GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

GAMMON INDIA LIMITED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

the issue of shares to the trust, the Investments in ATSL are shown as GIL shares Suspense<br />

account under Investments. When issued these shares shall be suitably disclosed in the<br />

accounts.<br />

f) The excess of assets over liabilities accounted in the company representing Amalgamation<br />

Reserve is treated as part of the General Reserve shall form part of the free reserves<br />

available for distribution of dividend and shall be reckoned for Net Wealth purposes in<br />

accordance with the scheme approved by the Honourable High Court. Had this treatment<br />

not been presented in the scheme, the said reserve would have been Capital reserve.<br />

g) The transaction of the business of ATSL with effect from 1 st April ,2008 have been<br />

incorporated in the accounts on the basis of the Audited Financial Statements of the<br />

business, which is treated as a Branch, as audited by M/s M.G.Shah & Associates and M/s<br />

Vinod Modi & Associates, the statutory auditors of the erstwhile ATSL before its<br />

amalgamation with the company, who have been appointed by the Board of Directors of the<br />

Company as Branch Auditors.<br />

h) All equity inter group transactions have been eliminated on incorporation of the accounts of<br />

ATSL in the company.<br />

B. In view of the Amalgamation of the business of ATSL in these financial statements the figures<br />

for the 2008-09 year are not comparable with that of the previous year.<br />

C. The preference capital to be issued to the holders of the preference share capital in the erstwhile<br />

ATSL as aforesaid are convertible optionally at the option of the preference share holder at the<br />

end of 18 months from the date of issue of the preference shares by ATSL which is 14 th July<br />

2009 into 2 equity shares of the Company. The provision for the dividends on the preference<br />

shares are made pending the issue of the preference shares. In the event of the preference<br />

shareholder not exercising the option, the preference shares become non-convertible and are<br />

redeemable at par at the end of five years from the date of allotment of the original optionally<br />

convertible preference shares.<br />

D. In the year 2008-09 the dividends received by the Company of Rs. 2.90 Millions from the<br />

erstwhile ATSL relating to the proposed dividend of ATSL for the year ended 31 st March 2008<br />

has been adjusted in the retained earnings. Similarly during the year the one line profit<br />

accounted in accordance with AS 23 in the earlier periods as an Associate by the Company has<br />

been reversed in the Appropriation account aggregating to Rs. 352.90 Millions.<br />

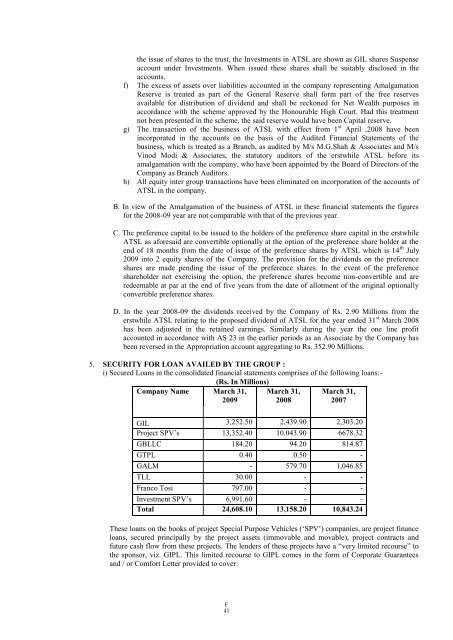

5. SECURITY FOR LOAN AVAILED BY THE GROUP :<br />

i) Secured Loans in the consolidated financial statements comprises of the following loans:-<br />

(Rs. In Millions)<br />

Company Name March 31,<br />

2009<br />

March 31,<br />

2008<br />

March 31,<br />

2007<br />

GIL 3,252.50 2,439.90 2,303.20<br />

Project SPV‟s 13,352.40 10,043.90 6678.32<br />

GBLLC 184.20 94.20 814.87<br />

GTPL 0.40 0.50 -<br />

GALM - 579.70 1,046.85<br />

TLL 30.00 - -<br />

Franco Tosi 797.00 - -<br />

Investment SPV‟s 6,991.60 - -<br />

Total 24,608.10 13,158.20 10,843.24<br />

These loans on the books of project Special Purpose Vehicles („SPV‟) companies, are project finance<br />

loans, secured principally by the project assets (immovable and movable), project contracts and<br />

future cash flow from these projects. The lenders of these projects have a “very limited recourse” to<br />

the sponsor, viz. GIPL. This limited recourse to GIPL comes in the form of Corporate Guarantees<br />

and / or Comfort Letter provided to cover:<br />

F<br />

41