GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

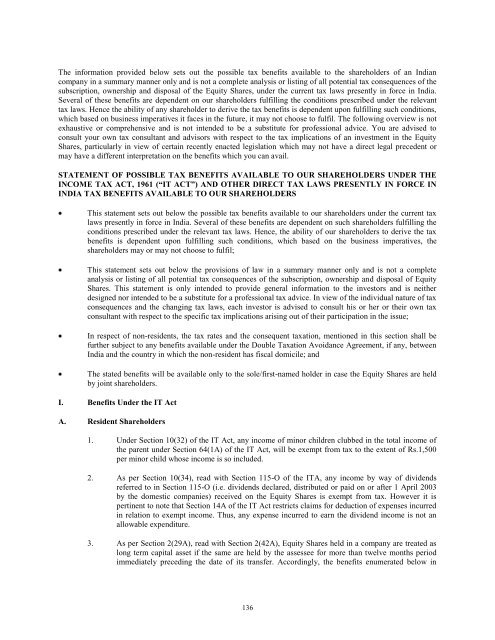

The information provided below sets out the possible tax benefits available to the shareholders of an Indian<br />

company in a summary manner only and is not a complete analysis or listing of all potential tax consequences of the<br />

subscription, ownership and disposal of the Equity Shares, under the current tax laws presently in force in India.<br />

Several of these benefits are dependent on our shareholders fulfilling the conditions prescribed under the relevant<br />

tax laws. Hence the ability of any shareholder to derive the tax benefits is dependent upon fulfilling such conditions,<br />

which based on business imperatives it faces in the future, it may not choose to fulfil. The following overview is not<br />

exhaustive or comprehensive and is not intended to be a substitute for professional advice. You are advised to<br />

consult your own tax consultant and advisors with respect to the tax implications of an investment in the Equity<br />

Shares, particularly in view of certain recently enacted legislation which may not have a direct legal precedent or<br />

may have a different interpretation on the benefits which you can avail.<br />

STATEMENT OF POSSIBLE TAX BENEFITS AVAILABLE TO OUR SHAREHOLDERS UNDER THE<br />

INCOME TAX ACT, 1961 (“IT ACT”) AND OTHER DIRECT TAX LAWS PRESENTLY IN FORCE IN<br />

<strong>INDIA</strong> TAX BENEFITS AVAILABLE TO OUR SHAREHOLDERS<br />

This statement sets out below the possible tax benefits available to our shareholders under the current tax<br />

laws presently in force in India. Several of these benefits are dependent on such shareholders fulfilling the<br />

conditions prescribed under the relevant tax laws. Hence, the ability of our shareholders to derive the tax<br />

benefits is dependent upon fulfilling such conditions, which based on the business imperatives, the<br />

shareholders may or may not choose to fulfil;<br />

This statement sets out below the provisions of law in a summary manner only and is not a complete<br />

analysis or listing of all potential tax consequences of the subscription, ownership and disposal of Equity<br />

Shares. This statement is only intended to provide general information to the investors and is neither<br />

designed nor intended to be a substitute for a professional tax advice. In view of the individual nature of tax<br />

consequences and the changing tax laws, each investor is advised to consult his or her or their own tax<br />

consultant with respect to the specific tax implications arising out of their participation in the issue;<br />

In respect of non-residents, the tax rates and the consequent taxation, mentioned in this section shall be<br />

further subject to any benefits available under the Double Taxation Avoidance Agreement, if any, between<br />

India and the country in which the non-resident has fiscal domicile; and<br />

The stated benefits will be available only to the sole/first-named holder in case the Equity Shares are held<br />

by joint shareholders.<br />

I. Benefits Under the IT Act<br />

A. Resident Shareholders<br />

1. Under Section 10(32) of the IT Act, any income of minor children clubbed in the total income of<br />

the parent under Section 64(1A) of the IT Act, will be exempt from tax to the extent of Rs.1,500<br />

per minor child whose income is so included.<br />

2. As per Section 10(34), read with Section 115-O of the ITA, any income by way of dividends<br />

referred to in Section 115-O (i.e. dividends declared, distributed or paid on or after 1 April 2003<br />

by the domestic companies) received on the Equity Shares is exempt from tax. However it is<br />

pertinent to note that Section 14A of the IT Act restricts claims for deduction of expenses incurred<br />

in relation to exempt income. Thus, any expense incurred to earn the dividend income is not an<br />

allowable expenditure.<br />

3. As per Section 2(29A), read with Section 2(42A), Equity Shares held in a company are treated as<br />

long term capital asset if the same are held by the assessee for more than twelve months period<br />

immediately preceding the date of its transfer. Accordingly, the benefits enumerated below in<br />

136