433369666-The-Case-for-Investing-in-South-Africa

South Africa's investment proposal

South Africa's investment proposal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

18 |<br />

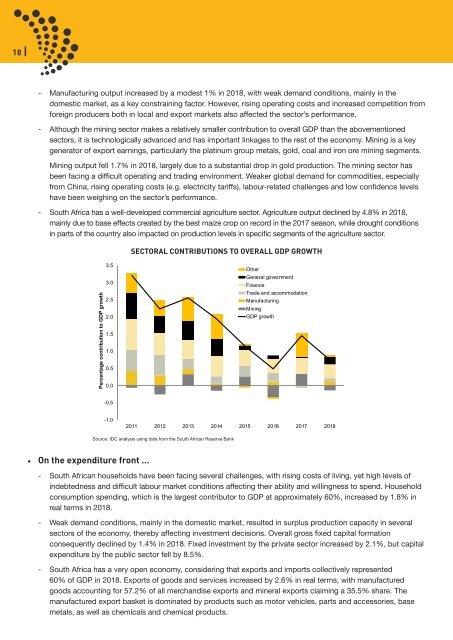

- Manufactur<strong>in</strong>g output <strong>in</strong>creased by a modest 1% <strong>in</strong> 2018, with weak demand conditions, ma<strong>in</strong>ly <strong>in</strong> the<br />

domestic market, as a key constra<strong>in</strong><strong>in</strong>g factor. However, ris<strong>in</strong>g operat<strong>in</strong>g costs and <strong>in</strong>creased competition from<br />

<strong>for</strong>eign producers both <strong>in</strong> local and export markets also affected the sector’s per<strong>for</strong>mance.<br />

- Although the m<strong>in</strong><strong>in</strong>g sector makes a relatively smaller contribution to overall GDP than the abovementioned<br />

sectors, it is technologically advanced and has important l<strong>in</strong>kages to the rest of the economy. M<strong>in</strong><strong>in</strong>g is a key<br />

generator of export earn<strong>in</strong>gs, particularly the plat<strong>in</strong>um group metals, gold, coal and iron ore m<strong>in</strong><strong>in</strong>g segments.<br />

M<strong>in</strong><strong>in</strong>g output fell 1.7% <strong>in</strong> 2018, largely due to a substantial drop <strong>in</strong> gold production. <strong>The</strong> m<strong>in</strong><strong>in</strong>g sector has<br />

been fac<strong>in</strong>g a difficult operat<strong>in</strong>g and trad<strong>in</strong>g environment. Weaker global demand <strong>for</strong> commodities, especially<br />

from Ch<strong>in</strong>a, ris<strong>in</strong>g operat<strong>in</strong>g costs (e.g. electricity tariffs), labour-related challenges and low confidence levels<br />

have been weigh<strong>in</strong>g on the sector’s per<strong>for</strong>mance.<br />

- <strong>South</strong> <strong>Africa</strong> has a well-developed commercial agriculture sector. Agriculture output decl<strong>in</strong>ed by 4.8% <strong>in</strong> 2018,<br />

ma<strong>in</strong>ly due to base effects created by the best maize crop on record <strong>in</strong> the 2017 season, while drought conditions<br />

<strong>in</strong> parts of the country also impacted on production levels <strong>in</strong> specific segments of the agriculture sector.<br />

SECTORAL CONTRIBUTIONS TO OVERALL GDP GROWTH<br />

Percentage contribution to GDP growth<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

Other<br />

General government<br />

F<strong>in</strong>ance<br />

Trade and accommodation<br />

Manufactur<strong>in</strong>g<br />

M<strong>in</strong><strong>in</strong>g<br />

GDP growth<br />

-0.5<br />

-1.0<br />

2011 2012 2013 2014 2015 2016 2017 2018<br />

Source: IDC analysis us<strong>in</strong>g data from the <strong>South</strong> <strong>Africa</strong>n Reserve Bank<br />

• On the expenditure front …<br />

- <strong>South</strong> <strong>Africa</strong>n households have been fac<strong>in</strong>g several challenges, with ris<strong>in</strong>g costs of liv<strong>in</strong>g, yet high levels of<br />

<strong>in</strong>debtedness and difficult labour market conditions affect<strong>in</strong>g their ability and will<strong>in</strong>gness to spend. Household<br />

consumption spend<strong>in</strong>g, which is the largest contributor to GDP at approximately 60%, <strong>in</strong>creased by 1.8% <strong>in</strong><br />

real terms <strong>in</strong> 2018.<br />

- Weak demand conditions, ma<strong>in</strong>ly <strong>in</strong> the domestic market, resulted <strong>in</strong> surplus production capacity <strong>in</strong> several<br />

sectors of the economy, thereby affect<strong>in</strong>g <strong>in</strong>vestment decisions. Overall gross fixed capital <strong>for</strong>mation<br />

consequently decl<strong>in</strong>ed by 1.4% <strong>in</strong> 2018. Fixed <strong>in</strong>vestment by the private sector <strong>in</strong>creased by 2.1%, but capital<br />

expenditure by the public sector fell by 8.5%.<br />

- <strong>South</strong> <strong>Africa</strong> has a very open economy, consider<strong>in</strong>g that exports and imports collectively represented<br />

60% of GDP <strong>in</strong> 2018. Exports of goods and services <strong>in</strong>creased by 2.6% <strong>in</strong> real terms, with manufactured<br />

goods account<strong>in</strong>g <strong>for</strong> 57.2% of all merchandise exports and m<strong>in</strong>eral exports claim<strong>in</strong>g a 35.5% share. <strong>The</strong><br />

manufactured export basket is dom<strong>in</strong>ated by products such as motor vehicles, parts and accessories, base<br />

metals, as well as chemicals and chemical products.