- Page 1:

2 0 0 9 - 2 0 1 0 UNDERGRADUATE CAT

- Page 4 and 5:

2 / A Mercy College Education A Mer

- Page 6 and 7:

4 / A Mercy College Education affor

- Page 8 and 9:

6 / Undergraduate Admissions Underg

- Page 10 and 11:

8 / Undergraduate Admissions admiss

- Page 12 and 13:

10 / Undergraduate Admissions flexi

- Page 14 and 15:

12 / The Mercy College PACT The Mer

- Page 16 and 17:

14 / Support Services and Resources

- Page 18 and 19:

16 / Tuition, Expenses, and Financi

- Page 20 and 21:

18 / Tuition, Expenses, and Financi

- Page 22 and 23:

20 / Tuition, Expenses, and Financi

- Page 24 and 25:

22 / Tuition, Expenses, and Financi

- Page 26 and 27:

24 / Tuition, Expenses, and Financi

- Page 28 and 29:

26 / Tuition, Expenses, and Financi

- Page 30 and 31:

28 / Tuition, Expenses, and Financi

- Page 32 and 33:

30 / Tuition, Expenses, and Financi

- Page 34 and 35:

32 / Tuition, Expenses, and Financi

- Page 36 and 37:

34 / Co-curricular and Student Life

- Page 38 and 39:

36 / Co-curricular and Student Life

- Page 40 and 41:

38 / Co-curricular and Student Life

- Page 42 and 43:

40 / Special Academic Opportunities

- Page 44 and 45:

42 / Special Academic Opportunities

- Page 46 and 47:

44 / Special Academic Opportunities

- Page 48 and 49:

46 / Special Academic Opportunities

- Page 50 and 51:

48 / Special Academic Opportunities

- Page 52 and 53: 50 / Special Academic Opportunities

- Page 54 and 55: 52 / Special Academic Opportunities

- Page 56 and 57: 54 / Special Academic Opportunities

- Page 58 and 59: 56 / Special Academic Opportunities

- Page 60 and 61: 58 / Special Academic Opportunities

- Page 62 and 63: 60 / Academic Regulations and Proce

- Page 64 and 65: 62 / Academic Regulations and Proce

- Page 66 and 67: 64 / Academic Regulations and Proce

- Page 68 and 69: 66 / Academic Regulations and Proce

- Page 70 and 71: 68 / Academic Regulations and Proce

- Page 72 and 73: 70 / Academic Regulations and Proce

- Page 74 and 75: 72 / Academic Regulations and Proce

- Page 76 and 77: 74 / Academic Regulations and Proce

- Page 78 and 79: 76 / Academic Regulations and Proce

- Page 80 and 81: 78 / Academic Regulations and Proce

- Page 82 and 83: 80 / Academic Regulations and Proce

- Page 84 and 85: 82 / Schools of Business School of

- Page 86 and 87: 84 / Schools of Business Major Conc

- Page 88 and 89: 86 / Schools of Business Major Conc

- Page 90 and 91: 88 / Schools of Business Major Conc

- Page 92 and 93: 90 / Schools of Business Major Conc

- Page 94 and 95: 92 / Schools of Business Major Conc

- Page 96 and 97: 94 / Schools of Business Associate

- Page 98 and 99: 96 / Schools of Business Major Conc

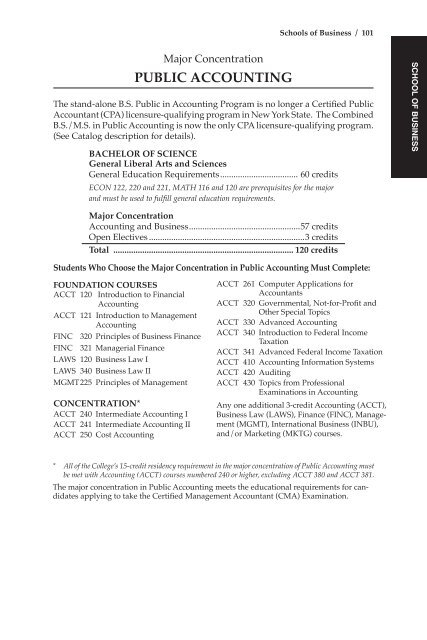

- Page 100 and 101: 98 / Schools of Business Major Conc

- Page 104 and 105: 102 / Schools of Business Dual Degr

- Page 106 and 107: 104 / Schools of Business Students

- Page 108 and 109: 106 / Schools of Business SELECTION

- Page 110 and 111: 108 / Schools of Education EDUCATIO

- Page 112 and 113: 110 / Schools of Education Dual Deg

- Page 114 and 115: 112 / Schools of Education Dual Deg

- Page 116 and 117: 114 / Schools of Education Dual Deg

- Page 118 and 119: 116 / Schools of Education Dual Deg

- Page 120 and 121: 118 / Schools of Education Dual Deg

- Page 122 and 123: 120 / Schools of Health & Natural S

- Page 124 and 125: 122 / Schools of Health & Natural S

- Page 126 and 127: 124 / Schools of Health & Natural S

- Page 128 and 129: 126 / Schools of Health & Natural S

- Page 130 and 131: 128 / Schools of Health & Natural S

- Page 132 and 133: 130 / Schools of Health & Natural S

- Page 134 and 135: 132 / Schools of Health & Natural S

- Page 136 and 137: 134 / Schools of Health & Natural S

- Page 138 and 139: 136 / Schools of Liberal Arts Dual

- Page 140 and 141: 138 / Schools of Liberal Arts MAJOR

- Page 142 and 143: 140 / Schools of Liberal Arts Major

- Page 144 and 145: 142 / Schools of Liberal Arts Major

- Page 146 and 147: 144 / Schools of Liberal Arts Major

- Page 148 and 149: 146 / Schools of Liberal Arts Major

- Page 150 and 151: 148 / Schools of Liberal Arts Admis

- Page 152 and 153:

150 / Schools of Liberal Arts Major

- Page 154 and 155:

152 / Schools of Liberal Arts Major

- Page 156 and 157:

154 / Schools of Liberal Arts Music

- Page 158 and 159:

156 / Schools of Liberal Arts Major

- Page 160 and 161:

158 / School of Social and Behavior

- Page 162 and 163:

160 / School of Social and Behavior

- Page 164 and 165:

162 / School of Social and Behavior

- Page 166 and 167:

164 / School of Social and Behavior

- Page 168 and 169:

166 / School of Social and Behavior

- Page 170 and 171:

168 / School of Social and Behavior

- Page 172 and 173:

170 / School of Social and Behavior

- Page 174 and 175:

172 / School of Social and Behavior

- Page 176 and 177:

174 / Course Descriptions ACCT 320

- Page 178 and 179:

176 / Course Descriptions ACCT 550

- Page 180 and 181:

178 / Course Descriptions Behaviora

- Page 182 and 183:

180 / Course Descriptions BHSC 345

- Page 184 and 185:

182 / Course Descriptions for Scien

- Page 186 and 187:

184 / Course Descriptions BIOL 310

- Page 188 and 189:

186 / Course Descriptions Communica

- Page 190 and 191:

188 / Course Descriptions also cove

- Page 192 and 193:

190 / Course Descriptions CART 330

- Page 194 and 195:

192 / Course Descriptions CART 495

- Page 196 and 197:

194 / Course Descriptions CISC 301

- Page 198 and 199:

196 / Course Descriptions CISC 395

- Page 200 and 201:

198 / Course Descriptions CHSC 320

- Page 202 and 203:

200 / Course Descriptions COCM 200

- Page 204 and 205:

202 / Course Descriptions CRJU 132

- Page 206 and 207:

204 / Course Descriptions CRJU 262

- Page 208 and 209:

206 / Course Descriptions to non-ma

- Page 210 and 211:

208 / Course Descriptions ENGL 206

- Page 212 and 213:

210 / Course Descriptions ENGL 285

- Page 214 and 215:

212 / Course Descriptions ENGL 380-

- Page 216 and 217:

214 / Course Descriptions FINC 320

- Page 218 and 219:

216 / Course Descriptions Freshman

- Page 220 and 221:

218 / Course Descriptions HLSC 402

- Page 222 and 223:

220 / Course Descriptions placed in

- Page 224 and 225:

222 / Course Descriptions HIST 336

- Page 226 and 227:

224 / Course Descriptions Honors Pr

- Page 228 and 229:

226 / Course Descriptions 490 Thesi

- Page 230 and 231:

228 / Course Descriptions IASP 440

- Page 232 and 233:

230 / Course Descriptions ITAL 265

- Page 234 and 235:

232 / Course Descriptions LAWS 295

- Page 236 and 237:

234 / Course Descriptions MGMT 235

- Page 238 and 239:

236 / Course Descriptions MGMT 442

- Page 240 and 241:

238 / Course Descriptions MATH 116

- Page 242 and 243:

240 / Course Descriptions MATH 360

- Page 244 and 245:

242 / Course Descriptions MEDA 154

- Page 246 and 247:

244 / Course Descriptions MEDA 234

- Page 248 and 249:

246 / Course Descriptions MEDA 310

- Page 250 and 251:

248 / Course Descriptions MUSI 201

- Page 252 and 253:

250 / Course Descriptions MTEC 295

- Page 254 and 255:

252 / Course Descriptions NURS 365

- Page 256 and 257:

254 / Course Descriptions OCTR 214

- Page 258 and 259:

256 / Course Descriptions Philosoph

- Page 260 and 261:

258 / Course Descriptions American

- Page 262 and 263:

260 / Course Descriptions a faculty

- Page 264 and 265:

262 / Course Descriptions PSYN 237

- Page 266 and 267:

264 / Course Descriptions on the ad

- Page 268 and 269:

266 / Course Descriptions 120 hours

- Page 270 and 271:

268 / Course Descriptions SOWK 314

- Page 272 and 273:

270 / Course Descriptions SOCL 101

- Page 274 and 275:

272 / Course Descriptions SOCL 246

- Page 276 and 277:

274 / Course Descriptions SOCL 355

- Page 278 and 279:

276 / Course Descriptions SPAN 230

- Page 280 and 281:

278 / Course Descriptions SPAN 311-

- Page 282 and 283:

280 / Course Descriptions SPCM 250

- Page 284 and 285:

282 / Course Descriptions Theatre A

- Page 286 and 287:

284 / Course Descriptions VETC 241

- Page 288 and 289:

286 Advisory Boards Program Advisor

- Page 290 and 291:

288 Advisory Boards Veterinary Tech

- Page 292 and 293:

290 Advisory Boards School of Educa

- Page 294 and 295:

292 Advisory Boards School of Liber

- Page 296 and 297:

294 / Faculty of Instruction FACULT

- Page 298 and 299:

296 / Faculty of Instruction Elina

- Page 300 and 301:

298 / Faculty of Instruction Marc C

- Page 302 and 303:

300 / Faculty of Instruction Barbar

- Page 304 and 305:

302 / Faculty of Instruction Joel F

- Page 306 and 307:

304 / Faculty of Instruction Theodo

- Page 308 and 309:

306 / Faculty of Instruction Rossi

- Page 310 and 311:

308 / Faculty of Instruction Judith

- Page 312 and 313:

310 / Correspondence Directory CORR

- Page 314 and 315:

312 / College Directories Joseph Ga

- Page 316 and 317:

RT. 9 (BROADWAY) 314 / Maps and Dir

- Page 318 and 319:

316 / Maps and Directions Direction

- Page 320 and 321:

318 / Maps and Directions Direction

- Page 322 and 323:

320 / Accreditations, Memberships,

- Page 324 and 325:

322 / Index Index A Academic Dismis

- Page 326 and 327:

324 / Index Life Achievement Course

- Page 328:

326 / Index Dobbs Ferry Campus 555