OECD Economic Outlook 69 - Biblioteca Hegoa

OECD Economic Outlook 69 - Biblioteca Hegoa

OECD Economic Outlook 69 - Biblioteca Hegoa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

84 - <strong>OECD</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>69</strong><br />

While fiscal policy is expected<br />

to be broadly neutral…<br />

… the tax reform should<br />

enhance wage moderation and<br />

economic growth<br />

The expansion is projected to<br />

continue, albeit at a slower,<br />

more sustainable pace<br />

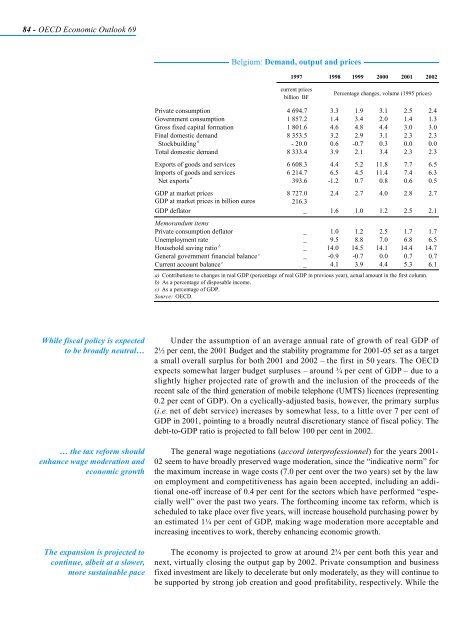

Belgium: Demand, output and prices<br />

1997 1998 1999 2000 2001 2002<br />

current prices<br />

billion BF<br />

Percentage changes, volume (1995 prices)<br />

Private consumption 4 <strong>69</strong>4.7 3.3 1.9 3.1 2.5 2.4<br />

Government consumption 1 857.2 1.4 3.4 2.0 1.4 1.3<br />

Gross fixed capital formation 1 801.6 4.6 4.8 4.4 3.0 3.0<br />

Final domestic demand 8 353.5 3.2 2.9 3.1 2.3 2.3<br />

a<br />

Stockbuilding - 20.0 0.6 -0.7 0.3 0.0 0.0<br />

Total domestic demand 8 333.4 3.9 2.1 3.4 2.3 2.3<br />

Exports of goods and services 6 608.3 4.4 5.2 11.8 7.7 6.5<br />

Imports of goods and services 6 214.7 6.5 4.5 11.4 7.4 6.3<br />

a<br />

Net exports 393.6 -1.2 0.7 0.8 0.6 0.5<br />

GDP at market prices 8 727.0 2.4 2.7 4.0 2.8 2.7<br />

GDPatmarketpricesinbillioneuros 216.3<br />

GDP deflator<br />

Memorandum items<br />

_ 1.6 1.0 1.2 2.5 2.1<br />

Private consumption deflator _ 1.0 1.2 2.5 1.7 1.7<br />

Unemployment rate _ 9.5 8.8 7.0 6.8 6.5<br />

b<br />

Household saving ratio _ 14.0 14.5 14.1 14.4 14.7<br />

c<br />

General government financial balance _ -0.9 -0.7 0.0 0.7 0.7<br />

c<br />

Current account balance _ 4.1 3.9 4.4 5.3 6.1<br />

a) Contributions to changes in real GDP (percentage of real GDP in previous year), actual amount in the first column.<br />

b) As a percentage of disposable income.<br />

c) As a percentage of GDP.<br />

Source: <strong>OECD</strong>.<br />

Under the assumption of an average annual rate of growth of real GDP of<br />

2½ per cent, the 2001 Budget and the stability programme for 2001-05 set as a target<br />

a small overall surplus for both 2001 and 2002 – the first in 50 years. The <strong>OECD</strong><br />

expects somewhat larger budget surpluses – around ¾ per cent of GDP – due to a<br />

slightly higher projected rate of growth and the inclusion of the proceeds of the<br />

recent sale of the third generation of mobile telephone (UMTS) licences (representing<br />

0.2 per cent of GDP). On a cyclically-adjusted basis, however, the primary surplus<br />

(i.e. net of debt service) increases by somewhat less, to a little over 7 per cent of<br />

GDP in 2001, pointing to a broadly neutral discretionary stance of fiscal policy. The<br />

debt-to-GDP ratio is projected to fall below 100 per cent in 2002.<br />

The general wage negotiations (accord interprofessionnel) for the years 2001-<br />

02 seem to have broadly preserved wage moderation, since the “indicative norm” for<br />

the maximum increase in wage costs (7.0 per cent over the two years) set by the law<br />

on employment and competitiveness has again been accepted, including an additional<br />

one-off increase of 0.4 per cent for the sectors which have performed “especially<br />

well” over the past two years. The forthcoming income tax reform, which is<br />

scheduled to take place over five years, will increase household purchasing power by<br />

an estimated 1¼ per cent of GDP, making wage moderation more acceptable and<br />

increasing incentives to work, thereby enhancing economic growth.<br />

The economy is projected to grow at around 2¾ per cent both this year and<br />

next, virtually closing the output gap by 2002. Private consumption and business<br />

fixed investment are likely to decelerate but only moderately, as they will continue to<br />

be supported by strong job creation and good profitability, respectively. While the