Annual report of the Town of Hampton, New Hampshire

Annual report of the Town of Hampton, New Hampshire

Annual report of the Town of Hampton, New Hampshire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

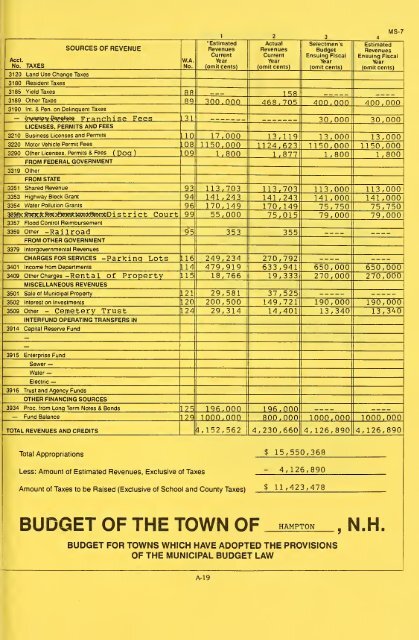

Acct.<br />

No.<br />

TAXES<br />

3120 Land Use Change Taxes<br />

3180 Resident Taxes<br />

SOURCES OF REVENUE<br />

W.A.<br />

No.<br />

1 2 3<br />

'Estimated<br />

Revenues<br />

Current<br />

Year<br />

(omit cents)<br />

Actual<br />

Revenues<br />

Current<br />

Year<br />

(omit cents)<br />

Selectmen's<br />

Budget<br />

Ensuing Fiscal<br />

Year<br />

(omit cents)<br />

MS-7<br />

4<br />

Estimated<br />

Revenues<br />

Ensuing Fiscal<br />

Year<br />

(omit cents)<br />

3185 Yield Taxes<br />

BR 1 58<br />

3189 O<strong>the</strong>r Taxes 89 300. nnn 468.705 400.000 400,000<br />

3190 Int. & Pen. on Delinquent Taxes<br />

- -J^sF^-S^teS- Franchise Fees L<br />

LICENSES, PERMITS AND FEES<br />

3 1 30,000 30,000<br />

3210 Business Licenses and Permits L 10 17,000 13,119 13,000 13,000<br />

3220 Motor Vehicle Permit Fees L08 1150,000 1124,623 1150,000 1150,000<br />

3290 O<strong>the</strong>r Licenses. Permits & Fees ( Doq ) L09 1,800 1 ,877 1 ,800 1,800<br />

FROM FEDERAL GOVERNMENT<br />

3319 O<strong>the</strong>r<br />

FROM STATE<br />

3351 Shared Revenue 93 113,703 113,703 113,000 113,000<br />

3353 Highway Block Grant 94 141 ,243 141,243 141 ,000 141 ,000<br />

3354 Water Pollution Grants 96 170,149 170,149 75,750 75,750<br />

3?s^«tKtK&;feslJ&[rK3ttaHdc5teo30Di strict Court 99 55,000 75,015 79,000 79,000<br />

3357 Flood Control Reimbursement<br />

3359 o<strong>the</strong>r -Railroad 95 353 355<br />

FROM OTHER GOVERNMENT<br />

3379 Intergovernmental Revenues<br />

CHARGES FOR SERVICES -Parkinq Lots 116 249,234 270,792<br />

3401 Income from Departments 114 479,919 633,941 650,000 650,000<br />

3409 O<strong>the</strong>r Charges -Rental <strong>of</strong> Property 115 18,766 19,333 270,000 270,000<br />

MISCELLANEOUS REVENUES<br />

3501 Sale <strong>of</strong> Municipal Property 121 29,581 37,525<br />

3502 Interest on Investments 120 200,500 149,721 190,000 190,000<br />

3509 O<strong>the</strong>r - Cemetery Trust 124 29,314 14,401 13,340 13,340<br />

INTERFUND OPERATING TRANSFERS IN<br />

3914 Capital Reserve Fund<br />

-<br />

-<br />

3915 Enterprise Fund<br />

Sewer —<br />

Water —<br />

Electric —<br />

3916 Trust and Agency Funds<br />

OTHER FINANCING SOURCES<br />

3934 Proc. from Long Term Notes & Bonds 125 196,000 196,000<br />

— Fund Balance<br />

1 79 1000,000 800,000 1000,000 1000,000<br />

TOTAL REVENUES AND CREDITS 4,152,562 4,230,660 4,126,890 4,126,890<br />

Total Appropriations $ 15,55 0,368<br />

Less: Amount <strong>of</strong> Estimated Revenues, Exclusive <strong>of</strong> Taxes<br />

- 4,12 6,890<br />

Amount <strong>of</strong> Taxes to be Raised (Exclusive <strong>of</strong> School and County Taxes) $ 11,42 3,478<br />

BUDGET OF THE TOWN O<br />

BUDGET FOR TOWNS WHICH HAVE ADOP1 ED THE PRC(VISIONS<br />

OF THE MUNICIPAL BUDGE TLAW<br />

F<br />

HAMP roN<br />

M.H.<br />

A-19