OECD Economic Outlook 69 - Biblioteca Hegoa

OECD Economic Outlook 69 - Biblioteca Hegoa

OECD Economic Outlook 69 - Biblioteca Hegoa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

92 - <strong>OECD</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>69</strong><br />

Weaker export demand should lead to a substantial decline in economic growth from 5¾ per cent in 2000 to around<br />

3¾ per cent in 2002. Labour market tensions are, nevertheless, likely to remain. With oil prices falling gradually, headline<br />

inflation should decelerate from 3¼ per cent in 2000 to slightly above 2 per cent in 2002.<br />

A large part of the sharp improvement in the government budget in 2000 was due to exceptional revenue rises. These<br />

should not be used to permanently increase government spending and the government should stick to its medium-term<br />

budgetary framework. Though the tax cuts in 2001 and 2002 will strengthen the supply side, other structural policy<br />

measures are also needed to ensure a further fall in unemployment.<br />

Surging exports spurred growth<br />

and labour market tensions<br />

have intensified<br />

The government surplus rose<br />

steeply due to an exceptional<br />

increase in tax revenues<br />

Finland<br />

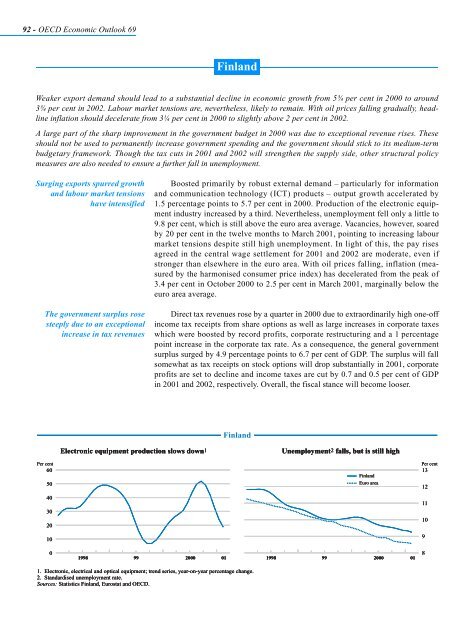

Boosted primarily by robust external demand – particularly for information<br />

and communication technology (ICT) products – output growth accelerated by<br />

1.5 percentage points to 5.7 per cent in 2000. Production of the electronic equipment<br />

industry increased by a third. Nevertheless, unemployment fell only a little to<br />

9.8 per cent, which is still above the euro area average. Vacancies, however, soared<br />

by 20 per cent in the twelve months to March 2001, pointing to increasing labour<br />

market tensions despite still high unemployment. In light of this, the pay rises<br />

agreed in the central wage settlement for 2001 and 2002 are moderate, even if<br />

stronger than elsewhere in the euro area. With oil prices falling, inflation (measured<br />

by the harmonised consumer price index) has decelerated from the peak of<br />

3.4 per cent in October 2000 to 2.5 per cent in March 2001, marginally below the<br />

euro area average.<br />

Direct tax revenues rose by a quarter in 2000 due to extraordinarily high one-off<br />

income tax receipts from share options as well as large increases in corporate taxes<br />

which were boosted by record profits, corporate restructuring and a 1 percentage<br />

point increase in the corporate tax rate. As a consequence, the general government<br />

surplus surged by 4.9 percentage points to 6.7 per cent of GDP. The surplus will fall<br />

somewhat as tax receipts on stock options will drop substantially in 2001, corporate<br />

profits are set to decline and income taxes are cut by 0.7 and 0.5 per cent of GDP<br />

in 2001 and 2002, respectively. Overall, the fiscal stance will become looser.<br />

Per cent Per cent<br />

60<br />

13<br />

50<br />

Finland<br />

Euro area<br />

12<br />

40<br />

30<br />

11<br />

20<br />

10<br />

10<br />

9<br />

0<br />

Finland<br />

Electronic equipment production slows down1 down1 down1 Unemployment2 Unemployment2 Unemployment2 falls, but is still high<br />

1998 99 2000<br />

01 1998 99 2000<br />

01<br />

1. Electronic, electrical and optical equipment; trend series, year-on-year percentage change.<br />

2. Standardised unemployment rate.<br />

Sources: Statistics Finland, Eurostat and <strong>OECD</strong>.<br />

8