- Page 2 and 3:

U.S. International Trade Commission

- Page 4 and 5:

This report was prepared principall

- Page 6 and 7:

CONTENTS-Continued Chapter 3. Secto

- Page 8 and 9:

CONTENTS—Continued Chapter 5. Imp

- Page 10 and 11:

CONTENTS-Continued Chapter 7. Liter

- Page 12 and 13:

CONTENTS-Continued Tables—Continu

- Page 15 and 16: Abbreviations and Acronyms 3G third

- Page 17 and 18: Abbreviations and Acronyms—Contin

- Page 19: Abbreviations and Acronyms—Contin

- Page 22 and 23: vehicles) would likely be diverted

- Page 24 and 25: Sector-specific Assessments The U.S

- Page 26 and 27: total increased fish imports from K

- Page 28 and 29: Korea would likely limit the impact

- Page 30 and 31: Intellectual property rights (IPR):

- Page 32 and 33: sector barriers. 5 These merchandis

- Page 34 and 35: Table 1.1 U.S.-Korea FTA: Location

- Page 36 and 37: Table 1.2 Korean tariff rates on im

- Page 38 and 39: Table 1.4 U.S.-Korea FTA: Summary o

- Page 40 and 41: observed GDP for model regions). Th

- Page 42 and 43: Box 2.1 Interpreting the model resu

- Page 44 and 45: Table 2.1 U.S.-Korea FTA: Simulated

- Page 46 and 47: 2-8 This page has been updated to r

- Page 48 and 49: Figure 2.2 U.S-Korea FTA: Simulated

- Page 50 and 51: As shown in figure 2.2, the largest

- Page 52 and 53: 2-14 This page has been updated to

- Page 54 and 55: Economy-wide Impact of Implementing

- Page 56 and 57: Grain (Wheat, Corn, and Other Feed

- Page 58 and 59: Korea imported 3.8 million mt of wh

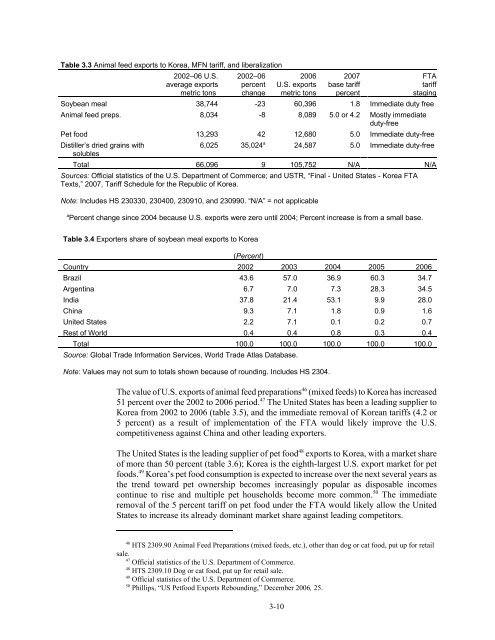

- Page 60 and 61: U.S. oilseed product exports to Kor

- Page 62 and 63: Table 3.2 U.S. oilseed product expo

- Page 66 and 67: consumed domestically by the U.S. l

- Page 68 and 69: ates. For corn starch, the United S

- Page 70 and 71: quota rates have been effectively e

- Page 72 and 73: Noncitrus Fruit 87 Views of Interes

- Page 74 and 75: 3-20 Table 3.9 U.S.-Korea trade and

- Page 76 and 77: Korean grapes are much more costly

- Page 78 and 79: Potato Products 122 Assessment The

- Page 80 and 81: ate is 304 percent ad valorem. 141

- Page 82 and 83: Other Vegetables 162 Assessment The

- Page 84 and 85: U.S. exports of other fresh and pro

- Page 86 and 87: tariff concessions that could accru

- Page 88 and 89: Dairy Products 215 Similarly, the p

- Page 90 and 91: TRQ for food whey, 223 based on cur

- Page 92 and 93: potential changes in trade based so

- Page 94 and 95: Figure Figure 3.1 Korea: Beef and v

- Page 96 and 97: Views of Interested Parties The inc

- Page 98 and 99: are subject to the same food safety

- Page 100 and 101: enefit under the provisions of this

- Page 102 and 103: Box 3.2 Potential price and quantit

- Page 104 and 105: 50 percent, while the vegetable jui

- Page 106 and 107: and major supplier, and U.S. tariff

- Page 108 and 109: textiles and apparel through 2005.

- Page 110 and 111: U.S. Exports The impact of the FTA

- Page 112 and 113: passage. NCTO indicated that, even

- Page 114 and 115:

In its report, the ITAC on Distribu

- Page 116 and 117:

of the U.S. footwear market, with C

- Page 118 and 119:

of these producers. 362 RPFMA noted

- Page 120 and 121:

prohibit improper inducements by ph

- Page 122 and 123:

Machinery, Electronics, and Transpo

- Page 124 and 125:

U.S. exports of auto parts would be

- Page 126 and 127:

imports from and exports to Korea.

- Page 128 and 129:

Passenger Vehicles 433 Assessment U

- Page 130 and 131:

Table 3.16 Korean passenger vehicle

- Page 132 and 133:

import activities have continued

- Page 134 and 135:

Box 3.4 Automotive-related FTA Prov

- Page 136 and 137:

access. The FTA affirms the parties

- Page 138 and 139:

gaining U.S. market share regardles

- Page 140 and 141:

keep the products out.” 492 Mr. B

- Page 142 and 143:

these vehicles to Korea. The commit

- Page 144 and 145:

Brown expressed concern about the r

- Page 146 and 147:

goods; and high-technology medical,

- Page 148 and 149:

device pricing, reimbursement, and

- Page 151 and 152:

CHAPTER 4 Impact of Market Access P

- Page 153 and 154:

elative to GDP than do China, Japan

- Page 155 and 156:

services as a substantial improveme

- Page 157 and 158:

Box 4.2 Financial services: Competi

- Page 159 and 160:

Summary of Provisions Chapter 13 of

- Page 161 and 162:

national treatment, full establishm

- Page 163 and 164:

Box 4.4 Competitive conditions in t

- Page 165 and 166:

and cross-connect links 70 are more

- Page 167 and 168:

Box 4.5 U.S. legal services trade w

- Page 169 and 170:

establish offices in Korea to provi

- Page 171 and 172:

Box 4.6 Competitive conditions in t

- Page 173 and 174:

equirements and foreign ownership r

- Page 175 and 176:

CHAPTER 5 Impact of Trade Facilitat

- Page 177 and 178:

publication and administration of t

- Page 179 and 180:

Views of Interested Parties In its

- Page 181 and 182:

Summary of Provisions This chapter

- Page 183 and 184:

use of TBTs to protect Korea’s au

- Page 185 and 186:

conformity assessment procedures el

- Page 187 and 188:

FTA Chapter 15-Electronic Commerce

- Page 189:

Views of Interested Parties The U.S

- Page 192 and 193:

quantities as to be a substantial c

- Page 194 and 195:

that such transshipment could imped

- Page 196 and 197:

Box 6.1 Foreign investment in Korea

- Page 198 and 199:

in the FTA. The awards made by any

- Page 200 and 201:

Table 6.1 U.S.-Korea FTA: Industry

- Page 202 and 203:

(ITAC 5) report cited as particular

- Page 204 and 205:

Section C of Chapter 11 and the lac

- Page 206 and 207:

practices, and violations of consum

- Page 208 and 209:

FTA Chapter 17—Government Procure

- Page 210 and 211:

Both the United States and Korea ar

- Page 212 and 213:

8) 87 also expressed support for th

- Page 214 and 215:

Box 6.2 Recent conditions of IPR pr

- Page 216 and 217:

protection to life of the author pl

- Page 218 and 219:

Views of Interested Parties A numbe

- Page 220 and 221:

GPHA stated in testimony before the

- Page 222 and 223:

Box 6.3 Labor market conditions in

- Page 224 and 225:

FTA Chapter 20—Environment 131 As

- Page 226 and 227:

trade measures are the least disrup

- Page 228 and 229:

FTA Chapter 22-Institutional Provis

- Page 230 and 231:

Views of Interested Parties The Ind

- Page 233 and 234:

CHAPTER 7 Literature Review and Sum

- Page 235 and 236:

7-3 Table 7.1 Model, liberalization

- Page 237 and 238:

terms. Much of the increase in U.S.

- Page 239 and 240:

Liberalization generated small incr

- Page 241 and 242:

Sander Levin, Member of the U.S. Ho

- Page 243 and 244:

Regarding footwear and travel goods

- Page 245 and 246:

Korea’s establishment as a region

- Page 247 and 248:

The California Table Grape Commissi

- Page 249 and 250:

order activity, and facilitate expa

- Page 251 and 252:

At the Commission’s hearing, Mr.

- Page 253 and 254:

Information Technology Industry Cou

- Page 255 and 256:

With respect to tariff and nontarif

- Page 257 and 258:

deterring illegal transshipments. I

- Page 259 and 260:

PhRMA identified what it views as t

- Page 261 and 262:

the TIA stated that it supports the

- Page 263 and 264:

access to the market. The Council a

- Page 265 and 266:

United States, Spain, Chile, Brazil

- Page 267 and 268:

Bibliography Advanced Medical Techn

- Page 269 and 270:

AT&T. “AT&T Reaction to Free Trad

- Page 271 and 272:

______. “Korea-U.S. Free Trade Re

- Page 273 and 274:

______. “Country Finance: South K

- Page 275 and 276:

Global Trade Information Services I

- Page 277 and 278:

International Labor Organization (I

- Page 279 and 280:

Jones, Laura E. Executive Director.

- Page 281 and 282:

Lee, Hyunok, and Daniel A. Sumner.

- Page 283 and 284:

Nam, In-Soo. “Helio's Losses To W

- Page 285 and 286:

Powers, Mark. Northwest Horticultur

- Page 287 and 288:

Smith, Brad. American Council of Li

- Page 289 and 290:

U.S.-Korea Business Council (USKBC)

- Page 291 and 292:

______. “Korea, Republic of Oilse

- Page 293 and 294:

U.S. International Trade Commission

- Page 295 and 296:

Ward, David. American Council on Ed

- Page 297:

APPENDIX A Request Letter from USTR

- Page 301:

APPENDIX B Federal Register Notices

- Page 304 and 305:

pwalker on PROD1PC71 with NOTICES 2

- Page 307:

APPENDIX C Hearing Participants

- Page 310 and 311:

ORGANIZATION AND WITNESS: PANEL 1 (

- Page 313:

APPENDIX D U.S.-Korea FTA: Chapter-

- Page 316 and 317:

fees and charges on trade in goods

- Page 318 and 319:

determines the tariff classificatio

- Page 320 and 321:

The transparency provisions would a

- Page 322 and 323:

necessary duties within 1 year of i

- Page 324 and 325:

technical regulation or conformity

- Page 326 and 327:

procedures), and practices of a par

- Page 328 and 329:

aviation, fisheries, or maritime ma

- Page 330 and 331:

of standards and criteria and on te

- Page 332 and 333:

of the FTA that impose unilateral o

- Page 334 and 335:

use of electronic authentication in

- Page 336 and 337:

parties’ rights and obligations u

- Page 338 and 339:

establishment of Uniform Domain-Nam

- Page 340 and 341:

government to take appropriate meas

- Page 342 and 343:

environmental laws. 102 In the U.S.

- Page 344 and 345:

not limited to, policies on commerc

- Page 347 and 348:

Economic indicators 2002 2006 Popul

- Page 349 and 350:

Table E.1 Leading U.S. exports to K

- Page 351:

APPENDIX F GTAP Model

- Page 354 and 355:

Updating the GTAP Database The curr

- Page 356 and 357:

Key Assumptions Agency. 4 The price

- Page 358 and 359:

Table F.2 U.S.-Korea FTA benchmark

- Page 360 and 361:

Measuring the Impacts of the FTA an

- Page 363 and 364:

General Effects of Trade Agreements

- Page 365:

APPENDIX H Tariff Equivalents in Ko

- Page 368 and 369:

Previous Literature The method for

- Page 370 and 371:

For the purposes of this report, a

- Page 372 and 373:

Table H.1 Tariff equivalents in Kor

- Page 375:

APPENDIX I Services Nonconforming M

- Page 378 and 379:

Table I.1 U.S.-Korea FTA: Korean se

- Page 381:

APPENDIX J Description of Possible

- Page 384 and 385:

are in effect import prices, and th

- Page 387:

APPENDIX K Overview of Agricultural

- Page 390 and 391:

Additionally, although current regu

- Page 392:

About This Report The United States