GENERAL PRINCIPLES - Shivaji University

GENERAL PRINCIPLES - Shivaji University

GENERAL PRINCIPLES - Shivaji University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901<br />

1234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901<br />

1234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901<br />

1234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901<br />

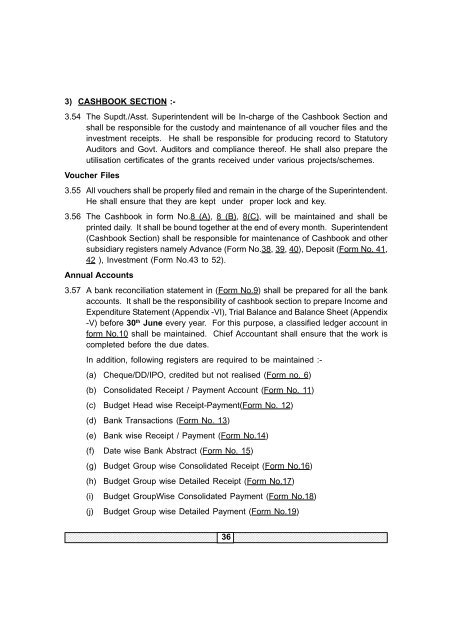

3) CASHBOOK SECTION :-<br />

3.54 The Supdt./Asst. Superintendent will be In-charge of the Cashbook Section and<br />

shall be responsible for the custody and maintenance of all voucher files and the<br />

investment receipts. He shall be responsible for producing record to Statutory<br />

Auditors and Govt. Auditors and compliance thereof. He shall also prepare the<br />

utilisation certificates of the grants received under various projects/schemes.<br />

Voucher Files<br />

3.55 All vouchers shall be properly filed and remain in the charge of the Superintendent.<br />

He shall ensure that they are kept under proper lock and key.<br />

3.56 The Cashbook in form No.8 (A), 8 (B), 8(C), will be maintained and shall be<br />

printed daily. It shall be bound together at the end of every month. Superintendent<br />

(Cashbook Section) shall be responsible for maintenance of Cashbook and other<br />

subsidiary registers namely Advance (Form No.38, 39, 40), Deposit (Form No. 41,<br />

42 ), Investment (Form No.43 to 52).<br />

Annual Accounts<br />

3.57 A bank reconciliation statement in (Form No.9) shall be prepared for all the bank<br />

accounts. It shall be the responsibility of cashbook section to prepare Income and<br />

Expenditure Statement (Appendix -VI), Trial Balance and Balance Sheet (Appendix<br />

-V) before 30 th June every year. For this purpose, a classified ledger account in<br />

form No.10 shall be maintained. Chief Accountant shall ensure that the work is<br />

completed before the due dates.<br />

In addition, following registers are required to be maintained :-<br />

(a) Cheque/DD/IPO, credited but not realised (Form no. 6)<br />

(b) Consolidated Receipt / Payment Account (Form No. 11)<br />

(c) Budget Head wise Receipt-Payment(Form No. 12)<br />

(d) Bank Transactions (Form No. 13)<br />

(e)<br />

Bank wise Receipt / Payment (Form No.14)<br />

(f) Date wise Bank Abstract (Form No. 15)<br />

(g)<br />

(h)<br />

(i)<br />

(j)<br />

Budget Group wise Consolidated Receipt (Form No.16)<br />

Budget Group wise Detailed Receipt (Form No.17)<br />

Budget GroupWise Consolidated Payment (Form No.18)<br />

Budget Group wise Detailed Payment (Form No.19)<br />

36<br />

1234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901