OECD Economic Outlook 69 - Biblioteca Hegoa

OECD Economic Outlook 69 - Biblioteca Hegoa

OECD Economic Outlook 69 - Biblioteca Hegoa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

106 - <strong>OECD</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>69</strong><br />

Monetary conditions and<br />

export markets are less<br />

supportive of growth<br />

Growth and inflation should<br />

slow from a peak in 2000<br />

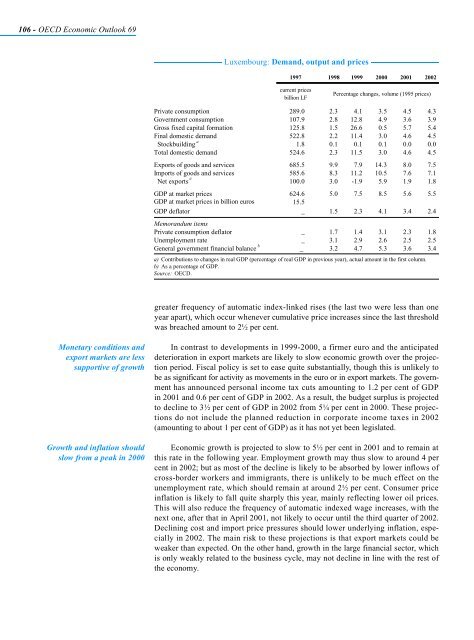

Luxembourg: Demand, output and prices<br />

1997 1998 1999 2000 2001 2002<br />

current prices<br />

billion LF<br />

Percentage changes, volume (1995 prices)<br />

Private consumption 289.0 2.3 4.1 3.5 4.5 4.3<br />

Government consumption 107.9 2.8 12.8 4.9 3.6 3.9<br />

Gross fixed capital formation 125.8 1.5 26.6 0.5 5.7 5.4<br />

Final domestic demand 522.8 2.2 11.4 3.0 4.6 4.5<br />

a<br />

Stockbuilding 1.8 0.1 0.1 0.1 0.0 0.0<br />

Total domestic demand 524.6 2.3 11.5 3.0 4.6 4.5<br />

Exports of goods and services 685.5 9.9 7.9 14.3 8.0 7.5<br />

Imports of goods and services 585.6 8.3 11.2 10.5 7.6 7.1<br />

a<br />

Net exports 100.0 3.0 -1.9 5.9 1.9 1.8<br />

GDP at market prices 624.6 5.0 7.5 8.5 5.6 5.5<br />

GDP at market prices in billion euros 15.5<br />

GDP deflator _ 1.5 2.3 4.1 3.4 2.4<br />

Memorandum items<br />

Private consumption deflator _ 1.7 1.4 3.1 2.3 1.8<br />

Unemployment rate _ 3.1 2.9 2.6 2.5 2.5<br />

b<br />

General government financial balance _ 3.2 4.7 5.3 3.6 3.4<br />

a) Contributions to changes in real GDP (percentage of real GDP in previous year), actual amount in the first column.<br />

b) As a percentage of GDP.<br />

Source: <strong>OECD</strong>.<br />

greater frequency of automatic index-linked rises (the last two were less than one<br />

year apart), which occur whenever cumulative price increases since the last threshold<br />

was breached amount to 2½ per cent.<br />

In contrast to developments in 1999-2000, a firmer euro and the anticipated<br />

deterioration in export markets are likely to slow economic growth over the projection<br />

period. Fiscal policy is set to ease quite substantially, though this is unlikely to<br />

be as significant for activity as movements in the euro or in export markets. The government<br />

has announced personal income tax cuts amounting to 1.2 per cent of GDP<br />

in 2001 and 0.6 per cent of GDP in 2002. As a result, the budget surplus is projected<br />

to decline to 3½ per cent of GDP in 2002 from 5¼ per cent in 2000. These projections<br />

do not include the planned reduction in corporate income taxes in 2002<br />

(amounting to about 1 per cent of GDP) as it has not yet been legislated.<br />

<strong>Economic</strong> growth is projected to slow to 5½ per cent in 2001 and to remain at<br />

this rate in the following year. Employment growth may thus slow to around 4 per<br />

cent in 2002; but as most of the decline is likely to be absorbed by lower inflows of<br />

cross-border workers and immigrants, there is unlikely to be much effect on the<br />

unemployment rate, which should remain at around 2½ per cent. Consumer price<br />

inflation is likely to fall quite sharply this year, mainly reflecting lower oil prices.<br />

This will also reduce the frequency of automatic indexed wage increases, with the<br />

next one, after that in April 2001, not likely to occur until the third quarter of 2002.<br />

Declining cost and import price pressures should lower underlying inflation, especially<br />

in 2002. The main risk to these projections is that export markets could be<br />

weaker than expected. On the other hand, growth in the large financial sector, which<br />

is only weakly related to the business cycle, may not decline in line with the rest of<br />

the economy.