GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ecognized provision for marked to market loss of Rs.46.04 million for the year ended March 31, 2008 as<br />

compared to nil for the year ended March 31, 2007. As a percentage of our total gross sales, our financial<br />

costs increased to 3.67% for the year ended March 31, 2008 from 2.68% for the year ended March 31, 2007.<br />

Depreciation.. Depreciation costs increased by 13.46% to Rs.883.17 million for the year ended March 31,<br />

2008 from Rs.778.39 million for the year ended March 31, 2007, as a result of an increase in our fixed<br />

assets to Rs.16,645.08 million as of March 31, 2008 from Rs.15,139.24 million as of March 31, 2007. As a<br />

percentage of our total gross sales, our depreciation costs increased to 3.34% for the year ended March 31,<br />

2008 from 3.30% for the year ended March 31, 2007.<br />

Goodwill Amortized. We recognized goodwill amortized of Rs.20.72 million for the year ended March 31,<br />

2007, as compared to nil for the year ended March 31, 2008, due to change in the method of amortizing<br />

goodwill by following extant accounting standards and generally accepted accounting principles followed.<br />

The management has reviewed any possible impairment and has concluded that there is no impairment in<br />

the goodwill on acquisition of shares.<br />

Share of Profits/(Loss) in Associates. Our share of profit in associates increased by 16.29% to Rs.151.04<br />

million for the year ended March 31, 2008 from Rs.129.89 million for the year ended March 31, 2007. This<br />

was due to better performance shown by ATSL during this period .<br />

Taxation. Our provision for taxation increased by 11.85% to Rs.644.35 million for the year ended March<br />

31, 2008 from Rs.576.09 million for the year ended March 31, 2007. This change was primarily due to<br />

increase in taxable income.<br />

Profit After Tax. Our profit after tax decreased by 18.15% to Rs.814.64 million for the year ended March<br />

31, 2008 from Rs.995.25 million for the year ended March 31, 2007.<br />

Minority interest. Profit after tax attributable to minority interest increased by 4.07% to Rs.79.72 million for<br />

the year ended March 31, 2008 from Rs.76.60 million for the year ended March 31, 2007. This minority<br />

interest represents the shareholdings of other shareholders in our subsidiaries. The increase is mainly<br />

attributable to the further issue of capital by our subsidiary, GIPL, which reduced our shareholding from<br />

82.50% to 76.15% and other factors, including an increase in the number of subsidiaries, which were not<br />

wholly owned by us, from nine as of March 31, 2007 to 10 as of March 31, 2008.<br />

Net profit After Prior Year Tax Charge. Our net profit after prior year tax charge increased by 103.30% to<br />

Rs.712.90 million for the year ended March 31, 2008 from Rs.350.65 million for the year ended March 31,<br />

2007.<br />

Financial Condition, Liquidity and Capital Resources<br />

Cash Flows<br />

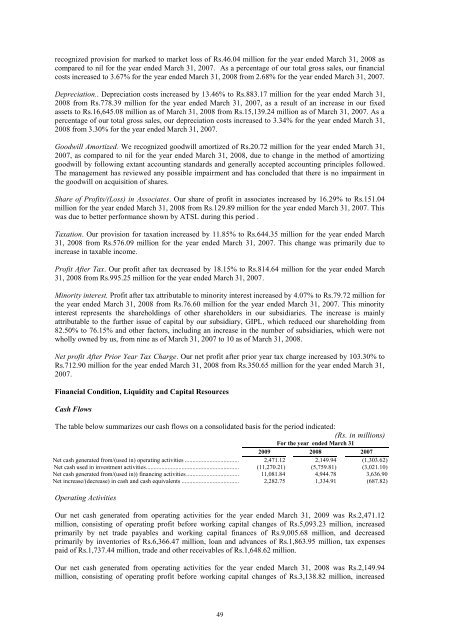

The table below summarizes our cash flows on a consolidated basis for the period indicated:<br />

(Rs. in millions)<br />

For the year ended March 31<br />

2009 2008 2007<br />

Net cash generated from/(used in) operating activities ...................................... 2,471.12 2,149.94 (1,303.62)<br />

Net cash used in investment activities ............................................................... (11,270.21) (5,759.81) (3,021.10)<br />

Net cash generated from/(used in)) financing activities ..................................... 11,081.84 4,944.78 3,636.90<br />

Net increase/(decrease) in cash and cash equivalents ........................................ 2,282.75 1,334.91 (687.82)<br />

Operating Activities<br />

Our net cash generated from operating activities for the year ended March 31, 2009 was Rs.2,471.12<br />

million, consisting of operating profit before working capital changes of Rs.5,093.23 million, increased<br />

primarily by net trade payables and working capital finances of Rs.9,005.68 million, and decreased<br />

primarily by inventories of Rs.6,366.47 million, loan and advances of Rs.1,863.95 million, tax expenses<br />

paid of Rs.1,737.44 million, trade and other receivables of Rs.1,648.62 million.<br />

Our net cash generated from operating activities for the year ended March 31, 2008 was Rs.2,149.94<br />

million, consisting of operating profit before working capital changes of Rs.3,138.82 million, increased<br />

49