Annual report of the Town of Hampton, New Hampshire

Annual report of the Town of Hampton, New Hampshire

Annual report of the Town of Hampton, New Hampshire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

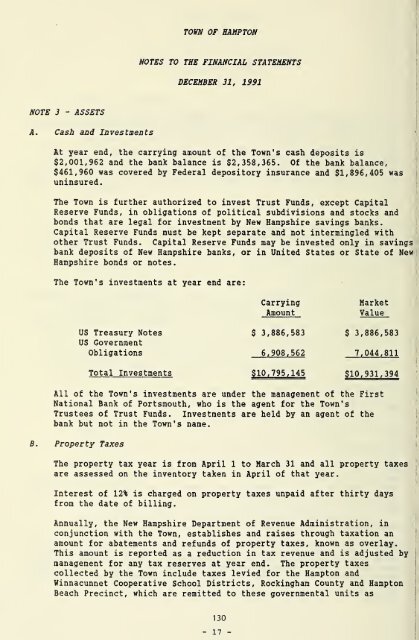

TOWN OF HAMPTON<br />

NOTES TO<br />

THE FINANCIAL STATEMENTS<br />

DECEMBER 31, 1991<br />

NOTE 3 - ASSETS<br />

A. Cash and Investments<br />

At year end, <strong>the</strong> carrying amount <strong>of</strong> <strong>the</strong> <strong>Town</strong>'s cash deposits is<br />

$2,001,962 and <strong>the</strong> bank balance is $2,358,365. Of <strong>the</strong> bank balance,<br />

$461,960 was covered by Federal depository insurance and $1,896,405 was<br />

uninsured.<br />

The <strong>Town</strong> is fur<strong>the</strong>r authorized to invest Trust Funds, except Capital<br />

Reserve Funds, in obligations <strong>of</strong> political subdivisions and stocks and<br />

bonds that are legal for investment by <strong>New</strong> <strong>Hampshire</strong> savings banks.<br />

Capital Reserve Funds must be kept separate and not intermingled with<br />

o<strong>the</strong>r Trust Funds. Capital Reserve Funds may be invested only in savings<br />

bank deposits <strong>of</strong> <strong>New</strong> <strong>Hampshire</strong> banks, or in United States or State <strong>of</strong> <strong>New</strong><br />

<strong>Hampshire</strong> bonds or notes.<br />

The <strong>Town</strong>'s investments at year end are:<br />

US Treasury Notes<br />

US Government<br />

Obligations<br />

Total<br />

Investments<br />

All <strong>of</strong> <strong>the</strong> <strong>Town</strong>'s investments are under <strong>the</strong> management <strong>of</strong> <strong>the</strong> First<br />

National Bank <strong>of</strong> Portsmouth, who is <strong>the</strong> agent for <strong>the</strong> <strong>Town</strong>'s<br />

Trustees <strong>of</strong> Trust Funds. Investments are held by an agent <strong>of</strong> <strong>the</strong><br />

bank but not in <strong>the</strong> <strong>Town</strong>'s name.<br />

B. Property Taxes<br />

Carrying<br />

Amount<br />

130<br />

- 17 -<br />

Market<br />

Value<br />

$ 3,886,583 $ 3,886,583<br />

6,908,562 7,044,811<br />

$10,795,145 $10,931,394<br />

The property tax year is from April 1 to March 31 and all property taxes<br />

are assessed on <strong>the</strong> inventory taken in April <strong>of</strong> that year.<br />

Interest <strong>of</strong> 12% is charged on property taxes unpaid after thirty days<br />

from <strong>the</strong> date <strong>of</strong> billing.<br />

<strong>Annual</strong>ly, <strong>the</strong> <strong>New</strong> <strong>Hampshire</strong> Department <strong>of</strong> Revenue Administration, in<br />

conjunction with <strong>the</strong> <strong>Town</strong>, establishes and raises through taxation an<br />

amount for abatements and refunds <strong>of</strong> property taxes, known as overlay.<br />

This amount is <strong>report</strong>ed as a reduction in tax revenue and is adjusted by<br />

management for any tax reserves at year end. The property taxes<br />

collected by <strong>the</strong> <strong>Town</strong> include taxes levied for <strong>the</strong> <strong>Hampton</strong> and<br />

Winnacunnet Cooperative School Districts, Rockingham County and <strong>Hampton</strong><br />

Beach Precinct, which are remitted to <strong>the</strong>se governmental units as