GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

interest and voting rights in respect of 25,500 (Year 2007-08 Nil, Year 2006-07 Nil) equity shares<br />

from GIL.<br />

ii) During the year 2008-09, its subsidiary Company GIPL acquired 50,000 (Year 2007-08 Nil,<br />

Year 2006-07 Nil) equity shares in the joint venture company Gammon L & T Infra MRTS Ltd<br />

(„GLTIML‟) from L & T Infrastructure Projects Limited. Due to this acquisition, GLTIML became<br />

a wholly owned subsidiary of the Company. The name of GLTIML was subsequently changed to<br />

Gammon Metro Transport Limited (GMTL).<br />

iii) During the year 2008-09, BSL, GHL, JPDL, PREL, and YPVL (Year 2007-08 GLL, GICL,<br />

HBPL, KBICL, MPSL, THPL; Year 2006-07 Nil) were incorporated by its subsidiary company<br />

GIPL by subscribing to the memorandum.<br />

f) Warrant Issued to Investor<br />

Pursuant to the approval of the members of CBICL at an EGM, a Warrant Subscription<br />

Agreement between the CBICL, Gammon India Ltd and AMIF I Ltd („the investor‟) has been<br />

executed on 30th November, 2005. Based on the agreement CBICL has issued an Optionally<br />

Convertible Warrant on a preferential basis, which gives the investor an option to subscribe to<br />

25% of the issued and paid share capital of CBICL on a fully diluted basis, on a preferential<br />

allotment basis, at any time after 1st January, 2011 but before 31st March, 2011, by paying the<br />

CBICL fair value therefore. As per put and call option of the said agreement, CBICL has<br />

exercised the option for repurchasing the warrant. However, during the year 2007-08 these<br />

warrants were cancelled and are not outstanding as at 31st March 2009.<br />

2. JOINT VENTURES<br />

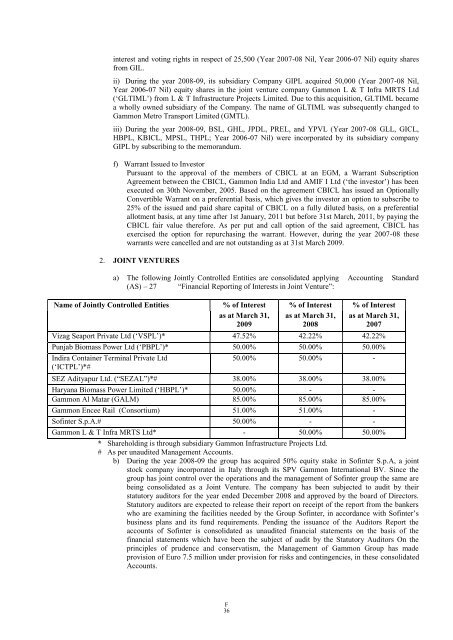

a) The following Jointly Controlled Entities are consolidated applying Accounting Standard<br />

(AS) – 27 “Financial Reporting of Interests in Joint Venture”:<br />

Name of Jointly Controlled Entities % of Interest % of Interest % of Interest<br />

as at March 31,<br />

2009<br />

as at March 31,<br />

2008<br />

as at March 31,<br />

2007<br />

Vizag Seaport Private Ltd („VSPL‟)* 47.52% 42.22% 42.22%<br />

Punjab Biomass Power Ltd („PBPL‟)* 50.00% 50.00% 50.00%<br />

Indira Container Terminal Private Ltd<br />

(„ICTPL‟)*#<br />

50.00% 50.00% -<br />

SEZ Adityapur Ltd. (“SEZAL”)*# 38.00% 38.00% 38.00%<br />

Haryana Biomass Power Limited („HBPL‟)* 50.00% - -<br />

Gammon Al Matar (GALM) 85.00% 85.00% 85.00%<br />

Gammon Encee Rail (Consortium) 51.00% 51.00% -<br />

Sofinter S.p.A.# 50.00% - -<br />

Gammon L & T Infra MRTS Ltd* - 50.00% 50.00%<br />

* Shareholding is through subsidiary Gammon Infrastructure Projects Ltd.<br />

# As per unaudited Management Accounts.<br />

b) During the year 2008-09 the group has acquired 50% equity stake in Sofinter S.p.A, a joint<br />

stock company incorporated in Italy through its SPV Gammon International BV. Since the<br />

group has joint control over the operations and the management of Sofinter group the same are<br />

being consolidated as a Joint Venture. The company has been subjected to audit by their<br />

statutory auditors for the year ended December 2008 and approved by the board of Directors.<br />

Statutory auditors are expected to release their report on receipt of the report from the bankers<br />

who are examining the facilities needed by the Group Sofinter, in accordance with Sofinter‟s<br />

business plans and its fund requirements. Pending the issuance of the Auditors Report the<br />

accounts of Sofinter is consolidated as unaudited financial statements on the basis of the<br />

financial statements which have been the subject of audit by the Statutory Auditors On the<br />

principles of prudence and conservatism, the Management of Gammon Group has made<br />

provision of Euro 7.5 million under provision for risks and contingencies, in these consolidated<br />

Accounts.<br />

F<br />

36