U.S.-Korea Free Trade Agreement: Potential Economy-wide ... - USITC

U.S.-Korea Free Trade Agreement: Potential Economy-wide ... - USITC

U.S.-Korea Free Trade Agreement: Potential Economy-wide ... - USITC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

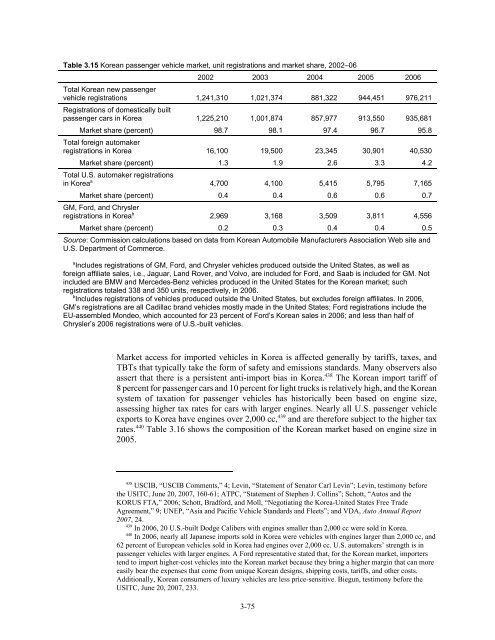

Table 3.15 <strong>Korea</strong>n passenger vehicle market, unit registrations and market share, 2002–06<br />

2002 2003 2004 2005 2006<br />

Total <strong>Korea</strong>n new passenger<br />

vehicle registrations<br />

Registrations of domestically built<br />

1,241,310 1,021,374 881,322 944,451 976,211<br />

passenger cars in <strong>Korea</strong> 1,225,210 1,001,874 857,977 913,550 935,681<br />

Market share (percent)<br />

Total foreign automaker<br />

98.7 98.1 97.4 96.7 95.8<br />

registrations in <strong>Korea</strong> 16,100 19,500 23,345 30,901 40,530<br />

Market share (percent)<br />

Total U.S. automaker registrations<br />

1.3 1.9 2.6 3.3 4.2<br />

in <strong>Korea</strong> a 4,700 4,100 5,415 5,795 7,165<br />

Market share (percent)<br />

GM, Ford, and Chrysler<br />

0.4 0.4 0.6 0.6 0.7<br />

registrations in <strong>Korea</strong> b 2,969 3,168 3,509 3,811 4,556<br />

Market share (percent) 0.2 0.3 0.4 0.4 0.5<br />

Source: Commission calculations based on data from <strong>Korea</strong>n Automobile Manufacturers Association Web site and<br />

U.S. Department of Commerce.<br />

a Includes registrations of GM, Ford, and Chrysler vehicles produced outside the United States, as well as<br />

foreign affiliate sales, i.e., Jaguar, Land Rover, and Volvo, are included for Ford, and Saab is included for GM. Not<br />

included are BMW and Mercedes-Benz vehicles produced in the United States for the <strong>Korea</strong>n market; such<br />

registrations totaled 338 and 350 units, respectively, in 2006.<br />

b Includes registrations of vehicles produced outside the United States, but excludes foreign affiliates. In 2006,<br />

GM’s registrations are all Cadillac brand vehicles mostly made in the United States; Ford registrations include the<br />

EU-assembled Mondeo, which accounted for 23 percent of Ford’s <strong>Korea</strong>n sales in 2006; and less than half of<br />

Chrysler’s 2006 registrations were of U.S.-built vehicles.<br />

Market access for imported vehicles in <strong>Korea</strong> is affected generally by tariffs, taxes, and<br />

TBTs that typically take the form of safety and emissions standards. Many observers also<br />

assert that there is a persistent anti-import bias in <strong>Korea</strong>. 438 The <strong>Korea</strong>n import tariff of<br />

8 percent for passenger cars and 10 percent for light trucks is relatively high, and the <strong>Korea</strong>n<br />

system of taxation for passenger vehicles has historically been based on engine size,<br />

assessing higher tax rates for cars with larger engines. Nearly all U.S. passenger vehicle<br />

exports to <strong>Korea</strong> have engines over 2,000 cc, 439 and are therefore subject to the higher tax<br />

rates. 440 Table 3.16 shows the composition of the <strong>Korea</strong>n market based on engine size in<br />

2005.<br />

438 USCIB, “USCIB Comments,” 4; Levin, “Statement of Senator Carl Levin”; Levin, testimony before<br />

the <strong>USITC</strong>, June 20, 2007, 160-61; ATPC, “Statement of Stephen J. Collins”; Schott, “Autos and the<br />

KORUS FTA,” 2006; Schott, Bradford, and Moll, “Negotiating the <strong>Korea</strong>-United States <strong>Free</strong> <strong>Trade</strong><br />

<strong>Agreement</strong>,” 9; UNEP, “Asia and Pacific Vehicle Standards and Fleets”; and VDA, Auto Annual Report<br />

2007, 24.<br />

439 In 2006, 20 U.S.-built Dodge Calibers with engines smaller than 2,000 cc were sold in <strong>Korea</strong>.<br />

440 In 2006, nearly all Japanese imports sold in <strong>Korea</strong> were vehicles with engines larger than 2,000 cc, and<br />

62 percent of European vehicles sold in <strong>Korea</strong> had engines over 2,000 cc. U.S. automakers’ strength is in<br />

passenger vehicles with larger engines. A Ford representative stated that, for the <strong>Korea</strong>n market, importers<br />

tend to import higher-cost vehicles into the <strong>Korea</strong>n market because they bring a higher margin that can more<br />

easily bear the expenses that come from unique <strong>Korea</strong>n designs, shipping costs, tariffs, and other costs.<br />

Additionally, <strong>Korea</strong>n consumers of luxury vehicles are less price-sensitive. Biegun, testimony before the<br />

<strong>USITC</strong>, June 20, 2007, 233.<br />

3-75