Annual report of the Town of Hampton, New Hampshire

Annual report of the Town of Hampton, New Hampshire

Annual report of the Town of Hampton, New Hampshire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

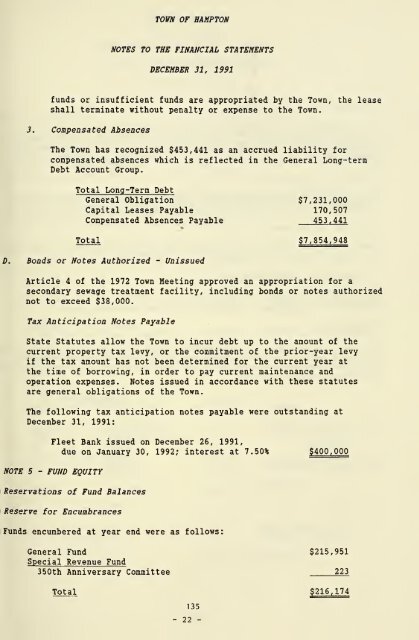

TOWN OF HAMPTON<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

DECEMBER 31, 1991<br />

funds or insufficient funds are appropriated by <strong>the</strong> <strong>Town</strong>, <strong>the</strong> lease<br />

shall terminate without penalty or expense to <strong>the</strong> <strong>Town</strong>.<br />

3. Compensated Absences<br />

The <strong>Town</strong> has recognized $453,441 as an accrued liability for<br />

compensated absences which is reflected in <strong>the</strong> General Long-term<br />

Debt Account Group.<br />

Total Long-Term Debt<br />

General Obligation $7,231,000<br />

Capital Leases Payable 170,507<br />

Compensated Absences Payable 453,441<br />

Total $7,854,948<br />

D. Bonds or Notes Authorized - Unissued<br />

Article 4 <strong>of</strong> <strong>the</strong> 1972 <strong>Town</strong> Meeting approved an appropriation for a<br />

secondary sewage treatment facility, including bonds or notes authorized<br />

not to exceed $38,000.<br />

Tax Anticipation Notes Payable<br />

State Statutes allow <strong>the</strong> <strong>Town</strong> to incur debt up to <strong>the</strong> amount <strong>of</strong> <strong>the</strong><br />

current property tax levy, or <strong>the</strong> commitment <strong>of</strong> <strong>the</strong> prior-year levy<br />

if <strong>the</strong> tax amount has not been determined for <strong>the</strong> current year at<br />

<strong>the</strong> time <strong>of</strong> borrowing, in order to pay current maintenance and<br />

operation expenses. Notes issued in accordance with <strong>the</strong>se statutes<br />

are general obligations <strong>of</strong> <strong>the</strong> <strong>Town</strong>.<br />

The following tax anticipation notes payable were outstanding at<br />

December 31, 1991:<br />

Fleet Bank issued on December 26, 1991,<br />

due on January 30, 1992; interest at 7.50% $400,000<br />

NOTE 5<br />

- FUND EQUITY<br />

Reservations <strong>of</strong> Fund Balances<br />

Reserve for Encumbrances<br />

Funds encumbered at year end were as follows:<br />

General Fund $215,951<br />

Special Revenue Fund<br />

350th Anniversary Committee 223<br />

Total $216,174<br />

135<br />

- 22 -