

reference date.<br />

(2) Lowest CET1 ratio over the three-year horiz<strong>on</strong> of the stress test.<br />

N<strong>on</strong>e of the three banks fell below the relevant thresholds based <strong>on</strong> the impact of the<br />

AQR and stress test. C<strong>on</strong>sequently, they do not face capital shortfalls as a result of<br />

the comprehensive assessment. However, the banks are expected to undertake<br />

acti<strong>on</strong>s to address qualitative findings from the AQR such as deficiencies in policies,<br />

and processes as well as weaknesses in data systems. This is c<strong>on</strong>sistent with the<br />

approach taken in the previous exercises in 2014 and 2015.<br />

<str<strong>on</strong>g>ECB</str<strong>on</strong>g> <str<strong>on</strong>g>Annual</str<strong>on</strong>g> <str<strong>on</strong>g>Report</str<strong>on</strong>g> <strong>on</strong> <strong>supervisory</strong> <strong>activities</strong> 2016 − Authorisati<strong>on</strong>s, enforcement and<br />

sancti<strong>on</strong>ing proceedings 33