GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Further, during the year 2008-09, the Compensation Committee of the Board of Directors of GIPL at its<br />

meeting held on December 5, 2008, allotted 500,000 stock options under the “GIPL Employees Stock<br />

Options Scheme 2008” to its Managing Director enabling him to apply for 500,000 equity shares at par<br />

on completion of the vesting period of one year. The market price on the date of grant was Rs 43.45 per<br />

equity share.<br />

27. The market value of investments does not consider the market value of the Company‟s share which is<br />

part of the shares to be issued to the proposed trust to be created for the issue of equity shares of the<br />

company in lieu of the shares held by the company in ATSL pursuant to the amalgamation of the<br />

company with ATSL.<br />

28. Unpaid dividend includes Rs. 0.50 Millions in the year 2007-08 (2006-07 – Rs. 0.30 Millions) to be<br />

transferred to the Investor Education & Protection Fund.<br />

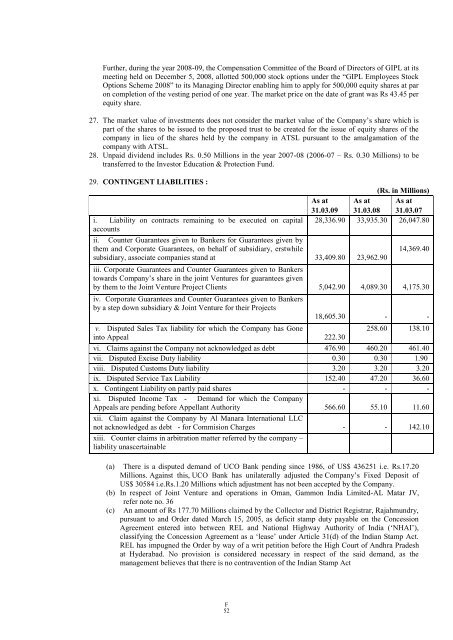

29. CONTINGENT LIABILITIES :<br />

i. Liability on contracts remaining to be executed on capital<br />

accounts<br />

ii. Counter Guarantees given to Bankers for Guarantees given by<br />

them and Corporate Guarantees, on behalf of subsidiary, erstwhile<br />

subsidiary, associate companies stand at<br />

iii. Corporate Guarantees and Counter Guarantees given to Bankers<br />

towards Company‟s share in the joint Ventures for guarantees given<br />

by them to the Joint Venture Project Clients<br />

iv. Corporate Guarantees and Counter Guarantees given to Bankers<br />

by a step down subsidiary & Joint Venture for their Projects<br />

v. Disputed Sales Tax liability for which the Company has Gone<br />

into Appeal<br />

As at As at<br />

(Rs. in Millions)<br />

As at<br />

31.03.09 31.03.08 31.03.07<br />

28,336.90 33,935.30 26,047.80<br />

33,409.80<br />

5,042.90<br />

18,605.30<br />

222.30<br />

23,962.90<br />

4,089.30<br />

-<br />

14,369.40<br />

4,175.30<br />

258.60 138.10<br />

vi. Claims against the Company not acknowledged as debt 476.90 460.20 461.40<br />

vii. Disputed Excise Duty liability 0.30 0.30 1.90<br />

viii. Disputed Customs Duty liability 3.20 3.20 3.20<br />

ix. Disputed Service Tax Liability 152.40 47.20 36.60<br />

x. Contingent Liability on partly paid shares<br />

xi. Disputed Income Tax - Demand for which the Company<br />

- - -<br />

Appeals are pending before Appellant Authority<br />

566.60 55.10 11.60<br />

xii. Claim against the Company by Al Manara International LLC<br />

not acknowledged as debt - for Commision Charges<br />

xiii. Counter claims in arbitration matter referred by the company –<br />

liability unascertainable<br />

(a) There is a disputed demand of UCO Bank pending since 1986, of US$ 436251 i.e. Rs.17.20<br />

Millions. Against this, UCO Bank has unilaterally adjusted the Company‟s Fixed Deposit of<br />

US$ 30584 i.e.Rs.1.20 Millions which adjustment has not been accepted by the Company.<br />

(b) In respect of Joint Venture and operations in Oman, Gammon India Limited-AL Matar JV,<br />

refer note no. 36<br />

(c) An amount of Rs 177.70 Millions claimed by the Collector and District Registrar, Rajahmundry,<br />

pursuant to and Order dated March 15, 2005, as deficit stamp duty payable on the Concession<br />

Agreement entered into between REL and National Highway Authority of India („NHAI‟),<br />

classifying the Concession Agreement as a „lease‟ under Article 31(d) of the Indian Stamp Act.<br />

REL has impugned the Order by way of a writ petition before the High Court of Andhra Pradesh<br />

at Hyderabad. No provision is considered necessary in respect of the said demand, as the<br />

management believes that there is no contravention of the Indian Stamp Act<br />

F<br />

52<br />

-<br />

-<br />

-<br />

142.10