Annual report of the Town of Hampton, New Hampshire

Annual report of the Town of Hampton, New Hampshire

Annual report of the Town of Hampton, New Hampshire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

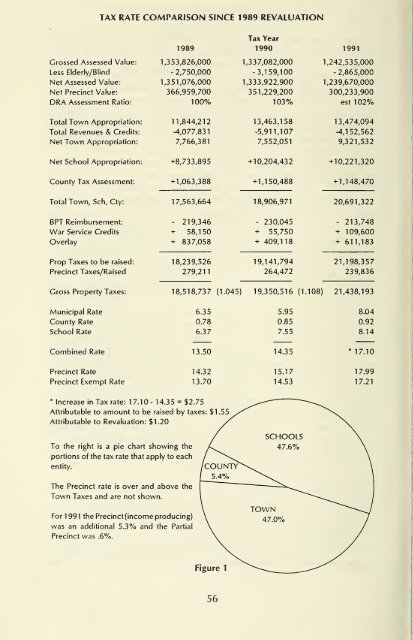

TAX RATE COMPARISON SINCE 1989 REVALUATION<br />

Tax Year<br />

1989 1990 1991<br />

Crossed Assessed Value: 1,353,826,000 1,337,082,000 1,242,535,000<br />

Less Elderly/Blind - 2,750,000 -3,159,100 - 2,865,000<br />

Net Assessed Value: 1,351,076,000 1,333,922,900 1,239,670,000<br />

Net Precinct Value: 366,959,700 351,229,200 300,233,900<br />

DRA Assessment Ratio: 100% 103% est 102%<br />

Total <strong>Town</strong> Appropriation: 11,844,212 13,463,158 13,474,094<br />

Total Revenues & Credits: -4,077,831 -5,911,107 -4,152,562<br />

Net <strong>Town</strong> Appropriation: 7,766,381 7,552,051 9,321,532<br />

Net School Appropriation: +8,733,895 +10,204,432 +10,221,320<br />

County Tax Assessment: + 1,063,388 +1,150,488 +1,148,470<br />

Total <strong>Town</strong>, Sch, Cty: 17,563,664 18,906,971 20,691,322<br />

BPT Reimbursement: - 219,346 - 230,045 - 213,748<br />

War Service Credits + 58,150 + 55,750 + 109,600<br />

Overlay + 837,058 + 409,118 + 611,183<br />

Prop Taxes to be raised:<br />

Precinct Taxes/Raised<br />

18,239,526<br />

279,211<br />

19,141,794<br />

264,472<br />

21,198,357<br />

239,836<br />

Gross Property Taxes:<br />

18,518,737 (1.045) 19,350,516 (1.108) 21,438,193<br />

Municipal Rate<br />

County Rate<br />

School Rate<br />

6.35<br />

0.78<br />

6.37<br />

5.95<br />

0.85<br />

7.55<br />

8.04<br />

0.92<br />

8.14<br />

Combined Rate<br />

13.50<br />

14.35<br />

*<br />

17.10<br />

Precinct Rate<br />

Precinct Exempt Rate<br />

14.32<br />

13.70<br />

15.17<br />

14.53<br />

17.99<br />

17.21<br />

*<br />

Increase in Tax rate: 1 7.1 - 1 4.35 = $2.75<br />

Attributable to amount to be raised by taxes: $1.55<br />

Attributable to Revaluation: $1.20<br />

To <strong>the</strong> right is a pie chart showing <strong>the</strong><br />

portions <strong>of</strong> <strong>the</strong> tax rate that apply to each<br />

entity.<br />

The Precinct rate is over and above <strong>the</strong><br />

<strong>Town</strong> Taxes and are not shown.<br />

For 1 991 <strong>the</strong> Precinct (income producing)<br />

was an additional 5.3% and <strong>the</strong> Partial<br />

Precinct was .6%.