GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

amounting to Rs. 26.80 Millions has been reversed. The effect of the change in method of depreciation<br />

for this year is Rs. 28.50 Millions. On account of this change in the method of depreciation the profit<br />

for that year was higher by Rs. 55.30 Millions.<br />

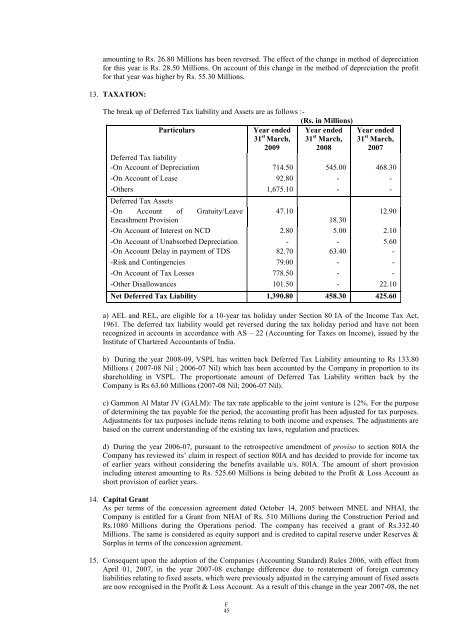

13. TAXATION:<br />

The break up of Deferred Tax liability and Assets are as follows :-<br />

(Rs. in Millions)<br />

Particulars Year ended<br />

31 st Year ended<br />

March, 31<br />

2009<br />

st Year ended<br />

March, 31<br />

2008<br />

st March,<br />

Deferred Tax liability<br />

2007<br />

-On Account of Depreciation 714.50 545.00 468.30<br />

-On Account of Lease 92.80 - -<br />

-Others 1,675.10 - -<br />

Deferred Tax Assets<br />

-On Account of Gratuity/Leave 47.10<br />

12.90<br />

Encashment Provision<br />

18.30<br />

-On Account of Interest on NCD 2.80 5.00 2.10<br />

-On Account of Unabsorbed Depreciation - - 5.60<br />

-On Account Delay in payment of TDS 82.70 63.40 -<br />

-Risk and Contingencies 79.00 - -<br />

-On Account of Tax Losses 778.50 - -<br />

-Other Disallowances 101.50 - 22.10<br />

Net Deferred Tax Liability 1,390.80 458.30 425.60<br />

a) AEL and REL, are eligible for a 10-year tax holiday under Section 80 IA of the Income Tax Act,<br />

1961. The deferred tax liability would get reversed during the tax holiday period and have not been<br />

recognized in accounts in accordance with AS – 22 (Accounting for Taxes on Income), issued by the<br />

Institute of Chartered Accountants of India.<br />

b) During the year 2008-09, VSPL has written back Deferred Tax Liability amounting to Rs 133.80<br />

Millions ( 2007-08 Nil ; 2006-07 Nil) which has been accounted by the Company in proportion to its<br />

shareholding in VSPL. The proportionate amount of Deferred Tax Liability written back by the<br />

Company is Rs 63.60 Millions (2007-08 Nil; 2006-07 Nil).<br />

c) Gammon Al Matar JV (GALM): The tax rate applicable to the joint venture is 12%. For the purpose<br />

of determining the tax payable for the period, the accounting profit has been adjusted for tax purposes.<br />

Adjustments for tax purposes include items relating to both income and expenses. The adjustments are<br />

based on the current understanding of the existing tax laws, regulation and practices.<br />

d) During the year 2006-07, pursuant to the retrospective amendment of proviso to section 80IA the<br />

Company has reviewed its‟ claim in respect of section 80IA and has decided to provide for income tax<br />

of earlier years without considering the benefits available u/s. 80IA. The amount of short provision<br />

including interest amounting to Rs. 525.60 Millions is being debited to the Profit & Loss Account as<br />

short provision of earlier years.<br />

14. Capital Grant<br />

As per terms of the concession agreement dated October 14, 2005 between MNEL and NHAI, the<br />

Company is entitled for a Grant from NHAI of Rs. 510 Millions during the Construction Period and<br />

Rs.1080 Millions during the Operations period. The company has received a grant of Rs.332.40<br />

Millions. The same is considered as equity support and is credited to capital reserve under Reserves &<br />

Surplus in terms of the concession agreement.<br />

15. Consequent upon the adoption of the Companies (Accounting Standard) Rules 2006, with effect from<br />

April 01, 2007, in the year 2007-08 exchange difference due to restatement of foreign currency<br />

liabilities relating to fixed assets, which were previously adjusted in the carrying amount of fixed assets<br />

are now recognised in the Profit & Loss Account. As a result of this change in the year 2007-08, the net<br />

F<br />

45