GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

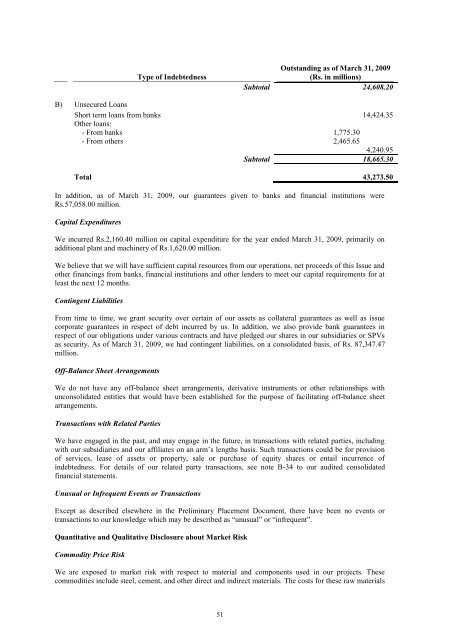

Type of Indebtedness<br />

51<br />

Outstanding as of March 31, 2009<br />

(Rs. in millions)<br />

Subtotal 24,608.20<br />

B) Unsecured Loans<br />

Short term loans from banks 14,424.35<br />

Other loans:<br />

- From banks 1,775.30<br />

- From others 2,465.65<br />

4,240.95<br />

Subtotal 18,665.30<br />

Total 43,273.50<br />

In addition, as of March 31, 2009, our guarantees given to banks and financial institutions were<br />

Rs.57,058.00 million.<br />

Capital Expenditures<br />

We incurred Rs.2,160.40 million on capital expenditure for the year ended March 31, 2009, primarily on<br />

additional plant and machinery of Rs.1,620.00 million.<br />

We believe that we will have sufficient capital resources from our operations, net proceeds of this Issue and<br />

other financings from banks, financial institutions and other lenders to meet our capital requirements for at<br />

least the next 12 months.<br />

Contingent Liabilities<br />

From time to time, we grant security over certain of our assets as collateral guarantees as well as issue<br />

corporate guarantees in respect of debt incurred by us. In addition, we also provide bank guarantees in<br />

respect of our obligations under various contracts and have pledged our shares in our subsidiaries or SPVs<br />

as security. As of March 31, 2009, we had contingent liabilities, on a consolidated basis, of Rs. 87,347.47<br />

million.<br />

Off-Balance Sheet Arrangements<br />

We do not have any off-balance sheet arrangements, derivative instruments or other relationships with<br />

unconsolidated entities that would have been established for the purpose of facilitating off-balance sheet<br />

arrangements.<br />

Transactions with Related Parties<br />

We have engaged in the past, and may engage in the future, in transactions with related parties, including<br />

with our subsidiaries and our affiliates on an arm‘s lengths basis. Such transactions could be for provision<br />

of services, lease of assets or property, sale or purchase of equity shares or entail incurrence of<br />

indebtedness. For details of our related party transactions, see note B-34 to our audited consolidated<br />

financial statements.<br />

Unusual or Infrequent Events or Transactions<br />

Except as described elsewhere in the Preliminary Placement Document, there have been no events or<br />

transactions to our knowledge which may be described as ―unusual‖ or ―infrequent‖.<br />

Quantitative and Qualitative Disclosure about Market Risk<br />

Commodity Price Risk<br />

We are exposed to market risk with respect to material and components used in our projects. These<br />

commodities include steel, cement, and other direct and indirect materials. The costs for these raw materials