GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

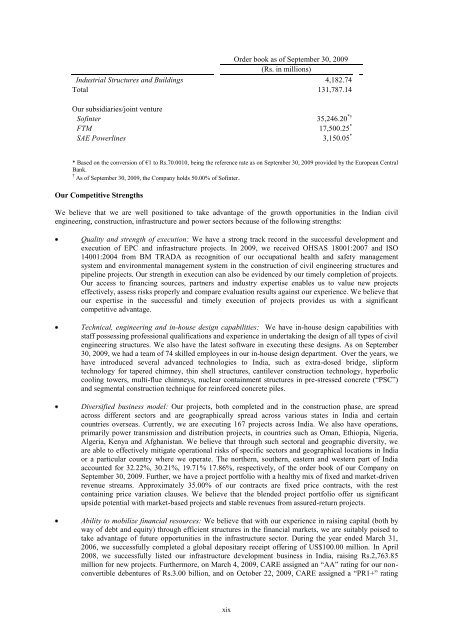

Order book as of September 30, 2009<br />

(Rs. in millions)<br />

Industrial Structures and Buildings 4,182.74<br />

Total 131,787.14<br />

Our subsidiaries/joint venture<br />

Sofinter 35,246.20 *†<br />

FTM 17,500.25 *<br />

SAE Powerlines 3,150.05 *<br />

* Based on the conversion of €1 to Rs.70.0010, being the reference rate as on September 30, 2009 provided by the European Central<br />

Bank.<br />

† As of September 30, 2009, the Company holds 50.00% of Sofinter.<br />

Our Competitive Strengths<br />

We believe that we are well positioned to take advantage of the growth opportunities in the Indian civil<br />

engineering, construction, infrastructure and power sectors because of the following strengths:<br />

Quality and strength of execution: We have a strong track record in the successful development and<br />

execution of EPC and infrastructure projects. In 2009, we received OHSAS 18001:2007 and ISO<br />

14001:2004 from BM TRADA as recognition of our occupational health and safety management<br />

system and environmental management system in the construction of civil engineering structures and<br />

pipeline projects. Our strength in execution can also be evidenced by our timely completion of projects.<br />

Our access to financing sources, partners and industry expertise enables us to value new projects<br />

effectively, assess risks properly and compare evaluation results against our experience. We believe that<br />

our expertise in the successful and timely execution of projects provides us with a significant<br />

competitive advantage.<br />

Technical, engineering and in-house design capabilities: We have in-house design capabilities with<br />

staff possessing professional qualifications and experience in undertaking the design of all types of civil<br />

engineering structures. We also have the latest software in executing these designs. As on September<br />

30, 2009, we had a team of 74 skilled employees in our in-house design department. Over the years, we<br />

have introduced several advanced technologies to India, such as extra-dosed bridge, slipform<br />

technology for tapered chimney, thin shell structures, cantilever construction technology, hyperbolic<br />

cooling towers, multi-flue chimneys, nuclear containment structures in pre-stressed concrete (―PSC‖)<br />

and segmental construction technique for reinforced concrete piles.<br />

Diversified business model: Our projects, both completed and in the construction phase, are spread<br />

across different sectors and are geographically spread across various states in India and certain<br />

countries overseas. Currently, we are executing 167 projects across India. We also have operations,<br />

primarily power transmission and distribution projects, in countries such as Oman, Ethiopia, Nigeria,<br />

Algeria, Kenya and Afghanistan. We believe that through such sectoral and geographic diversity, we<br />

are able to effectively mitigate operational risks of specific sectors and geographical locations in India<br />

or a particular country where we operate. The northern, southern, eastern and western part of India<br />

accounted for 32.22%, 30.21%, 19.71% 17.86%, respectively, of the order book of our Company on<br />

September 30, 2009. Further, we have a project portfolio with a healthy mix of fixed and market-driven<br />

revenue streams. Approximately 35.00% of our contracts are fixed price contracts, with the rest<br />

containing price variation clauses. We believe that the blended project portfolio offer us significant<br />

upside potential with market-based projects and stable revenues from assured-return projects.<br />

Ability to mobilize financial resources: We believe that with our experience in raising capital (both by<br />

way of debt and equity) through efficient structures in the financial markets, we are suitably poised to<br />

take advantage of future opportunities in the infrastructure sector. During the year ended March 31,<br />

2006, we successfully completed a global depositary receipt offering of US$100.00 million. In April<br />

2008, we successfully listed our infrastructure development business in India, raising Rs.2,763.85<br />

million for new projects. Furthermore, on March 4, 2009, CARE assigned an ―AA‖ rating for our nonconvertible<br />

debentures of Rs.3.00 billion, and on October 22, 2009, CARE assigned a ―PR1+‖ rating<br />

xix