Innovation in Global Power - Parsons Brinckerhoff

Innovation in Global Power - Parsons Brinckerhoff

Innovation in Global Power - Parsons Brinckerhoff

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

http://www.pbworld.com/news_events/publications/network/<br />

Plann<strong>in</strong>g and the Role of Regulators<br />

Asset Replacement: The Regulator’s View<br />

By John Douglas, Newcastle upon Tyne, UK, +44 191 226 2252, douglasJak@pbworld.com<br />

The expenditure required to<br />

replace age<strong>in</strong>g assets for<br />

a mature electricity<br />

transmission or distribution<br />

network can represent half<br />

of the network operator’s<br />

capital budget, and these<br />

costs cont<strong>in</strong>ue to rise. In a<br />

regulated power supply<br />

<strong>in</strong>dustry such as exists <strong>in</strong><br />

the UK, the regulator often<br />

has limited resources to<br />

perform a budgetary review<br />

<strong>in</strong> comparison with those<br />

available to the network<br />

operators who prepare the<br />

budget, but must ensure<br />

that an appropriate level of<br />

network performance is<br />

achieved at an efficient<br />

level of cost. PB has developed<br />

an asset replacement<br />

model that is help<strong>in</strong>g<br />

provide regulators with the<br />

<strong>in</strong>formation they need to<br />

make their decision. The<br />

author describes the model<br />

and recent changes <strong>in</strong> views<br />

on asset lives and changes<br />

to the regulatory review<br />

process.<br />

Sett<strong>in</strong>g the level of revenue a network operator can charge to fund operations and/or<br />

replacement of assets is generally the responsibility of the utility regulator, who acts <strong>in</strong> the<br />

<strong>in</strong>terests of the customers. The regulator has to balance the expenditures required, particularly<br />

for long-term reliable performance of the network, aga<strong>in</strong>st the correspond<strong>in</strong>g allowed revenue,<br />

the level of which is based on a regulatory price control review generally conducted every<br />

four to five years. As part that process, regulators can apply three tests:<br />

• Is there a justifiable need for the expenditure?<br />

• Have efficient design and life-cycle costs been taken <strong>in</strong>to consideration?<br />

• Is the tim<strong>in</strong>g of the expenditure appropriate?<br />

At the same time, some recent developments among network operators are that they:<br />

• Are <strong>in</strong>creas<strong>in</strong>g the attention they give to manag<strong>in</strong>g their ag<strong>in</strong>g transmission and distribution<br />

assets, <strong>in</strong>clud<strong>in</strong>g monitor<strong>in</strong>g the condition of their assets more extensively<br />

• Are adopt<strong>in</strong>g risk-based plann<strong>in</strong>g methods<br />

• Have <strong>in</strong>troduced annual expenditure and activity report<strong>in</strong>g to regulators<br />

• Have a limitation of resources available for asset replacement programmes.<br />

The level of asset replacement activity depends considerably on judg<strong>in</strong>g when an asset is “life<br />

expired.” There is generally a tendency for network operators to forecast high. If an unreasonably<br />

high expenditure was allowed under <strong>in</strong>centive-based price control regulation as <strong>in</strong> the UK, the<br />

network operator might readily achieve efficiency sav<strong>in</strong>gs to the detriment of the customer.<br />

A key dist<strong>in</strong>ction between a network operator and the regulator <strong>in</strong> the regulatory review<br />

process is that more <strong>in</strong>formation and time are available to the former. A regulator views<br />

the network at a high level, so requires a means of modell<strong>in</strong>g proposed asset replacement.<br />

Accord<strong>in</strong>gly, PB has developed an asset replacement model that has been used to review<br />

correspond<strong>in</strong>g expenditure for a number of regulators <strong>in</strong> different countries.<br />

Review of Replacement of Assets<br />

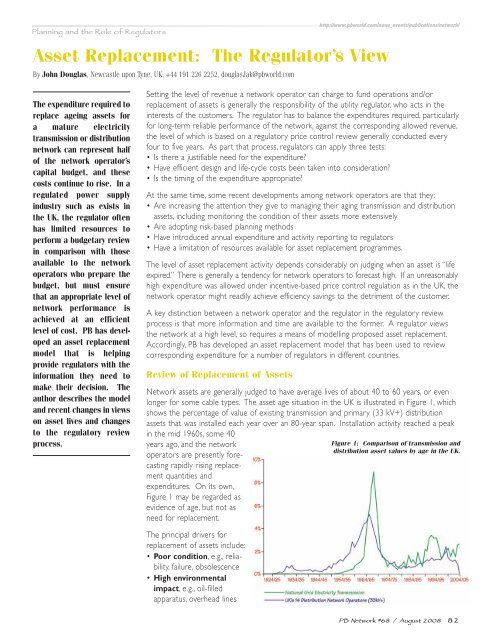

Network assets are generally judged to have average lives of about 40 to 60 years, or even<br />

longer for some cable types. The asset age situation <strong>in</strong> the UK is illustrated <strong>in</strong> Figure 1, which<br />

shows the percentage of value of exist<strong>in</strong>g transmission and primary (33 kV+) distribution<br />

assets that was <strong>in</strong>stalled each year over an 80-year span. Installation activity reached a peak<br />

<strong>in</strong> the mid 1960s, some 40<br />

years ago, and the network<br />

operators are presently forecast<strong>in</strong>g<br />

rapidly ris<strong>in</strong>g replacement<br />

quantities and<br />

expenditures. On its own,<br />

Figure 1 may be regarded as<br />

evidence of age, but not as<br />

need for replacement.<br />

The pr<strong>in</strong>cipal drivers for<br />

replacement of assets <strong>in</strong>clude:<br />

• Poor condition, e.g., reliability,<br />

failure, obsolescence<br />

• High environmental<br />

impact, e.g., oil-filled<br />

apparatus, overhead l<strong>in</strong>es<br />

Figure 1: Comparison of transmission and<br />

distribution asset values by age <strong>in</strong> the UK.<br />

PB Network #68 / August 2008 82