GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

y Busi Group. By an Agreement dated 2 nd March 2009, Busi Group agreed to give PVAN<br />

50% stake in lieu of its stake in Sadelmi for a consideration of Euro 1 and convert the S.r.L.<br />

status into an S.p.A. to facilitate the same. Consequently PVAN will cease to be a shareholder<br />

of Sadelmi from that date and will become a shareholder of Busi Power. Pending the approval<br />

of the courts in Italy for the composition no effects have been given in these accounts. Busi<br />

Group has also agreed to bring cash of Euro 2,500,000 into Busi S.r.L in order to capitalize<br />

Sadelmi India Pvt. Ltd. a wholly owned subsidiary in India as earlier contemplated by the<br />

shareholders of Sadelmi S.p.A. and has also permitted it to freely draw upon the references to<br />

undertake future Projects. Consequent upon this arrangement, Busi Group will be wholly<br />

responsible for the operations and all future funding of Busi Power S.r.L and Gammon will be<br />

wholly responsible for the operations and future funding of the Indian subsidiary for the<br />

projects undertaken by them in the territories identified respectively for them. Each party will<br />

however share 50% of the profits of the respective Busi Power and the Indian Subsidiary. The<br />

results of these operations will be consolidated in the Company with effect from FY 2010.In<br />

the absence of the results of operations of Sadelmi Spa for the year ended December 2008, the<br />

same has not been consolidated in the financial statements of the group. The investment in<br />

Sadelmi Spa of Rs. 506.4 Millions has therefore been accounted in accordance with AS-13<br />

“Accounting for Investment”, at cost.<br />

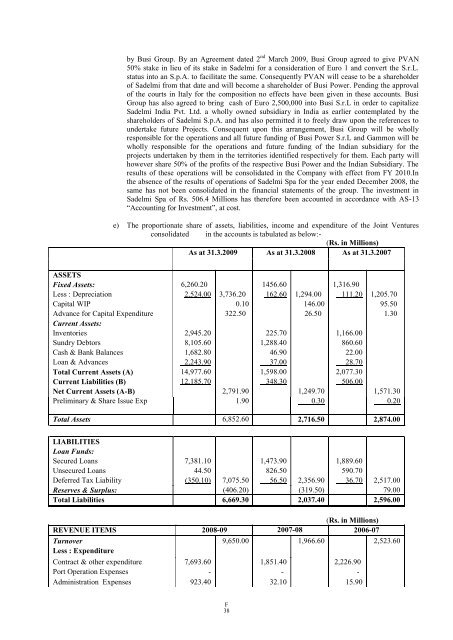

e) The proportionate share of assets, liabilities, income and expenditure of the Joint Ventures<br />

consolidated in the accounts is tabulated as below:-<br />

(Rs. in Millions)<br />

As at 31.3.2009 As at 31.3.2008 As at 31.3.2007<br />

ASSETS<br />

Fixed Assets: 6,260.20 1456.60 1,316.90<br />

Less : Depreciation 2,524.00 3,736.20 162.60 1,294.00 111.20 1,205.70<br />

Capital WIP 0.10 146.00 95.50<br />

Advance for Capital Expenditure<br />

Current Assets:<br />

322.50 26.50 1.30<br />

Inventories 2,945.20 225.70 1,166.00<br />

Sundry Debtors 8,105.60 1,288.40 860.60<br />

Cash & Bank Balances 1,682.80 46.90 22.00<br />

Loan & Advances 2,243.90 37.00 28.70<br />

Total Current Assets (A) 14,977.60 1,598.00 2,077.30<br />

Current Liabilities (B) 12,185.70 348.30 506.00<br />

Net Current Assets (A-B) 2,791.90 1,249.70 1,571.30<br />

Preliminary & Share Issue Exp<br />

1.90 0.30 0.20<br />

Total Assets 6,852.60 2,716.50 2,874.00<br />

LIABILITIES<br />

Loan Funds:<br />

Secured Loans 7,381.10 1,473.90 1,889.60<br />

Unsecured Loans 44.50 826.50 590.70<br />

Deferred Tax Liability (350.10) 7,075.50 56.50 2,356.90 36.70 2,517.00<br />

Reserves & Surplus: (406.20) (319.50) 79.00<br />

Total Liabilities 6,669.30 2,037.40 2,596.00<br />

(Rs. in Millions)<br />

REVENUE ITEMS 2008-09 2007-08 2006-07<br />

Turnover 9,650.00 1,966.60 2,523.60<br />

Less : Expenditure<br />

Contract & other expenditure 7,693.60 1,851.40 2,226.90<br />

Port Operation Expenses - - -<br />

Administration Expenses 923.40 32.10 15.90<br />

F<br />

38