GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

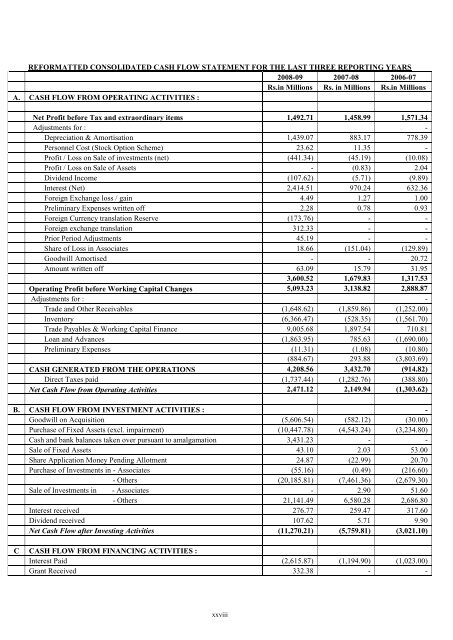

REFORMATTED CONSOLIDATED CASH FLOW STATEMENT FOR THE LAST THREE REPORTING YEARS<br />

2008-09 2007-08 2006-07<br />

Rs.in Millions Rs. in Millions Rs.in Millions<br />

A. CASH FLOW FROM OPERATING ACTIVITIES :<br />

Net Profit before Tax and extraordinary items 1,492.71 1,458.99 1,571.34<br />

Adjustments for : -<br />

Depreciation & Amortisation 1,439.07 883.17 778.39<br />

Personnel Cost (Stock Option Scheme) 23.62 11.35 -<br />

Profit / Loss on Sale of investments (net) (441.34) (45.19) (10.08)<br />

Profit / Loss on Sale of Assets - (0.83) 2.04<br />

Dividend Income (107.62) (5.71) (9.89)<br />

Interest (Net) 2,414.51 970.24 632.36<br />

Foreign Exchange loss / gain 4.49 1.27 1.00<br />

Preliminary Expenses written off 2.28 0.78 0.93<br />

Foreign Currency translation Reserve (173.76) - -<br />

Foreign exchange translation 312.33 - -<br />

Prior Period Adjustments 45.19 - -<br />

Share of Loss in Associates 18.66 (151.04) (129.89)<br />

Goodwill Amortised - - 20.72<br />

Amount written off 63.09 15.79 31.95<br />

3,600.52 1,679.83 1,317.53<br />

Operating Profit before Working Capital Changes 5,093.23 3,138.82 2,888.87<br />

Adjustments for : -<br />

Trade and Other Receivables (1,648.62) (1,859.86) (1,252.00)<br />

Inventory (6,366.47) (528.35) (1,561.70)<br />

Trade Payables & Working Capital Finance 9,005.68 1,897.54 710.81<br />

Loan and Advances (1,863.95) 785.63 (1,690.00)<br />

Preliminary Expenses (11.31) (1.08) (10.80)<br />

(884.67) 293.88 (3,803.69)<br />

CASH GENERATED FROM THE OPERATIONS 4,208.56 3,432.70 (914.82)<br />

Direct Taxes paid (1,737.44) (1,282.76) (388.80)<br />

Net Cash Flow from Operating Activities 2,471.12 2,149.94 (1,303.62)<br />

B. CASH FLOW FROM INVESTMENT ACTIVITIES : -<br />

Goodwill on Acquisition (5,606.54) (582.12) (30.00)<br />

Purchase of Fixed Assets (excl. impairment) (10,447.78) (4,543.24) (3,234.80)<br />

Cash and bank balances taken over pursuant to amalgamation 3,431.23 - -<br />

Sale of Fixed Assets 43.10 2.03 53.00<br />

Share Application Money Pending Allotment 24.87 (22.99) 20.70<br />

Purchase of Investments in - Associates (55.16) (0.49) (216.60)<br />

- Others (20,185.81) (7,461.36) (2,679.30)<br />

Sale of Investments in - Associates - 2.90 51.60<br />

- Others 21,141.49 6,580.28 2,686.80<br />

Interest received 276.77 259.47 317.60<br />

Dividend received 107.62 5.71 9.90<br />

Net Cash Flow after Investing Activities (11,270.21) (5,759.81) (3,021.10)<br />

C CASH FLOW FROM FINANCING ACTIVITIES :<br />

Interest Paid (2,615.87) (1,194.90) (1,023.00)<br />

Grant Received 332.38 - -<br />

xxviii