Town of Phippsburg 2012 Annual Report

Town of Phippsburg 2012 Annual Report

Town of Phippsburg 2012 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TOWN OF PHIPPSBURG<br />

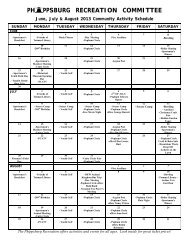

<strong>2012</strong> Valuation, Mil Rate, Assessments, Collections: Table T-1<br />

(Audit Schedule A-5)<br />

FY <strong>2012</strong> FY 2011<br />

Property Valuation (Taxable)<br />

Real Estate $607,584,000 $608,408,100<br />

Personal Property $2,527,700 $2,331,800<br />

Total Property Valuation $610,111,700 $610,739,900<br />

Mil Rate<br />

Minimum Mil Rate 7.46 7.37<br />

Maximum Mil Rate 7.83 7.73<br />

Chosen Mil Rate 7.60 7.60<br />

Overlay $86,086 $141,043<br />

<strong>Annual</strong> Taxes $4,636,848 $4,641,623<br />

Supplemental Taxes $00.00 $00.00<br />

Total Assessments $4,636,848 $4,641,623<br />

Collections and Credits<br />

Tax Collections $4,406,595 $4,430,682<br />

Abatements $4,808 $14,174<br />

Prepayments $9,501 $3,016<br />

Total Collections and Credits $4,420,905 $4,447,873<br />

Taxes Receivable on June 30th $215,943 $193,749<br />

State Valuation<br />

Taxable Real & Personal Property $609,150,000 $620,450,000<br />

Taxes Owed<br />

Table T-2 below shows taxes owed to the <strong>Town</strong> for past years. Real Estate is listed as receivable<br />

if not paid by the end <strong>of</strong> the fiscal year. It is then liened and eventually foreclosed on if taxes<br />

are not paid. Personal property is always listed as a receivable because there is no lien/<br />

foreclosure process.<br />

189