You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ILLUSTRATION © ROBERT HANSON II/EYECANDY.CO.UK<br />

NO<br />

SAYS ROSIE CARR<br />

LET’S GET ONE thing straight: not<br />

everyone who has a Swiss bank account<br />

is a drug-dealing money launderer or a<br />

dictator. But it’s always easier to build<br />

support for a crackdown on certain groups<br />

when you depict them as unsavoury. And<br />

so Swiss banks are routinely portrayed as<br />

hiding money for criminals and cheats,<br />

rather than hard-working business people<br />

fed up with handing over their money for<br />

someone else to spend.<br />

I don’t doubt there are some dubious<br />

people among the clients of Swiss banks.<br />

But that’s not the reason why governments<br />

are furious over laws that prevent them<br />

from discovering who’s been diverting<br />

money away from their control. Their<br />

determination to tear down the protection<br />

that Swiss banks offer is not driven by<br />

anger over moral issues. It’s not even driven<br />

by the lost tax.<br />

What it is about is control. Governments<br />

can’t bear the idea that their tax inspectors<br />

might hit a brick wall that stops them<br />

knowing exactly how much money we have<br />

and how much we earn from our savings<br />

and investments. What governments want<br />

is for us to meekly hand our money to the<br />

politicians who think they know best how<br />

to spend it. You see, governments have<br />

an insatiable appetite for tax. They need<br />

money to fund their long lists of grand<br />

schemes and lavish promises to loyal voters.<br />

But why wouldn’t high earners be<br />

indignant about the demands made<br />

on them? They already pay more tax<br />

than anyone else and in the wake of the<br />

economic crisis many countries have<br />

introduced special higher rates of tax for<br />

the highest earners. Clearly we all need to<br />

pay tax. Without that revenue, the state<br />

we live in could not afford to educate our<br />

children, look after the sick and the poor,<br />

BIG DEBATE | SWISS BANKING<br />

pay the police and armed forces, supply<br />

clean water and waste services, or build<br />

roads. But we must also be allowed to<br />

retain most of our income to spend how we<br />

choose. We are not the slaves of the state<br />

and we should not be treated as such.<br />

These so-called tax evaders and cheats<br />

already pay large amounts of tax, but<br />

the greed of the state knows no bounds.<br />

Look at Britain – under a high-spending,<br />

tax-loving Labour government, new laws<br />

force almost everyone to spill the beans on<br />

everyone else where income is concerned.<br />

Britain has also changed its tax laws so<br />

that its high earners will have to pay tax<br />

on every penny they earn – their tax-free<br />

allowance has been withdrawn entirely. No<br />

wonder governments are keen to end secret<br />

bank accounts when they give taxpayers<br />

incentives to hide their money!<br />

We should all pay tax, but no<br />

government has the right to trample<br />

over our right to privacy or to mug us at<br />

gunpoint in its unseemly haste to get its<br />

hands on our money.<br />

Rosie Carr is deputy editor of Investors<br />

Chronicle magazine<br />

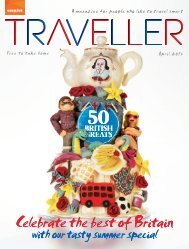

DECEMBER 09 | TRAVELLER | 97