OECD Economic Outlook 69 - Biblioteca Hegoa

OECD Economic Outlook 69 - Biblioteca Hegoa

OECD Economic Outlook 69 - Biblioteca Hegoa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Mexico<br />

Developments in individual <strong>OECD</strong> countries - 107<br />

Output growth accelerated to almost 7 per cent in 2000, underpinned by robust demand in the United States and an easy<br />

fiscal stance. Yet the strength of the peso and tight monetary conditions helped inflation to come down. The deterioration<br />

of the current account was limited by improving terms of trade. Owing to the slowdown in the United States, GDP growth<br />

is projected to weaken in 2001, regaining momentum thereafter. Inflation is projected to fall further, but the current<br />

account deficit could widen significantly, as oil export revenues decline.<br />

Sustained improvement in economic performance will require the maintenance of prudent macroeconomic policies.<br />

Despite the United States slowdown, fiscal restraint is needed to take pressure off monetary policy and cool domestic<br />

demand. In the structural area, the proposed tax reform should strengthen budget revenue, while reducing tax distortions.<br />

Further steps to increase product market competition are also needed to enhance Mexico’s supply-side performance.<br />

Real output growth reached close to 7 per cent in 2000, driven by persistently<br />

robust exports to the United States and booming domestic demand. Retail sales and<br />

consumer and investment goods imports were still expanding rapidly at the start<br />

of 2001, but exports have shown some signs of slowing. Owing to high oil prices and<br />

a strong peso, Mexico’s terms of trade improved, helping to stabilise the current<br />

account deficit at around 3 per cent of GDP, despite the buoyancy of imports.<br />

Foreign direct investment reached a record US$13.2 billion, financing three-quarters<br />

of the current account deficit.<br />

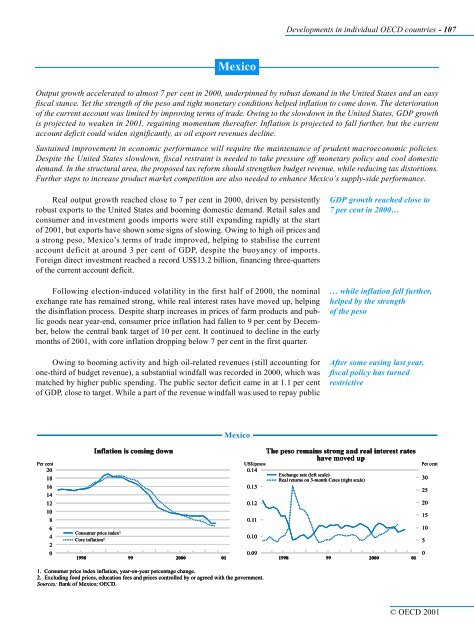

Following election-induced volatility in the first half of 2000, the nominal<br />

exchange rate has remained strong, while real interest rates have moved up, helping<br />

the disinflation process. Despite sharp increases in prices of farm products and public<br />

goods near year-end, consumer price inflation had fallen to 9 per cent by December,<br />

below the central bank target of 10 per cent. It continued to decline in the early<br />

months of 2001, with core inflation dropping below 7 per cent in the first quarter.<br />

Owing to booming activity and high oil-related revenues (still accounting for<br />

one-third of budget revenue), a substantial windfall was recorded in 2000, which was<br />

matched by higher public spending. The public sector deficit came in at 1.1 per cent<br />

of GDP, close to target. While a part of the revenue windfall was used to repay public<br />

Mexico<br />

GDP growth reached close to<br />

7 per cent in 2000…<br />

… while inflation fell further,<br />

helped by the strength<br />

of the peso<br />

After some easing last year,<br />

fiscal policy has turned<br />

restrictive<br />

Inflation is coming down<br />

The peso remains strong and real interest rates<br />

have moved up<br />

Per cent US$/pesos Per cent<br />

20<br />

18<br />

0.14<br />

30<br />

16<br />

14<br />

0.13<br />

25<br />

12<br />

0.12<br />

20<br />

10<br />

8<br />

0.11<br />

15<br />

6<br />

4<br />

2<br />

Consumer price index<br />

0.10<br />

10<br />

5<br />

0<br />

1998 99 2000 01<br />

0.09<br />

1998 99 2000 01<br />

0<br />

1<br />

Core inflation2 Inflation is coming down<br />

The peso remains strong and real interest rates<br />

have moved up<br />

Per cent US$/pesos Per cent<br />

20<br />

18<br />

0.14<br />

Exchange rate (left scale)<br />

Real returns on 3-month Cetes (right scale)<br />

30<br />

16<br />

14<br />

0.13<br />

25<br />

12<br />

0.12<br />

20<br />

10<br />

8<br />

0.11<br />

15<br />

6<br />

4<br />

2<br />

Consumer price index<br />

0.10<br />

10<br />

5<br />

0<br />

1998 99 2000 01<br />

0.09<br />

1998 99 2000 01<br />

0<br />

1<br />

Core inflation2 Inflation is coming down<br />

The peso remains strong and real interest rates<br />

have moved up<br />

Per cent US$/pesos Per cent<br />

20<br />

18<br />

0.14<br />

Exchange rate (left scale)<br />

Real returns on 3-month Cetes (right scale)<br />

30<br />

16<br />

14<br />

0.13<br />

25<br />

12<br />

0.12<br />

20<br />

10<br />

8<br />

0.11<br />

15<br />

6<br />

4<br />

2<br />

Consumer price index<br />

0.10<br />

10<br />

5<br />

0<br />

1998 99 2000 01<br />

0.09<br />

1998 99 2000 01<br />

0<br />

1<br />

Core inflation2 Exchange rate (left scale)<br />

Real returns on 3-month Cetes (right scale)<br />

1. Consumer price index inflation, year-on-year percentage change.<br />

2. Excluding food prices, education fees and prices controlled by or agreed with the government.<br />

Sources: Bank of Mexico; <strong>OECD</strong>.<br />

© <strong>OECD</strong> 2001