- Page 1 and 2:

OECD Economic Outlook ECONOMICS «

- Page 3 and 4:

OECD ECONOMIC OUTLOOK 69 JUNE 2001

- Page 5 and 6:

FOREWORD This edition of the OECD E

- Page 7 and 8:

TABLE OF CONTENTS Editorial .......

- Page 9 and 10:

Table of contents - vii I.5. Profit

- Page 11 and 12:

EDITORIAL Economic growth in the OE

- Page 13 and 14:

ingness to liquidate insolvent bank

- Page 15 and 16:

2 - OECD Economic Outlook 69 Weakne

- Page 17 and 18:

4 - OECD Economic Outlook 69 Easier

- Page 19 and 20:

6 - OECD Economic Outlook 69 Box I.

- Page 21 and 22:

8 - OECD Economic Outlook 69 ... wh

- Page 23 and 24:

10 - OECD Economic Outlook 69 Curre

- Page 25 and 26:

12 - OECD Economic Outlook 69 Decem

- Page 27 and 28:

14 - OECD Economic Outlook 69 The s

- Page 29 and 30:

16 - OECD Economic Outlook 69 Per c

- Page 31 and 32:

18 - OECD Economic Outlook 69 Per c

- Page 33 and 34:

20 - OECD Economic Outlook 69 … b

- Page 35 and 36:

22 - OECD Economic Outlook 69 Per c

- Page 37 and 38:

24 - OECD Economic Outlook 69 Falli

- Page 39 and 40:

26 - OECD Economic Outlook 69 Unite

- Page 41 and 42:

28 - OECD Economic Outlook 69 Monet

- Page 43 and 44:

30 - OECD Economic Outlook 69 Box I

- Page 45 and 46:

32 - OECD Economic Outlook 69 Per c

- Page 47 and 48:

34 - OECD Economic Outlook 69 The f

- Page 49 and 50:

36 - OECD Economic Outlook 69 Monet

- Page 51 and 52:

38 - OECD Economic Outlook 69 More

- Page 53 and 54:

40 - OECD Economic Outlook 69 ... w

- Page 55 and 56:

42 - OECD Economic Outlook 69 … w

- Page 57 and 58:

44 - OECD Economic Outlook 69 Per c

- Page 59 and 60:

II. DEVELOPMENTS IN INDIVIDUAL OECD

- Page 61 and 62:

1998 1999 2000 2001 2002 Household

- Page 63 and 64:

the long-run tax cut will be introd

- Page 65 and 66:

Japan: Employment, income and infla

- Page 67 and 68:

Japan: External indicators 1998 199

- Page 69 and 70:

Germany Developments in individual

- Page 71 and 72:

1998 1999 2000 2001 2002 Household

- Page 73 and 74:

France Developments in individual O

- Page 75 and 76:

1998 1999 2000 2001 2002 Household

- Page 77 and 78:

Italy Developments in individual OE

- Page 79 and 80:

1998 1999 2000 2001 2002 Household

- Page 81 and 82:

United Kingdom Developments in indi

- Page 83 and 84:

1998 1999 2000 2001 2002 Household

- Page 85 and 86:

Canada Developments in individual O

- Page 87 and 88:

1998 1999 2000 2001 2002 Household

- Page 89 and 90:

86 Australia Developments in indivi

- Page 91 and 92:

cially after the RBA’s recent int

- Page 93 and 94:

Austria: Demand, output and prices

- Page 95 and 96:

Belgium Developments in individual

- Page 97 and 98:

contribution of net exports to grow

- Page 99 and 100:

Czech Republic: Demand, output and

- Page 101 and 102:

Denmark Developments in individual

- Page 103 and 104:

hold incomes recover. Although expo

- Page 105 and 106:

Finland: Demand, output and prices

- Page 107 and 108:

Greece: Demand, output and prices 1

- Page 109 and 110:

Hungary: Demand, output and prices

- Page 111 and 112:

Iceland: Demand, output and prices

- Page 113 and 114:

Ireland: Demand, output and prices

- Page 115 and 116:

Korea Developments in individual OE

- Page 117 and 118:

Luxembourg Developments in individu

- Page 119 and 120:

Mexico Developments in individual O

- Page 121 and 122:

Netherlands Developments in individ

- Page 123 and 124:

age this year, mainly reflecting ta

- Page 125 and 126:

New Zealand: Demand, output and pri

- Page 127 and 128:

Norway Developments in individual O

- Page 129 and 130:

There are substantial risks to the

- Page 131 and 132:

Poland: Demand, output and prices 1

- Page 133 and 134: Portugal Developments in individual

- Page 135 and 136: especially as the deficit has been

- Page 137 and 138: Slovak Republic: Demand, output and

- Page 139 and 140: Spain: Demand, output and prices 19

- Page 141 and 142: Sweden Developments in individual O

- Page 143 and 144: Despite recent indicators suggestin

- Page 145 and 146: Switzerland: Demand, output and pri

- Page 147 and 148: Turkey: Demand, output and prices 1

- Page 149 and 150: III. DEVELOPMENTS IN SELECTED NON-M

- Page 151 and 152: Substantial progress has been made

- Page 153 and 154: with a 7 per cent increase in urban

- Page 155 and 156: the current account should remain q

- Page 157 and 158: IV. FISCAL IMPLICATIONS OF AGEING:

- Page 159 and 160: Third, in any case, projections ove

- Page 161 and 162: The baseline projections for public

- Page 163 and 164: Old-age pension spending Levels of

- Page 165 and 166: Old-age pension spending trends to

- Page 167 and 168: Fiscal implications of ageing: proj

- Page 169 and 170: ment is to be maintained for all. F

- Page 171 and 172: Table IV.5. Changes in spending, re

- Page 173 and 174: The projected deterioration in the

- Page 175 and 176: Fiscal implications of ageing: proj

- Page 177 and 178: period (Table IV.6, Panel B). This

- Page 179 and 180: BIBLIOGRAPHY Fiscal implications of

- Page 181 and 182: 170 - OECD Economic Outlook 69 Tax

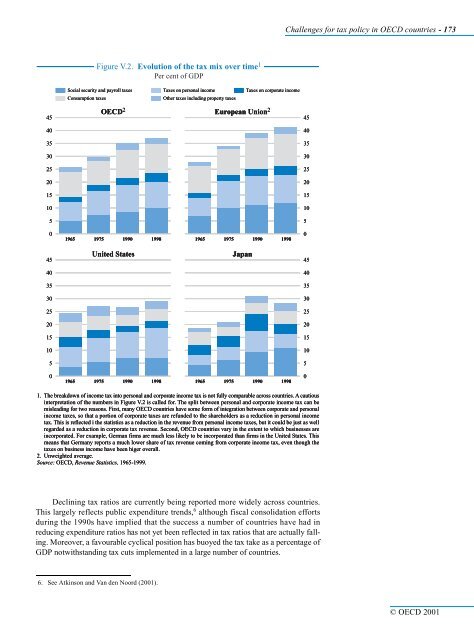

- Page 183: 172 - OECD Economic Outlook 69 Tabl

- Page 187 and 188: 176 - OECD Economic Outlook 69 …

- Page 189 and 190: 178 - OECD Economic Outlook 69 …

- Page 191 and 192: 180 - OECD Economic Outlook 69 Prog

- Page 193 and 194: 182 - OECD Economic Outlook 69 Ther

- Page 195 and 196: 184 - OECD Economic Outlook 69 coun

- Page 197 and 198: VI. ENCOURAGING ENVIRONMENTALLY SUS

- Page 199 and 200: Tax base Table VI.1. Use of economi

- Page 201 and 202: A complication with permit trading

- Page 203 and 204: A double dividend? In practice, new

- Page 205 and 206: Environmental policies that are eff

- Page 207 and 208: eing hit with the full tax. This av

- Page 209 and 210: US$/cubic metre 3.5 3.0 2.5 2.0 1.5

- Page 211 and 212: the economic effects of environment

- Page 213 and 214: Cost-benefit analysis Encouraging e

- Page 215 and 216: may play an important role in the a

- Page 217 and 218: BIBLIOGRAPHY Encouraging environmen

- Page 219 and 220: 210 - OECD Economic Outlook 69 …

- Page 221 and 222: 212 - OECD Economic Outlook 69 Prod

- Page 223 and 224: 214 - OECD Economic Outlook 69 The

- Page 225 and 226: 216 - OECD Economic Outlook 69 Many

- Page 227 and 228: 218 - OECD Economic Outlook 69 Entr

- Page 229 and 230: 220 - OECD Economic Outlook 69 Box

- Page 231 and 232: 222 - OECD Economic Outlook 69 BIBL

- Page 233 and 234: 224 - OECD Economic Outlook 69 List

- Page 235 and 236:

226 - OECD Economic Outlook 69 Coun

- Page 237 and 238:

Annex Tables Statistical Annex - 22

- Page 239 and 240:

© OECD 2001 Average 1973-83 1984 1

- Page 241 and 242:

© OECD 2001 Average 1973-83 1984 1

- Page 243 and 244:

© OECD 2001 Average 1973-83 1984 1

- Page 245 and 246:

© OECD 2001 Average 1973-83 1984 1

- Page 247 and 248:

© OECD 2001 Average 1973-83 1984 1

- Page 249 and 250:

© OECD 2001 Annex Table 11. Output

- Page 251 and 252:

© OECD 2001 Annex Table 13. Unit l

- Page 253 and 254:

© OECD 2001 Average 1973-83 1984 1

- Page 255 and 256:

© OECD 2001 Annex Table 17. Oil an

- Page 257 and 258:

© OECD 2001 Average 1973-83 Annex

- Page 259 and 260:

© OECD 2001 Annex Table 21. Unempl

- Page 261 and 262:

© OECD 2001 Annex Table 23. Labour

- Page 263 and 264:

© OECD 2001 Annex Table 27. Gross

- Page 265 and 266:

© OECD 2001 Annex Table 29 . Gener

- Page 267 and 268:

© OECD 2001 Annex Table 31. Genera

- Page 269 and 270:

© OECD 2001 Annex Table 33. Genera

- Page 271 and 272:

© OECD 2001 Annex Table 35. Genera

- Page 273 and 274:

© OECD 2001 1983 1984 1985 1986 An

- Page 275 and 276:

© OECD 2001 Annex Table 39. Effect

- Page 277 and 278:

© OECD 2001 Annex Table 41. Import

- Page 279 and 280:

© OECD 2001 Annex Table 43. Import

- Page 281 and 282:

© OECD 2001 1983 1984 1985 1986 An

- Page 283 and 284:

© OECD 2001 Annex Table 47. Shares

- Page 285 and 286:

© OECD 2001 Annex Table 49. Non-fa

- Page 287 and 288:

© OECD 2001 Annex Table 51. Curren

- Page 289 and 290:

© OECD 2001 Annex Table 53. Struct

- Page 291 and 292:

Annex Table 54. (cont'd) Semiannual

- Page 293 and 294:

Annex Table 56. Contributions to ch

- Page 295 and 296:

Annex Table 57. Household wealth an

- Page 297 and 298:

Annex Table 61. Monetary and credit

- Page 299 and 300:

Annex Table 63. Geographical struct

- Page 301 and 302:

OTHER OECD STATISTICAL SERIES ON DI

- Page 303 and 304:

For customers in Austria, Germany a