BAM Abbreviated Annual Report 2011 - Siteseeing in the world of ...

BAM Abbreviated Annual Report 2011 - Siteseeing in the world of ...

BAM Abbreviated Annual Report 2011 - Siteseeing in the world of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

54<br />

<strong>2011</strong><br />

Decision on Article 10 <strong>of</strong> <strong>the</strong> Takeover<br />

Directive<br />

The follow<strong>in</strong>g <strong>in</strong>formation and explanations relate to <strong>the</strong><br />

provisions <strong>of</strong> <strong>the</strong> Decree <strong>of</strong> 5 April 2006 implement<strong>in</strong>g<br />

Article 10 <strong>of</strong> Directive number 2004/25/EC <strong>of</strong> <strong>the</strong><br />

European Parliament and <strong>the</strong> Council <strong>of</strong> <strong>the</strong> European<br />

Union dated 21 April 2004.<br />

Capital structure<br />

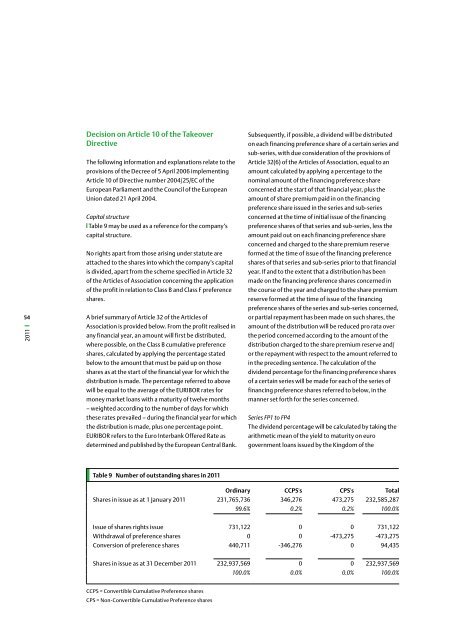

Table 9 may be used as a reference for <strong>the</strong> company’s<br />

capital structure.<br />

No rights apart from those aris<strong>in</strong>g under statute are<br />

attached to <strong>the</strong> shares <strong>in</strong>to which <strong>the</strong> company’s capital<br />

is divided, apart from <strong>the</strong> scheme specified <strong>in</strong> Article 32<br />

<strong>of</strong> <strong>the</strong> Articles <strong>of</strong> Association concern<strong>in</strong>g <strong>the</strong> application<br />

<strong>of</strong> <strong>the</strong> pr<strong>of</strong>it <strong>in</strong> relation to Class B and Class F preference<br />

shares.<br />

A brief summary <strong>of</strong> Article 32 <strong>of</strong> <strong>the</strong> Articles <strong>of</strong><br />

Association is provided below. From <strong>the</strong> pr<strong>of</strong>it realised <strong>in</strong><br />

any f<strong>in</strong>ancial year, an amount will first be distributed,<br />

where possible, on <strong>the</strong> Class B cumulative preference<br />

shares, calculated by apply<strong>in</strong>g <strong>the</strong> percentage stated<br />

below to <strong>the</strong> amount that must be paid up on those<br />

shares as at <strong>the</strong> start <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year for which <strong>the</strong><br />

distribution is made. The percentage referred to above<br />

will be equal to <strong>the</strong> average <strong>of</strong> <strong>the</strong> EURIBOR rates for<br />

money market loans with a maturity <strong>of</strong> twelve months<br />

– weighted accord<strong>in</strong>g to <strong>the</strong> number <strong>of</strong> days for which<br />

<strong>the</strong>se rates prevailed – dur<strong>in</strong>g <strong>the</strong> f<strong>in</strong>ancial year for which<br />

<strong>the</strong> distribution is made, plus one percentage po<strong>in</strong>t.<br />

EURIBOR refers to <strong>the</strong> Euro Interbank Offered Rate as<br />

determ<strong>in</strong>ed and published by <strong>the</strong> European Central Bank.<br />

Table 9 Number <strong>of</strong> outstand<strong>in</strong>g shares <strong>in</strong> <strong>2011</strong><br />

Subsequently, if possible, a dividend will be distributed<br />

on each f<strong>in</strong>anc<strong>in</strong>g preference share <strong>of</strong> a certa<strong>in</strong> series and<br />

sub-series, with due consideration <strong>of</strong> <strong>the</strong> provisions <strong>of</strong><br />

Article 32(6) <strong>of</strong> <strong>the</strong> Articles <strong>of</strong> Association, equal to an<br />

amount calculated by apply<strong>in</strong>g a percentage to <strong>the</strong><br />

nom<strong>in</strong>al amount <strong>of</strong> <strong>the</strong> f<strong>in</strong>anc<strong>in</strong>g preference share<br />

concerned at <strong>the</strong> start <strong>of</strong> that f<strong>in</strong>ancial year, plus <strong>the</strong><br />

amount <strong>of</strong> share premium paid <strong>in</strong> on <strong>the</strong> f<strong>in</strong>anc<strong>in</strong>g<br />

preference share issued <strong>in</strong> <strong>the</strong> series and sub-series<br />

concerned at <strong>the</strong> time <strong>of</strong> <strong>in</strong>itial issue <strong>of</strong> <strong>the</strong> f<strong>in</strong>anc<strong>in</strong>g<br />

preference shares <strong>of</strong> that series and sub-series, less <strong>the</strong><br />

amount paid out on each f<strong>in</strong>anc<strong>in</strong>g preference share<br />

concerned and charged to <strong>the</strong> share premium reserve<br />

formed at <strong>the</strong> time <strong>of</strong> issue <strong>of</strong> <strong>the</strong> f<strong>in</strong>anc<strong>in</strong>g preference<br />

shares <strong>of</strong> that series and sub-series prior to that f<strong>in</strong>ancial<br />

year. If and to <strong>the</strong> extent that a distribution has been<br />

made on <strong>the</strong> f<strong>in</strong>anc<strong>in</strong>g preference shares concerned <strong>in</strong><br />

<strong>the</strong> course <strong>of</strong> <strong>the</strong> year and charged to <strong>the</strong> share premium<br />

reserve formed at <strong>the</strong> time <strong>of</strong> issue <strong>of</strong> <strong>the</strong> f<strong>in</strong>anc<strong>in</strong>g<br />

preference shares <strong>of</strong> <strong>the</strong> series and sub-series concerned,<br />

or partial repayment has been made on such shares, <strong>the</strong><br />

amount <strong>of</strong> <strong>the</strong> distribution will be reduced pro rata over<br />

<strong>the</strong> period concerned accord<strong>in</strong>g to <strong>the</strong> amount <strong>of</strong> <strong>the</strong><br />

distribution charged to <strong>the</strong> share premium reserve and/<br />

or <strong>the</strong> repayment with respect to <strong>the</strong> amount referred to<br />

<strong>in</strong> <strong>the</strong> preced<strong>in</strong>g sentence. The calculation <strong>of</strong> <strong>the</strong><br />

dividend percentage for <strong>the</strong> f<strong>in</strong>anc<strong>in</strong>g preference shares<br />

<strong>of</strong> a certa<strong>in</strong> series will be made for each <strong>of</strong> <strong>the</strong> series <strong>of</strong><br />

f<strong>in</strong>anc<strong>in</strong>g preference shares referred to below, <strong>in</strong> <strong>the</strong><br />

manner set forth for <strong>the</strong> series concerned.<br />

Series FP1 to FP4<br />

The dividend percentage will be calculated by tak<strong>in</strong>g <strong>the</strong><br />

arithmetic mean <strong>of</strong> <strong>the</strong> yield to maturity on euro<br />

government loans issued by <strong>the</strong> K<strong>in</strong>gdom <strong>of</strong> <strong>the</strong><br />

Ord<strong>in</strong>ary CCPS's CPS's Total<br />

Shares <strong>in</strong> issue as at 1 January <strong>2011</strong> 231,765,736 346,276 473,275 232,585,287<br />

99.6% 0.2% 0.2% 100.0%<br />

Issue <strong>of</strong> shares rights issue 731,122 0 0 731,122<br />

Withdrawal <strong>of</strong> preference shares 0 0 -473,275 -473,275<br />

Conversion <strong>of</strong> preference shares 440,711 -346,276 0 94,435<br />

Shares <strong>in</strong> issue as at 31 December <strong>2011</strong> 232,937,569 0 0 232,937,569<br />

CCPS = Convertible Cumulative Preference shares<br />

CPS = Non-Convertible Cumulative Preference shares<br />

100.0% 0.0% 0.0% 100.0%