Annual report of the Town of Hampton, New Hampshire

Annual report of the Town of Hampton, New Hampshire

Annual report of the Town of Hampton, New Hampshire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

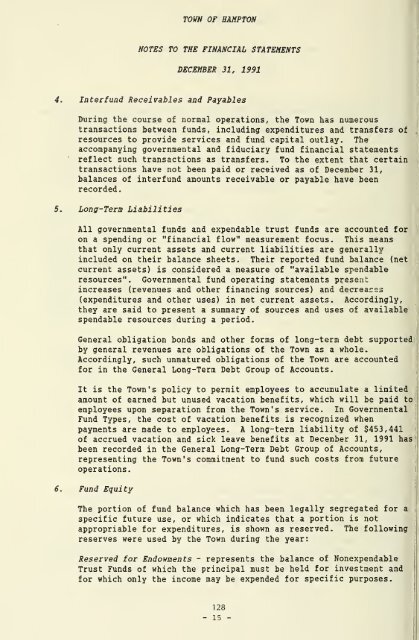

TOWN OF HAMPTON<br />

NOTES TO<br />

THE FINANCIAL STATEMENTS<br />

DECEMBER 31, 1991<br />

Interfund Receivables and Payables<br />

During <strong>the</strong> course <strong>of</strong> normal operations, <strong>the</strong> <strong>Town</strong> has numerous<br />

transactions between funds, including expenditures and transfers <strong>of</strong><br />

resources to provide services and fund capital outlay. The<br />

accompanying governmental and fiduciary fund financial statements<br />

reflect such transactions as transfers. To <strong>the</strong> extent that certain<br />

transactions have not been paid or received as <strong>of</strong> December 31,<br />

balances <strong>of</strong> interfund amounts receivable or payable have been<br />

recorded.<br />

Long-Term Li abiliti es<br />

All governmental funds and expendable trust funds are accounted for<br />

on a spending or "financial flow" measurement focus. This means<br />

that only current assets and current liabilities are generally<br />

included on <strong>the</strong>ir balance sheets. Their <strong>report</strong>ed fund balance (net<br />

current assets) is considered a measure <strong>of</strong> "available spendable<br />

resources". Governmental fund operating statements present<br />

increases (revenues and o<strong>the</strong>r financing sources) and decreases<br />

(expenditures and o<strong>the</strong>r uses) in net current assets. Accordingly,<br />

<strong>the</strong>y are said to present a summary <strong>of</strong> sources and uses <strong>of</strong> available<br />

spendable resources during a period.<br />

General obligation bonds and o<strong>the</strong>r forms <strong>of</strong> long-term debt supported<br />

by general revenues are obligations <strong>of</strong> <strong>the</strong> <strong>Town</strong> as a whole.<br />

Accordingly, such unmatured obligations <strong>of</strong> <strong>the</strong> <strong>Town</strong> are accounted<br />

for in <strong>the</strong> General Long-Term Debt Group <strong>of</strong> Accounts.<br />

It is <strong>the</strong> <strong>Town</strong>'s policy to permit employees to accumulate a limited<br />

amount <strong>of</strong> earned but unused vacation benefits, which will be paid to<br />

employees upon separation from <strong>the</strong> <strong>Town</strong>'s service. In Governmental<br />

Fund Types, <strong>the</strong> cost <strong>of</strong> vacation benefits is recognized when<br />

payments are made to employees. A long-term liability <strong>of</strong> $453,441<br />

<strong>of</strong> accrued vacation and sick leave benefits at December 31, 1991 has<br />

been recorded in <strong>the</strong> General Long-Term Debt Group <strong>of</strong> Accounts,<br />

representing <strong>the</strong> <strong>Town</strong>'s commitment to fund such costs from future<br />

operations.<br />

Fund Equity<br />

The portion <strong>of</strong> fund balance which has been legally segregated for a<br />

specific future use, or which indicates that a portion is not<br />

appropriable for expenditures, is shown as reserved. The following<br />

reserves were used by <strong>the</strong> <strong>Town</strong> during <strong>the</strong> year:<br />

Reserved for Endowments - represents <strong>the</strong> balance <strong>of</strong> Nonexpendable<br />

Trust Funds <strong>of</strong> which <strong>the</strong> principal must be held for investment and<br />

for which only <strong>the</strong> income may be expended for specific purposes.<br />

128<br />

- 15 -