OECD Economic Outlook 69 - Biblioteca Hegoa

OECD Economic Outlook 69 - Biblioteca Hegoa

OECD Economic Outlook 69 - Biblioteca Hegoa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

122 - <strong>OECD</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>69</strong><br />

As growth slows, imbalances<br />

should start to be corrected<br />

There are risks to<br />

competitiveness and export<br />

markets<br />

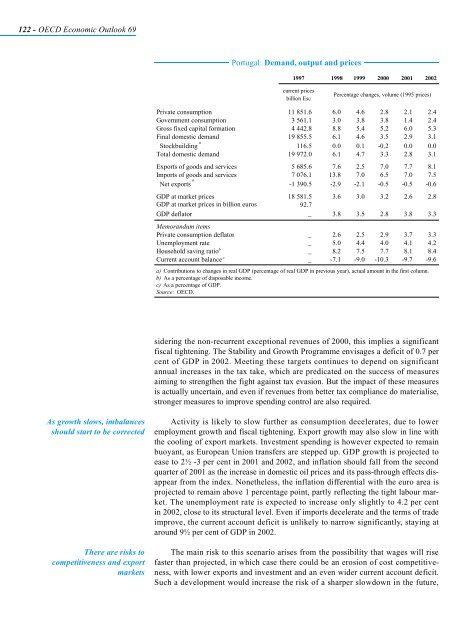

Portugal: Demand, output and prices<br />

1997 1998 1999 2000 2001 2002<br />

current prices<br />

billion Esc<br />

Percentage changes, volume (1995 prices)<br />

Private consumption 11 851.6 6.0 4.6 2.8 2.1 2.4<br />

Government consumption 3 561.1 3.0 3.8 3.8 1.4 2.4<br />

Gross fixed capital formation 4 442.8 8.8 5.4 5.2 6.0 5.3<br />

Final domestic demand 19 855.5 6.1 4.6 3.5 2.9 3.1<br />

a<br />

Stockbuilding 116.5 0.0 0.1 -0.2 0.0 0.0<br />

Total domestic demand 19 972.0 6.1 4.7 3.3 2.8 3.1<br />

Exports of goods and services 5 685.6 7.6 2.5 7.0 7.7 8.1<br />

Imports of goods and services 7 076.1 13.8 7.0 6.5 7.0 7.5<br />

a<br />

Net exports -1 390.5 -2.9 -2.1 -0.5 -0.5 -0.6<br />

GDP at market prices 18 581.5 3.6 3.0 3.2 2.6 2.8<br />

GDPatmarketpricesinbillioneuros 92.7<br />

GDP deflator<br />

Memorandum items<br />

_ 3.8 3.5 2.8 3.8 3.3<br />

Private consumption deflator _ 2.6 2.5 2.9 3.7 3.3<br />

Unemployment rate _ 5.0 4.4 4.0 4.1 4.2<br />

b<br />

Household saving ratio _ 8.2 7.5 7.7 8.1 8.4<br />

c<br />

Current account balance _ -7.1 -9.0 -10.3 -9.7 -9.6<br />

a) Contributions to changes in real GDP (percentage of real GDP in previous year), actual amount in the first column.<br />

b) As a percentage of disposable income.<br />

c) As a percentage of GDP.<br />

Source: <strong>OECD</strong>.<br />

sidering the non-recurrent exceptional revenues of 2000, this implies a significant<br />

fiscal tightening. The Stability and Growth Programme envisages a deficit of 0.7 per<br />

cent of GDP in 2002. Meeting these targets continues to depend on significant<br />

annual increases in the tax take, which are predicated on the success of measures<br />

aiming to strengthen the fight against tax evasion. But the impact of these measures<br />

is actually uncertain, and even if revenues from better tax compliance do materialise,<br />

stronger measures to improve spending control are also required.<br />

Activity is likely to slow further as consumption decelerates, due to lower<br />

employment growth and fiscal tightening. Export growth may also slow in line with<br />

the cooling of export markets. Investment spending is however expected to remain<br />

buoyant, as European Union transfers are stepped up. GDP growth is projected to<br />

ease to 2½ -3 per cent in 2001 and 2002, and inflation should fall from the second<br />

quarter of 2001 as the increase in domestic oil prices and its pass-through effects disappear<br />

from the index. Nonetheless, the inflation differential with the euro area is<br />

projected to remain above 1 percentage point, partly reflecting the tight labour market.<br />

The unemployment rate is expected to increase only slightly to 4.2 per cent<br />

in 2002, close to its structural level. Even if imports decelerate and the terms of trade<br />

improve, the current account deficit is unlikely to narrow significantly, staying at<br />

around 9½ per cent of GDP in 2002.<br />

The main risk to this scenario arises from the possibility that wages will rise<br />

faster than projected, in which case there could be an erosion of cost competitiveness,<br />

with lower exports and investment and an even wider current account deficit.<br />

Such a development would increase the risk of a sharper slowdown in the future,