AN EXERCISE IN WORLDMAKING 2009 - ISS

AN EXERCISE IN WORLDMAKING 2009 - ISS

AN EXERCISE IN WORLDMAKING 2009 - ISS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

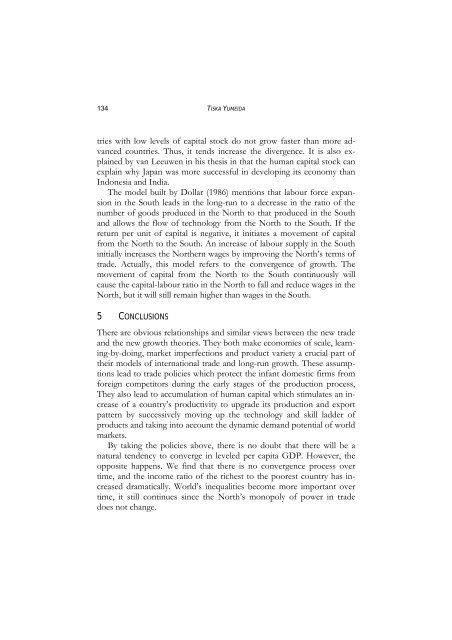

134 TISKA YUMEIDA<br />

tries with low levels of capital stock do not grow faster than more advanced<br />

countries. Thus, it tends increase the divergence. It is also explained<br />

by van Leeuwen in his thesis in that the human capital stock can<br />

explain why Japan was more successful in developing its economy than<br />

Indonesia and India.<br />

The model built by Dollar (1986) mentions that labour force expansion<br />

in the South leads in the long-run to a decrease in the ratio of the<br />

number of goods produced in the North to that produced in the South<br />

and allows the flow of technology from the North to the South. If the<br />

return per unit of capital is negative, it initiates a movement of capital<br />

from the North to the South. An increase of labour supply in the South<br />

initially increases the Northern wages by improving the North’s terms of<br />

trade. Actually, this model refers to the convergence of growth. The<br />

movement of capital from the North to the South continuously will<br />

cause the capital-labour ratio in the North to fall and reduce wages in the<br />

North, but it will still remain higher than wages in the South.<br />

5 CONCLUSIONS<br />

There are obvious relationships and similar views between the new trade<br />

and the new growth theories. They both make economies of scale, learning-by-doing,<br />

market imperfections and product variety a crucial part of<br />

their models of international trade and long-run growth. These assumptions<br />

lead to trade policies which protect the infant domestic firms from<br />

foreign competitors during the early stages of the production process,<br />

They also lead to accumulation of human capital which stimulates an increase<br />

of a country’s productivity to upgrade its production and export<br />

pattern by successively moving up the technology and skill ladder of<br />

products and taking into account the dynamic demand potential of world<br />

markets.<br />

By taking the policies above, there is no doubt that there will be a<br />

natural tendency to converge in leveled per capita GDP. However, the<br />

opposite happens. We find that there is no convergence process over<br />

time, and the income ratio of the richest to the poorest country has increased<br />

dramatically. World’s inequalities become more important over<br />

time, it still continues since the North’s monopoly of power in trade<br />

does not change.