GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PVAN:<br />

Term Loans from ICICI Bank are secured by charge over all the assets / investments of the company.<br />

The Parent Company has also pledged its entire shareholding of the company with the Bank and<br />

Corporate Guarantee by ultimate Parent Company.<br />

ii) During the year 2008-09 the total amount of borrowing cost capitalized was Rs. 986.4 Millions<br />

(2007-08 Rs. 268.60 Millions ; 2006-07 – Nil)<br />

6. Loans and advances include Rs. 500 Millions (2007-08 Rs. 110.40 Millions ; 2006-07 500.00 Millions)<br />

which are secured by pledge of equity shares of a private company. The security value is adequate to<br />

recover the amount advanced.<br />

7. Issued Share Capital includes 7,25,800 (2007-08 7,25,800 ; 2006-07- 7,25,800) Equity Shares of Rs.<br />

2/- each kept in abeyance. Share Forfeited account includes Rs. 2.60 Millions (2007-08 Rs. 2.60<br />

Millions ; 2006-07 Rs.2.60 Millions) of Share Premium collected on application in respect of forfeited<br />

shares.<br />

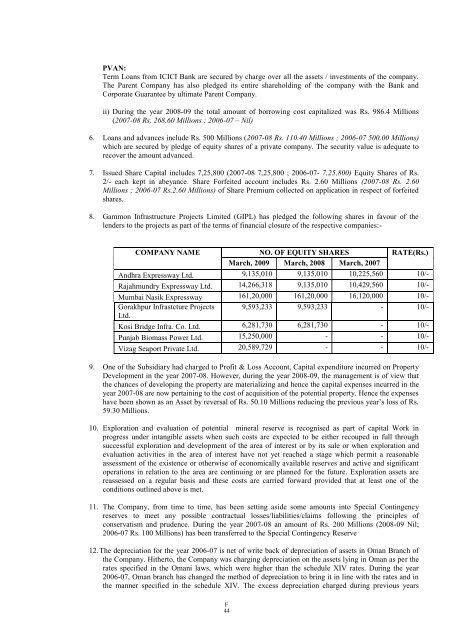

8. Gammon Infrastructure Projects Limited (GIPL) has pledged the following shares in favour of the<br />

lenders to the projects as part of the terms of financial closure of the respective companies:-<br />

COMPANY NAME NO. OF EQUITY SHARES RATE(Rs.)<br />

March, 2009 March, 2008 March, 2007<br />

Andhra Expressway Ltd. 9,135,010 9,135,010 10,225,560 10/-<br />

Rajahmundry Expressway Ltd. 14,266,318 9,135,010 10,429,560 10/-<br />

Mumbai Nasik Expressway 161,20,000 161,20,000 16,120,000 10/-<br />

Gorakhpur Infrastcture Projects<br />

Ltd.<br />

9,593,233 9,593,233 - 10/-<br />

Kosi Bridge Infra. Co. Ltd. 6,281,730 6,281,730 - 10/-<br />

Punjab Biomass Power Ltd. 15,250,000 - - 10/-<br />

Vizag Seaport Private Ltd. 20,589,729 - - 10/-<br />

9. One of the Subsidiary had charged to Profit & Loss Account, Capital expenditure incurred on Property<br />

Development in the year 2007-08. However, during the year 2008-09, the management is of view that<br />

the chances of developing the property are materializing and hence the capital expenses incurred in the<br />

year 2007-08 are now pertaining to the cost of acquisition of the potential property. Hence the expenses<br />

have been shown as an Asset by reversal of Rs. 50.10 Millions reducing the previous year‟s loss of Rs.<br />

59.30 Millions.<br />

10. Exploration and evaluation of potential mineral reserve is recognised as part of capital Work in<br />

progress under intangible assets when such costs are expected to be either recouped in full through<br />

successful exploration and development of the area of interest or by its sale or when exploration and<br />

evaluation activities in the area of interest have not yet reached a stage which permit a reasonable<br />

assessment of the existence or otherwise of economically available reserves and active and significant<br />

operations in relation to the area are continuing or are planned for the future. Exploration assets are<br />

reassessed on a regular basis and these costs are carried forward provided that at least one of the<br />

conditions outlined above is met.<br />

11. The Company, from time to time, has been setting aside some amounts into Special Contingency<br />

reserves to meet any possible contractual losses/liabilities/claims following the principles of<br />

conservatism and prudence. During the year 2007-08 an amount of Rs. 200 Millions (2008-09 Nil;<br />

2006-07 Rs. 100 Millions) has been transferred to the Special Contingency Reserve<br />

12. The depreciation for the year 2006-07 is net of write back of depreciation of assets in Oman Branch of<br />

the Company. Hitherto, the Company was charging depreciation on the assets lying in Oman as per the<br />

rates specified in the Omani laws, which were higher than the schedule XIV rates. During the year<br />

2006-07, Oman branch has changed the method of depreciation to bring it in line with the rates and in<br />

the manner specified in the schedule XIV. The excess depreciation charged during previous years<br />

F<br />

44