Annual report of the Town of Hampton, New Hampshire

Annual report of the Town of Hampton, New Hampshire

Annual report of the Town of Hampton, New Hampshire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

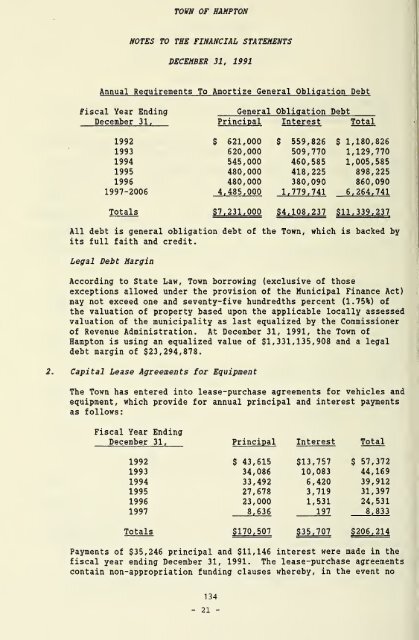

TOWN OF HAMPTON<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

DECEMBER 31, 1991<br />

<strong>Annual</strong><br />

Requirements To Amortize General Obligation Debt<br />

Fiscal Year Ending<br />

General Obligation Debt<br />

December 31, Principal Interest Total<br />

1992 $ 621,000 $ 559,826 $ 1,180,826<br />

1993 620,000 509,770 1,129,770<br />

1994 545,000 460,585 1,005,585<br />

1995 480,000 418,225 898,225<br />

1996 480,000 380,090 860,090<br />

1997-2006 4,485,000 1,779,741 6,264,741<br />

Totals $7, 231, 000 $4,108,237 $11,339,237<br />

All debt is general obligation debt <strong>of</strong> <strong>the</strong> <strong>Town</strong>, which is backed by<br />

its full faith and credit.<br />

Legal Debt Margin<br />

According to State Law, <strong>Town</strong> borrowing (exclusive <strong>of</strong> those<br />

exceptions allowed under <strong>the</strong> provision <strong>of</strong> <strong>the</strong> Municipal Finance Act)<br />

may not exceed one and seventy-five hundredths percent (1.75%) <strong>of</strong><br />

<strong>the</strong> valuation <strong>of</strong> property based upon <strong>the</strong> applicable locally assessed<br />

valuation <strong>of</strong> <strong>the</strong> municipality as last equalized by <strong>the</strong> Commissioner<br />

<strong>of</strong> Revenue Administration. At December 31, 1991, <strong>the</strong> <strong>Town</strong> <strong>of</strong><br />

<strong>Hampton</strong> is using an equalized value <strong>of</strong> $1,331,135,908 and a legal<br />

debt margin <strong>of</strong> $23,294,878.<br />

Capital<br />

Lease Agreements for Equipment<br />

The <strong>Town</strong> has entered into lease-purchase agreements for vehicles and<br />

equipment, which provide for annual principal and interest payments<br />

as follows:<br />

Fiscal Year Ending<br />

December 31, Principal<br />

Interest<br />

Total<br />

1992 $ 43,615 $13,757 $ 57,372<br />

1993 34,086 10,083 44,169<br />

1994 33,492 6,420 39,912<br />

1995 27,678 3,719 31,397<br />

1996 23,000 1,531 24,531<br />

1997 8,636 197 8,833<br />

Totals $170,507 $35,707 $206,214<br />

Payments <strong>of</strong> $35,246 principal and $11,146 interest were made in <strong>the</strong><br />

fiscal year ending December 31, 1991. The lease-purchase agreements<br />

contain non-appropriation funding clauses whereby, in <strong>the</strong> event no<br />

134<br />

- 21 -