GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

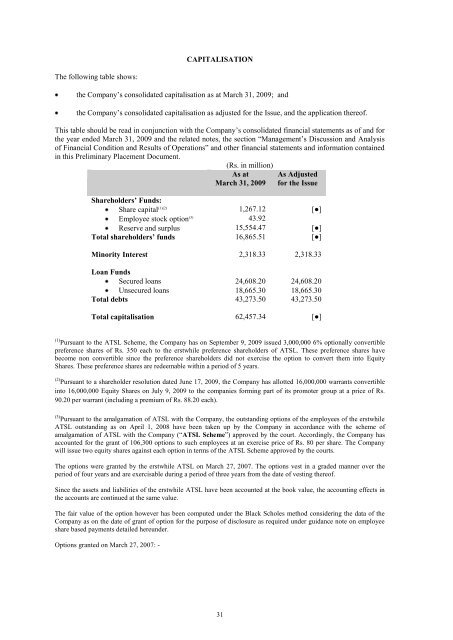

The following table shows:<br />

CAPITALISATION<br />

the Company‘s consolidated capitalisation as at March 31, 2009; and<br />

the Company‘s consolidated capitalisation as adjusted for the Issue, and the application thereof.<br />

This table should be read in conjunction with the Company‘s consolidated financial statements as of and for<br />

the year ended March 31, 2009 and the related notes, the section ―Management‘s Discussion and Analysis<br />

of Financial Condition and Results of Operations‖ and other financial statements and information contained<br />

in this Preliminary Placement Document.<br />

(Rs. in million)<br />

As at<br />

March 31, 2009<br />

31<br />

As Adjusted<br />

for the Issue<br />

Shareholders‟ Funds:<br />

Share capital (1)(2) 1,267.12 [●]<br />

Employee stock option (3) 43.92<br />

Reserve and surplus 15,554.47 [●]<br />

Total shareholders‟ funds 16,865.51 [●]<br />

Minority Interest 2,318.33 2,318.33<br />

Loan Funds<br />

Secured loans 24,608.20 24,608.20<br />

Unsecured loans 18,665.30 18,665.30<br />

Total debts 43,273.50 43,273.50<br />

Total capitalisation 62,457.34 [●]<br />

(1) Pursuant to the ATSL Scheme, the Company has on September 9, 2009 issued 3,000,000 6% optionally convertible<br />

preference shares of Rs. 350 each to the erstwhile preference shareholders of ATSL. These preference shares have<br />

become non convertible since the preference shareholders did not exercise the option to convert them into Equity<br />

Shares. These preference shares are redeemable within a period of 5 years.<br />

(2) Pursuant to a shareholder resolution dated June 17, 2009, the Company has allotted 16,000,000 warrants convertible<br />

into 16,000,000 Equity Shares on July 9, 2009 to the companies forming part of its promoter group at a price of Rs.<br />

90.20 per warrant (including a premium of Rs. 88.20 each).<br />

(3) Pursuant to the amalgamation of ATSL with the Company, the outstanding options of the employees of the erstwhile<br />

ATSL outstanding as on April 1, 2008 have been taken up by the Company in accordance with the scheme of<br />

amalgamation of ATSL with the Company (―ATSL Scheme‖) approved by the court. Accordingly, the Company has<br />

accounted for the grant of 106,300 options to such employees at an exercise price of Rs. 80 per share. The Company<br />

will issue two equity shares against each option in terms of the ATSL Scheme approved by the courts.<br />

The options were granted by the erstwhile ATSL on March 27, 2007. The options vest in a graded manner over the<br />

period of four years and are exercisable during a period of three years from the date of vesting thereof.<br />

Since the assets and liabilities of the erstwhile ATSL have been accounted at the book value, the accounting effects in<br />

the accounts are continued at the same value.<br />

The fair value of the option however has been computed under the Black Scholes method considering the data of the<br />

Company as on the date of grant of option for the purpose of disclosure as required under guidance note on employee<br />

share based payments detailed hereunder.<br />

Options granted on March 27, 2007: -